As a seasoned researcher with over a decade of experience tracking the cryptocurrency market, I’ve witnessed my fair share of bull and bear runs. Yesterday’s 10% surge in Ethereum was an impressive recovery that has rekindled the flames of optimism within the crypto community. It’s not every day we see ETH approach its yearly highs with such vigor!

Yesterday, I observed a significant increase of more than 10% in the value of Ethereum, reflecting a robust recovery and a highly bullish trend across the entire cryptocurrency market. This surge has rekindled enthusiasm among investors, particularly as Ethereum inches closer to its annual highs.

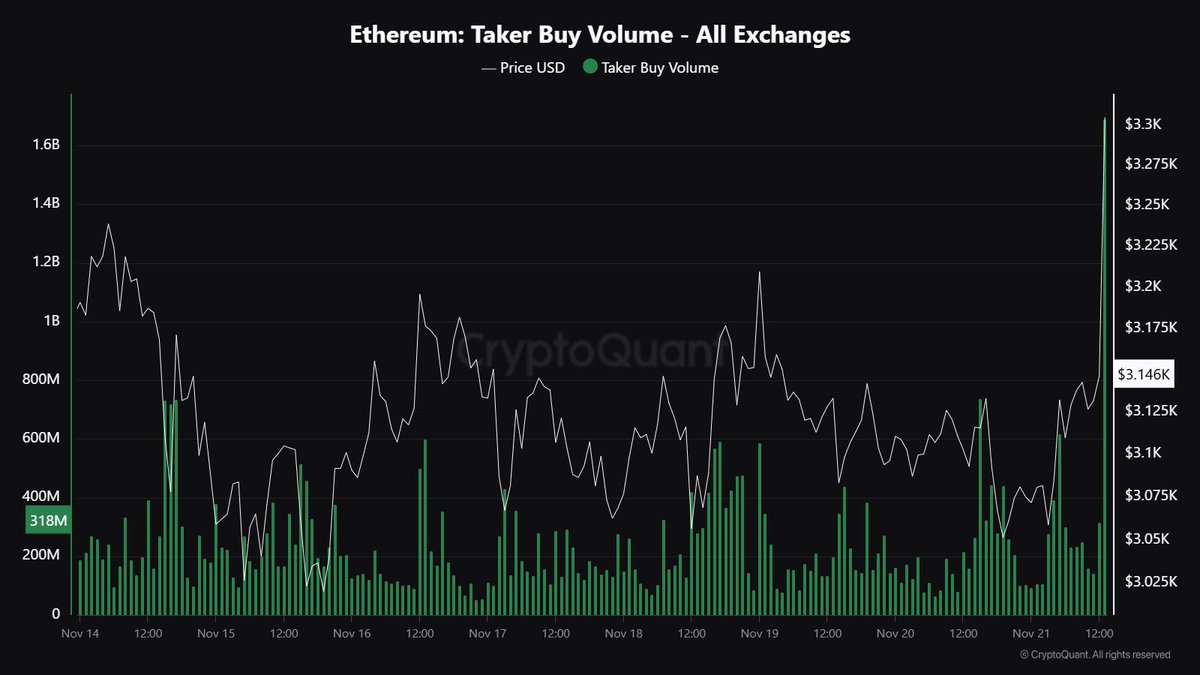

Information from CryptoQuant shows a strong bullish indication: The taker buy volume of Ethereum reached an impressive $1.683 billion within a single hourly period. This measurement signifies intense buying activity in the futures market, adding credence to Ethereum’s potential for further upward movement.

It seems that the surge in interest for Ethereum is likely due to investors shifting their earnings from Bitcoin. With Bitcoin continuously setting new record highs, investors are moving their profits into ETH, which is pushing up its value. The way Ethereum is leveraging Bitcoin’s growth demonstrates its importance as the second-largest cryptocurrency and a significant influencer in the broader market dynamics.

Over the coming days, Ethereum’s progress is significant because it’s approaching its annual maximum points. If it surges past these thresholds, it might initiate a fresh upward trend, reinforcing its optimistic outlook even more.

Ethereum Bulls Waking Up

After eight months of downtrend, Ethereum enthusiasts are showing renewed vigor as the price has jumped by more than 40% since November 5th. This significant upward movement mirrors the wider market’s growth, instilling hope that Ethereum’s resurgence is underway. The surge in optimism about Ethereum has made it a focal point for investors looking for promising investment opportunities within the current market landscape.

Based on information from analyst Maartunn at CryptoQuant, a massive $1.683 billion worth of Ethereum was bought by traders in a single hourly period, indicating strong demand and the participation of high-value transactions.

The heavy purchasing of Ethereum indicates optimism about its ability to maintain its growth trend. This intense demand puts a strain on prices, strengthening the belief that Ethereum will continue to rise.

Despite making progress, Ethereum encounters a significant challenge at the $3,550 mark, a barrier it has faced since late July. The upcoming days are crucial for Ethereum, as surpassing this key resistance may indicate its bullish trend continues. If it fails to do so, however, a brief period of sideways movement could follow. Everyone is now watching ETH closely, as its next actions could influence the overall altcoin market.

ETH Holding Above Key Levels

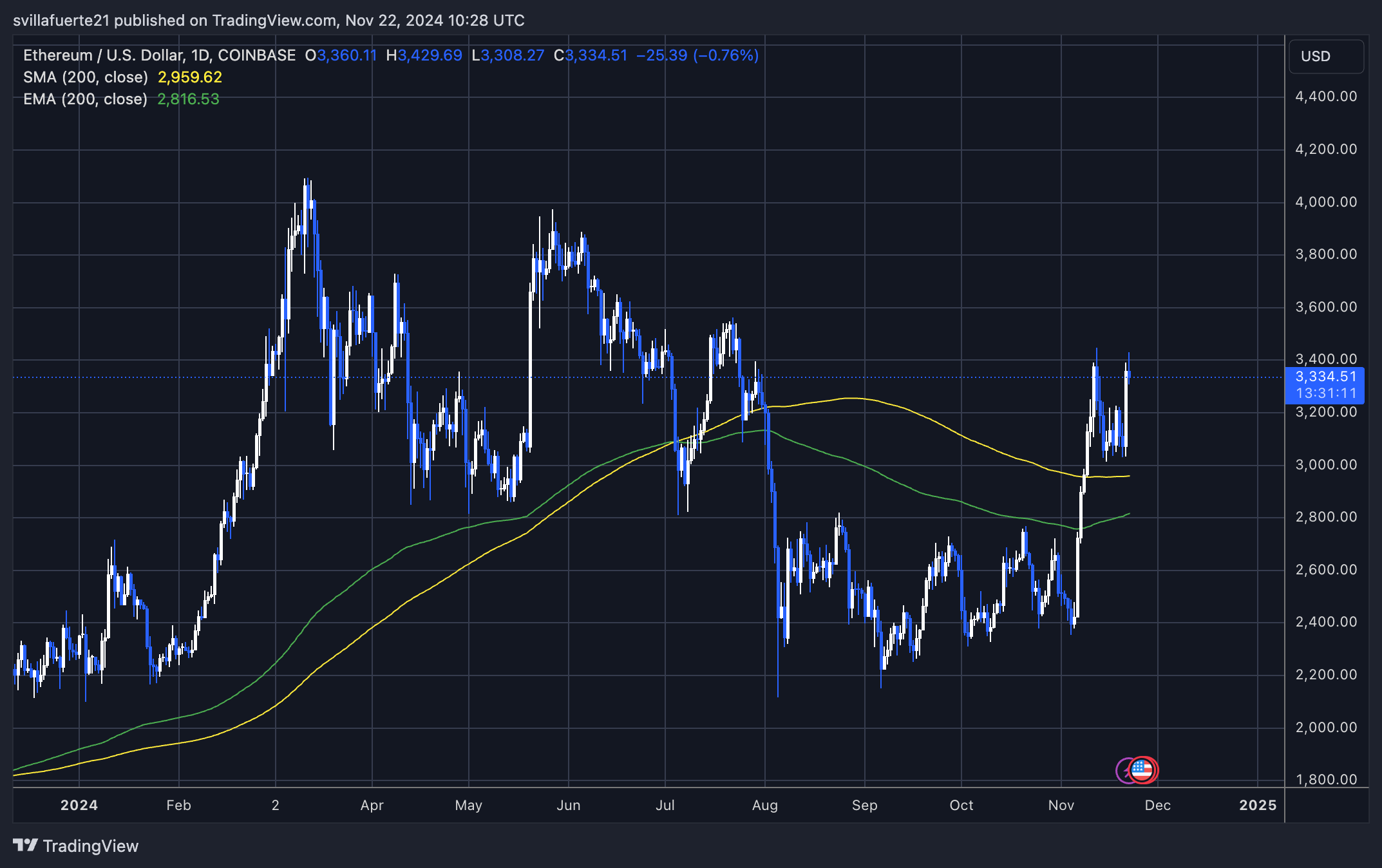

Currently, Ethereum (ETH) stands at $3,333, following a 10% increase yesterday which represents a substantial bounce back for the second-largest cryptocurrency. It’s currently testing a crucial resistance area close to the $3,450 mark, an area where sellers have been strong in the past. If buyers can push prices above this level and hold it, it would signal a resumption of the uptrend and set the stage for potential record-breaking highs.

The historical trend shows that this supply area has been a significant obstacle, but if Ethereum can push beyond it forcefully, it could indicate robust buying activity and the possibility of a prolonged upward movement. Additionally, staying above the 200-day moving average at $2,959 adds weight to the bullish perspective for Ethereum, as this metric is often seen as a significant marker for long-term price patterns.

If Ethereum manages to stay above its 200-day moving average and break through the $3,450 mark convincingly, it might trigger a bullish trend, aiming at stronger resistance levels in the near future.

If this supply zone isn’t conquered, it could lead to a temporary holding pattern as traders reorganize before attempting another assault on this key resistance level. At present, the market’s attention is primarily on whether Ethereum can surmount this significant hurdle and maintain its bullish momentum.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-11-23 03:40