As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen countless instances of missed opportunities due to premature selling. The story of the meme coin trader who missed out on a potential $25 million payout is a classic example of this phenomenon.

The world of cryptocurrency is constantly changing, with more than two million tokens available (and increasing), it can be challenging to predict which ones will surge in value and on what platform. It’s worth noting that meme coins have been grabbing attention, particularly on the Solana network. Coins like MooDeng, Bonk, and Pepe are attracting a lot of trader interest.

Meme Coin Trader Misses A $25 Million Payout

Recently, there’s been a lot of interest surrounding Sui Network, a contemporary blockchain that boasts the ability to handle over 50,000 transactions per second (TPS) and outpaces Solana in speed. This surge of activity can be attributed to the triumph of one of the largest meme coins within its ecosystem.

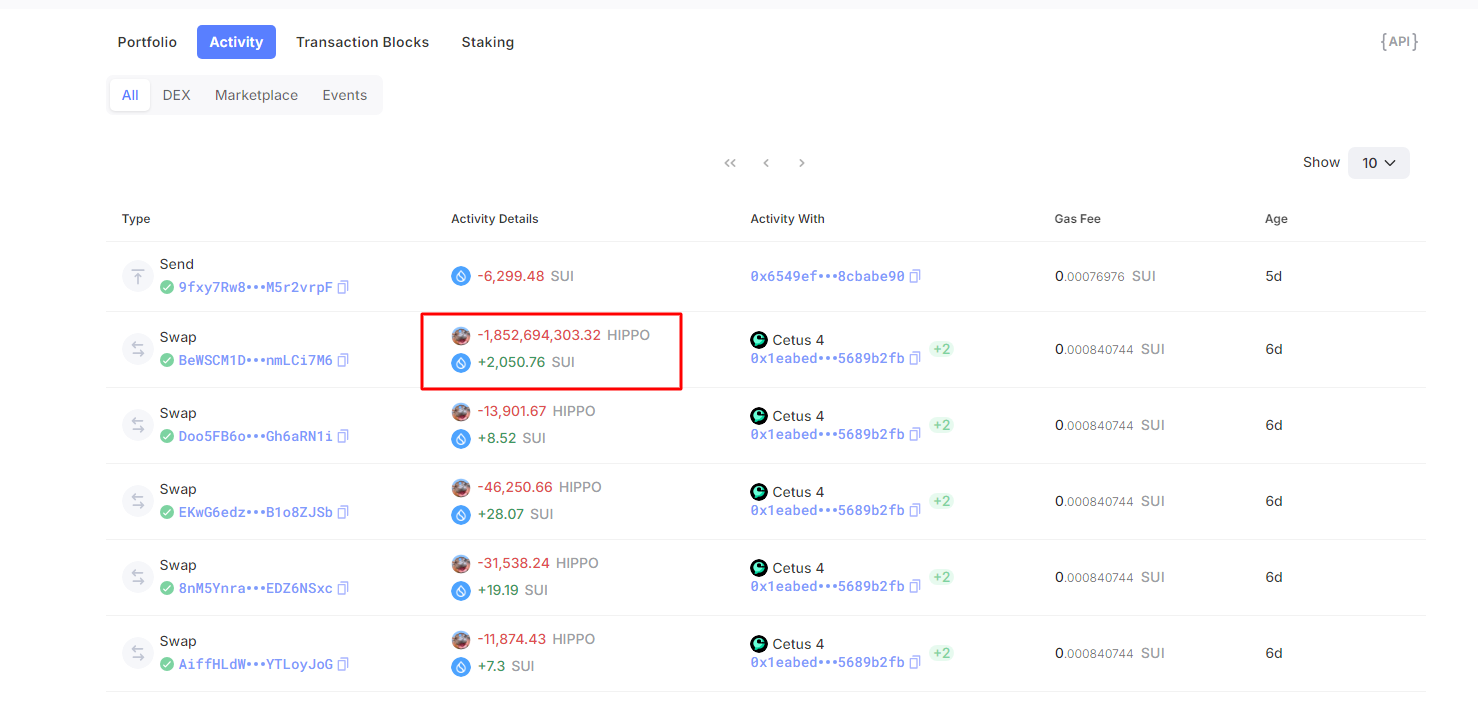

Following its launch approximately six days ago, Sudeng (HIPPO) is experiencing a significant boost, hitting new highs consecutively. This upward trend has resulted in an increase in HIPPO’s market capitalization and consequently, its liquidity. Notably, swap transactions on Sui Network’s decentralized exchange, Cetus 4, are showing increased activity with HIPPO.

If a cryptocurrency’s value rises by more than $0.010, it suggests that early investors who held onto their investments despite the market-wide sell-offs in Bitcoin could be reaping substantial profits. Conversely, one trader of a meme coin seems to be expressing regret after selling early and pocketing a modest profit from HIPPO.

Initially, when it was released, a trader disposed of approximately 258 SUI tokens valued at around $433 by receiving about 1.8 billion HIPPO. This represents close to 20% of the total supply, which stands at 10 billion tokens. Interestingly, six thousand two hundred and ninety-nine SUI days later, the trader decided to sell the entire cache, earning almost $11,000 in the process.

If the trader had opted to delay their decision by 36 more hours, it could have led to substantial profits. By October 4th, the value of the 1.8 billion HIPPO tokens has soared above $25 million.

It turns out that the early sale was a financial setback and a lost chance for greater profits. However, no one should place blame on the trader. In fact, the profit of $11,000 equates to over 200 times the initial investment.

Furthermore, should the trader decide to hold their position and wait for price increases, they might find it challenging to sell their entire position instantly.

HIPPO Concentration A Concern: Will The Sudeng Pump?

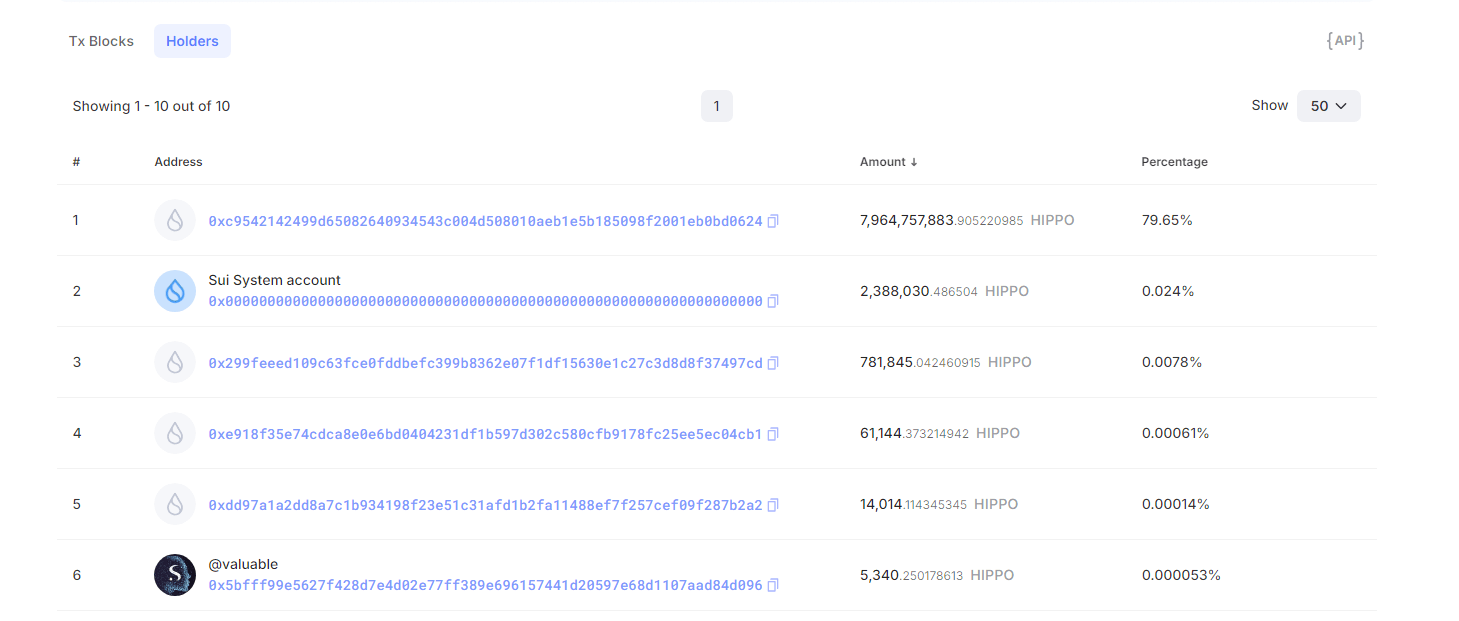

In simpler terms, the HIPPO cryptocurrency isn’t easily traded or exchanged, and when we examine who owns it using SuiScan, a single address holds about 7.6 billion tokens, which is far more than three-quarters (76%) of the entire supply.

Should the trader choose to maintain their position, they’d rank second among all holders. Attempts to offload assets would likely drive down prices, causing a cascade of sell-offs as other holders rush to exit the market, creating a sense of panic.

At present, traders are keeping a keen eye on HIPPO’s performance. As a meme token, its success is largely influenced by hype and the fear of missing out (FOMO). If FOMO is prevalent, the meme token could potentially rise above SUI, which is also showing strength.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-05 03:40