As a seasoned analyst with over two decades of experience in traditional finance and the crypto market, I have witnessed numerous cycles of bull runs and bear markets. The current scenario, with Bitcoin (BTC) exhibiting minimal resistance and almost all investors back in the green, presents an intriguing opportunity.

Data recorded on the blockchain indicates that there is limited opposition for Bitcoin, potentially paving the way for a surge towards a fresh record peak.

Almost All Bitcoin Investors Are Back In The Green With Latest Recovery

Based on data from the market intelligence platform IntoTheBlock, there appears to be relatively weak resistance in the upcoming price ranges. This assessment is derived from on-chain analysis, where the level of support and resistance is determined by the number of investors who previously purchased their coins at those levels.

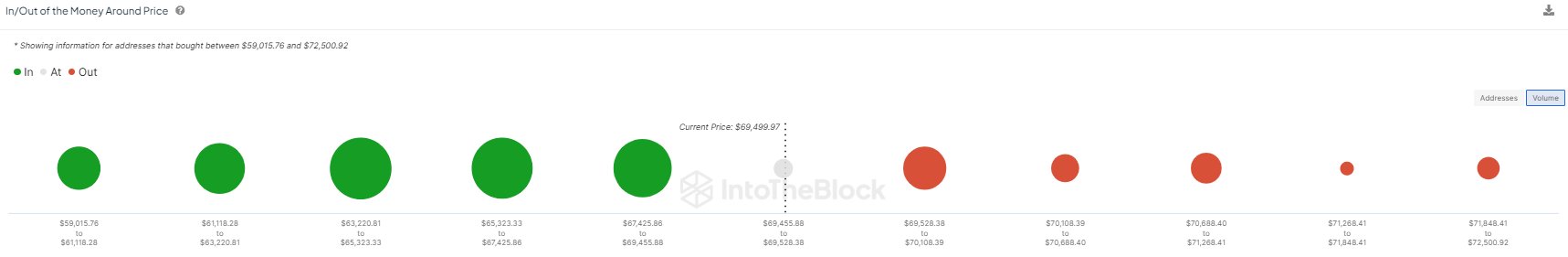

The chart below shows what the cost basis distribution on the Bitcoin network looked like at the time of the analytics firm’s post.

In the given graph, the size of each dot represents the number of unique addresses that bought cryptocurrency within the specified price range. At the time When IntoTheBlock released this information, it was noticeable that the upper price ranges were associated with fewer buyers, signified by smaller dots, whereas the lower price ranges had more buyers and larger dots on the graph.

Fewer investors with a higher purchase price for their investments remained in the market compared to the current market price. In other words, those holding assets at a loss were in a smaller number.

Following that point, Bitcoin (BTC) has experienced a dip, entering the initial large circle on the chart. Despite this, with the current pricing structure, the majority of holders are likely still reporting profits.

For any investor, the cost basis holds significant significance, serving as a crucial reference point. Their likelihood of taking action increases when this level is revisited. In the case of investors experiencing losses, they eagerly anticipate such a retest in order to sell off at breakeven, thereby mitigating their initial investment outlay.

If only a few investors choose to sell their stocks at their breakeven point, it won’t significantly impact the overall market. However, if a substantial number of investors have similar cost bases and decide to sell around the same time, this could potentially trigger price movements worthy of notice.

The connection between the number of investors and the significance of support and resistance price levels in on-chain analysis lies in the fact that these levels reflect previous buying and selling patterns. As more investors enter the market and establish their purchase prices, the historical data becomes more influential in shaping these levels. Thus, a larger investor base can increase the reliability and impact of support and resistance prices.

Investors who experienced losses on their Bitcoin (BTC) investments might consider selling if the price retests their initial purchase price. These points of potential resistance, represented by large red dots on charts, could slow down BTC’s upward momentum. However, with no major hurdles remaining in its path, BTC is poised to advance further and reach new heights.

1. From a crypto investor perspective, when losses prompt sell-offs among investors, it’s those in profit who find themselves in an advantageous position. Instead of cashing out, we can view the retest of our initial investment levels as a chance to purchase more. Hence, these ‘green zones’ serve as potential support points for cryptocurrencies. Given that Bitcoin has dipped to one such green zone, it might leverage this cushion to surge ahead in the relatively less intense red price ranges.

It’s worth noting that although finding investors eager to offload their investments at the break-even point might be uncommon, Bitcoin (BTC) could encounter another challenge: sell-offs due to profit-taking.

As an analyst, I can suggest that with the vast majority of investors currently in profitability, it is highly probable that some may feel compelled to cash out on their gains as the coin approaches a new all-time high. The question remains, however, whether the demand will be sufficient enough to counteract this potential selloff.

BTC Price

As an analyst, I observed that Bitcoin had previously reached close to the $70,000 threshold during the day. However, a subsequent downturn led it to approach the $67,800 level.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- Fear of God Releases ESSENTIALS Summer 2025 Collection

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Gold Rate Forecast

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

2024-07-30 08:12