As a seasoned financial analyst with over a decade of experience in the crypto market, I have witnessed its ups and downs, its booms and busts. The second quarter of 2024 was no exception to the volatile nature of this burgeoning industry. Following the impressive gains in Q1, the crypto market took a step back, with the total market capitalization dropping by 14.4% or $408.8 billion.

In Q1 of 2024, the crypto market experienced significant growth. However, there was a downturn in Q2. Remarkably, memecoins have continued to lead the market’s charge over the past three months.

Total Crypto Market Cap Falls 14% In Q2

I came across the latest Q2 2024 Crypto Industry Report published by CoinGecko on a recent Tuesday. The insights shared in this comprehensive report caught my attention as they indicated a decrease in the total market capitalization during the previous quarter.

As a crypto investor, I’ve observed a significant decline in the total crypto market capitalization over the past three months. Specifically, it dropped by 14.4%, which translates to a loss of $408.8 billion. By the end of Q2, the market cap had reached $2.43 trillion, but unfortunately, we failed to surpass the new all-time highs (ATH).

In comparison, the cryptocurrency market’s total valuation hit a record-breaking $2.9 trillion in March. The first quarter of the year saw an impressive surge of 64.5%, which more than doubled the market growth experienced during Q3 of 2024.

As a researcher examining the financial data, I’ve discovered that this quarter experienced an impressive increase of around $1.1 trillion. Remarkably, this expansion nearly doubled the previous quarter’s growth rate of approximately $0.61 trillion. A significant factor contributing to this surge was the approval of US-listed Bitcoin Exchange Traded Funds (ETFs) in early January. Consequently, Bitcoin reached a new peak price in March as a result.

In Q2, the S&P 500 surpassed the crypto market cap’s growth, recording a 3.9% rise, as pointed out by CoinGecko. This significant difference led to a drastic decrease in correlation between the two, falling from 0.84 in the first quarter to just 0.16 in the second.

During the second quarter, the crypto market experienced significant volatility with an annualized rate of 48.2%. This high instability affected the entire crypto market cap. In comparison, Bitcoin (BTC) and the S&P 500 exhibited respective volatilities of 48.2% and 12.7%.

Memecoins Continue Leading The Market

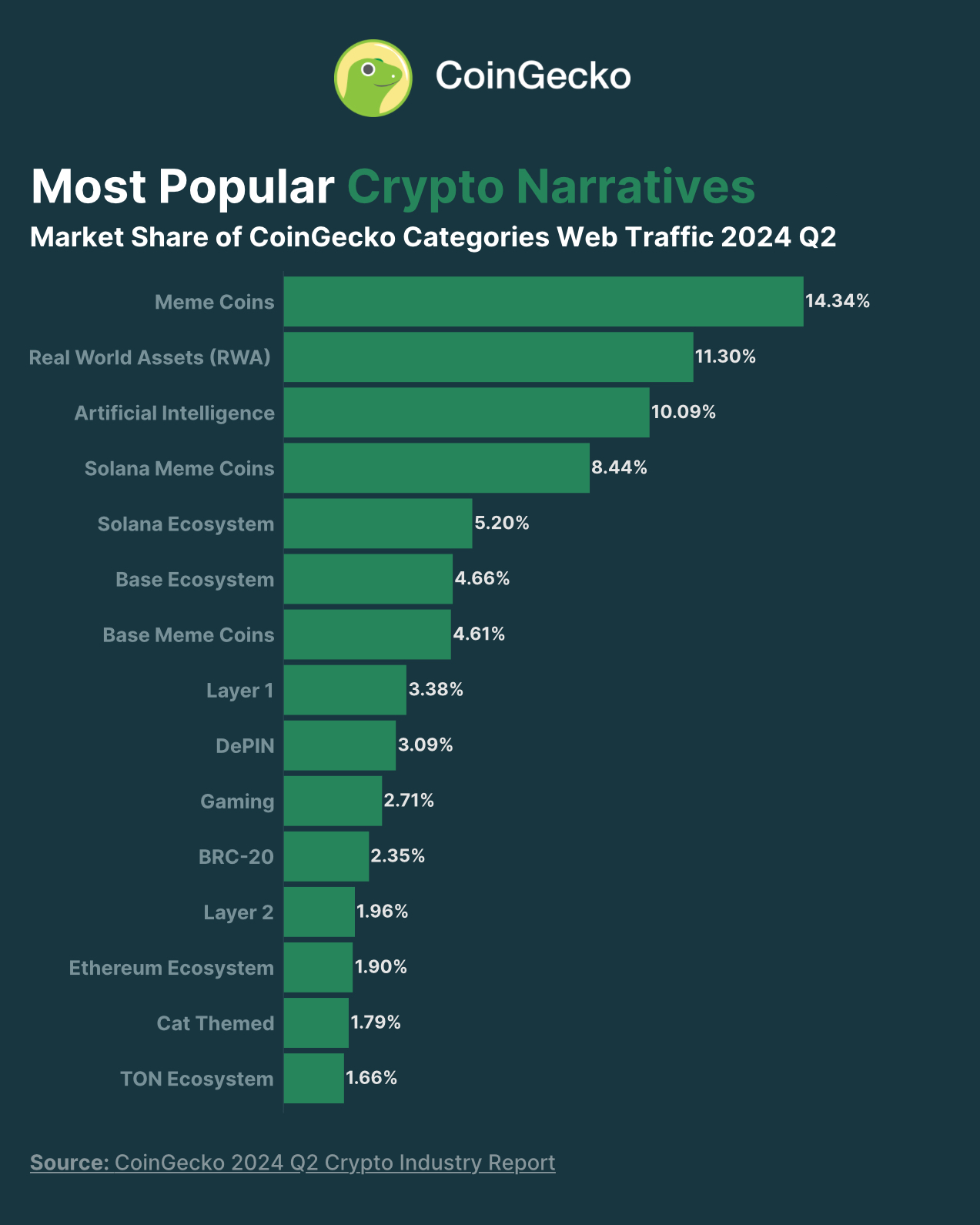

In contrast to the market downturn, memecoins continued to be a top topic of discussion in the second quarter. As per CoinGecko’s category data, this sector held a significant 14.3% share of the total market.

As a researcher studying the cryptocurrency market last quarter, I observed a significant trend towards Memecoins. In the opening months of 2024, this sector generated substantial profits. The average return for the leading Memecoins amounted to an impressive 1,313%.

As a crypto investor, I’ve witnessed firsthand the explosive growth of meme coins like Dogewhiz (WIF) and Book of Meme (BOME). The market was abuzz with their success stories, boasting returns of over 2,000% for Dogewhiz and an impressive 1,000% gain for Book of Meme.

During the past three months, there was a buzz in the market surrounding memcoins endorsed by celebrities. Notable figures such as Iggy Azalea, Caitlyn Jenner, and Andrew Tate entered the industry amidst contentious coin launches, cyberattacks, and allegations of scams.

Additionally, the PolitiFi memcoins experienced a significant rise in demand last week. These digital tokens gained momentum and exceeded the performance of many other crypto categories after the unsuccessful assassination attempt on former President Donald Trump.

As a crypto investor, I’ve noticed that memecoins took up a significant portion of the conversation in the top 15 narratives during the last quarter. Specifically, Solana and its meme counterpart, Base, held an impressive 8.44% and 4.61% share respectively. Intriguingly enough, cat-themed tokens managed to overshadow the previously dominant dog-inspired tokens.

As a researcher studying the cryptocurrency market this quarter, I discovered that feline-themed tokens managed to break into the top 15 rankings. The category saw remarkable growth during this cycle, with notable tokens such as “Cat in a Dogs World” (MEW) and “Popcat” (POPCAT) experiencing impressive surges of over 200%.

In a comparable fashion to Q1, Real World Assets (RWA) and Artificial Intelligence (AI) ranked as the second and third most favored sectors. RWA accounted for an 11.3% portion of the market’s focus, while IA tokens claimed a 10.9% share of market interest.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

2024-07-17 07:35