As a seasoned researcher who has witnessed the crypto market’s rollercoaster ride for over half a decade now, I must say that the recent surge of Bitcoin to new all-time highs is nothing short of remarkable. Having lived through the 2017 bull run and the subsequent bear market, this latest rally feels like deja vu – but with a twist. The fact that it’s happening during election night, and triggered by none other than Donald Trump’s victory, makes it all the more intriguing.

On the night of the elections, Bitcoin soared to unprecedented peaks, reaching an astonishing $75,300. The market’s enthusiasm peaked, leading Bitcoin to venture into new pricing territories, causing a wave of sizable liquidations on various trading platforms.

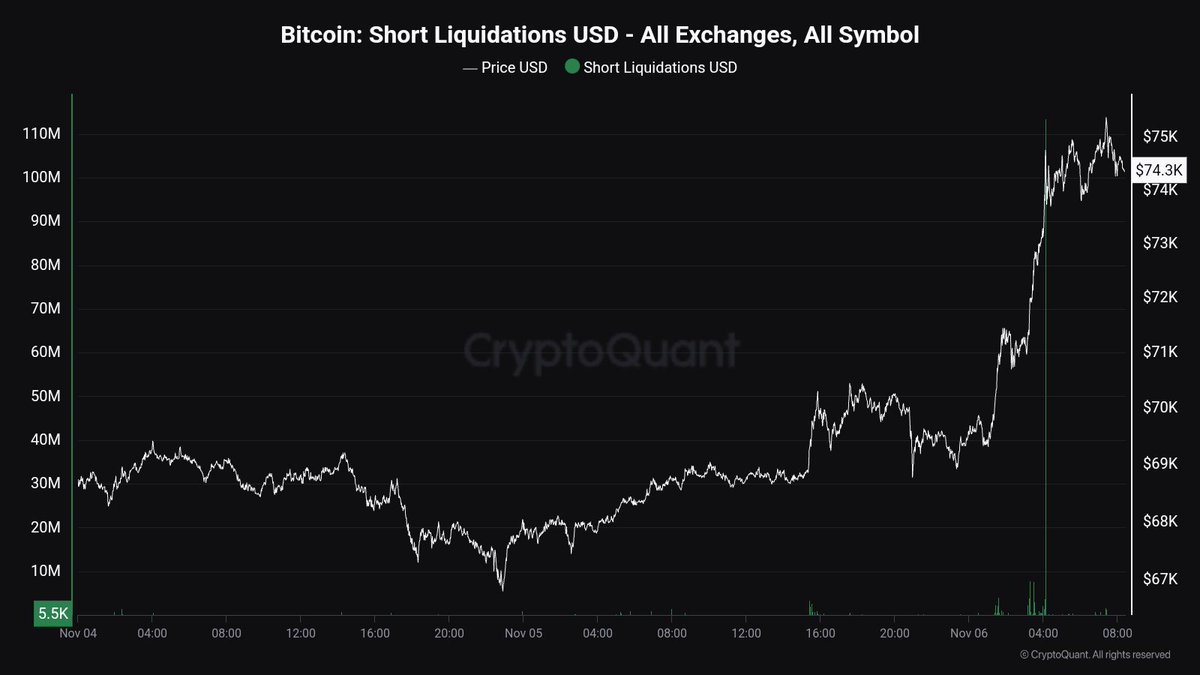

According to information from CryptoQuant, there was an extraordinary increase in short liquidations that exceeded $100 million within just one minute, creating a significant milestone in the history of Bitcoin.

The sudden surge in prices was likely triggered by the unexpected victory of Trump in the U.S. election, causing renewed excitement among investors about cryptocurrencies as they anticipate potential future economic policies. This election result has created ripples throughout the market, with Bitcoin spearheading a new rally within the crypto sphere.

Currently exploring new grounds, the surge of Bitcoin beyond $75,000 underscores investor conviction, despite lingering economic doubts. As Bitcoin enters a phase of price exploration, both traders and investors are readying themselves for potential market swings, with some predicting this upward trend might carry on to even greater peaks.

Over the next few days, Bitcoin’s price fluctuations are expected to significantly impact margin calls and set the tone for future market trends.

Bitcoin Bullish Phase Begins

Bitcoin has now entered a bullish period and is achieving new record highs, following the victory of Donald Trump in the election. As a well-known proponent of cryptocurrency, Trump’s win has fueled market enthusiasm, causing Bitcoin’s price to climb above its previous all-time highs in an upward trend that started as the election results showed him leading.

The surge in Bitcoin’s price was not only boosted by a bullish breakout but also triggered an intense sell-off, implying substantial purchasing activity as negative bets were promptly canceled. As per CryptoQuant analyst Maartunn’s findings, the short liquidations surpassed $100 million within a minute – a remarkable occurrence that underscores the vigor of this rally and hints that Bitcoin’s bullish trend might still be in its early stages.

Over the next few days, we can expect market turbulence as various economies process the election results and prepare for the Federal Reserve’s interest rate announcement due this Thursday. Given these circumstances, investors are gearing up for a potentially impactful reaction in both traditional and digital currency markets.

If the Federal Reserve decides to maintain current interest rates or implement accommodative changes, it might fuel Bitcoin’s price surge and enhance overall confidence in the cryptocurrency market.

The overall perspective continues to be optimistic since the Bitcoin market’s attitude is improving during its latest price exploration stage. Although temporary ups and downs may occur with these significant happenings, the long-term forecast suggests a bullish trend as Bitcoin appears to be driving the crypto market upward in this fresh post-election climate.

BTC Visits Uncharted Territory

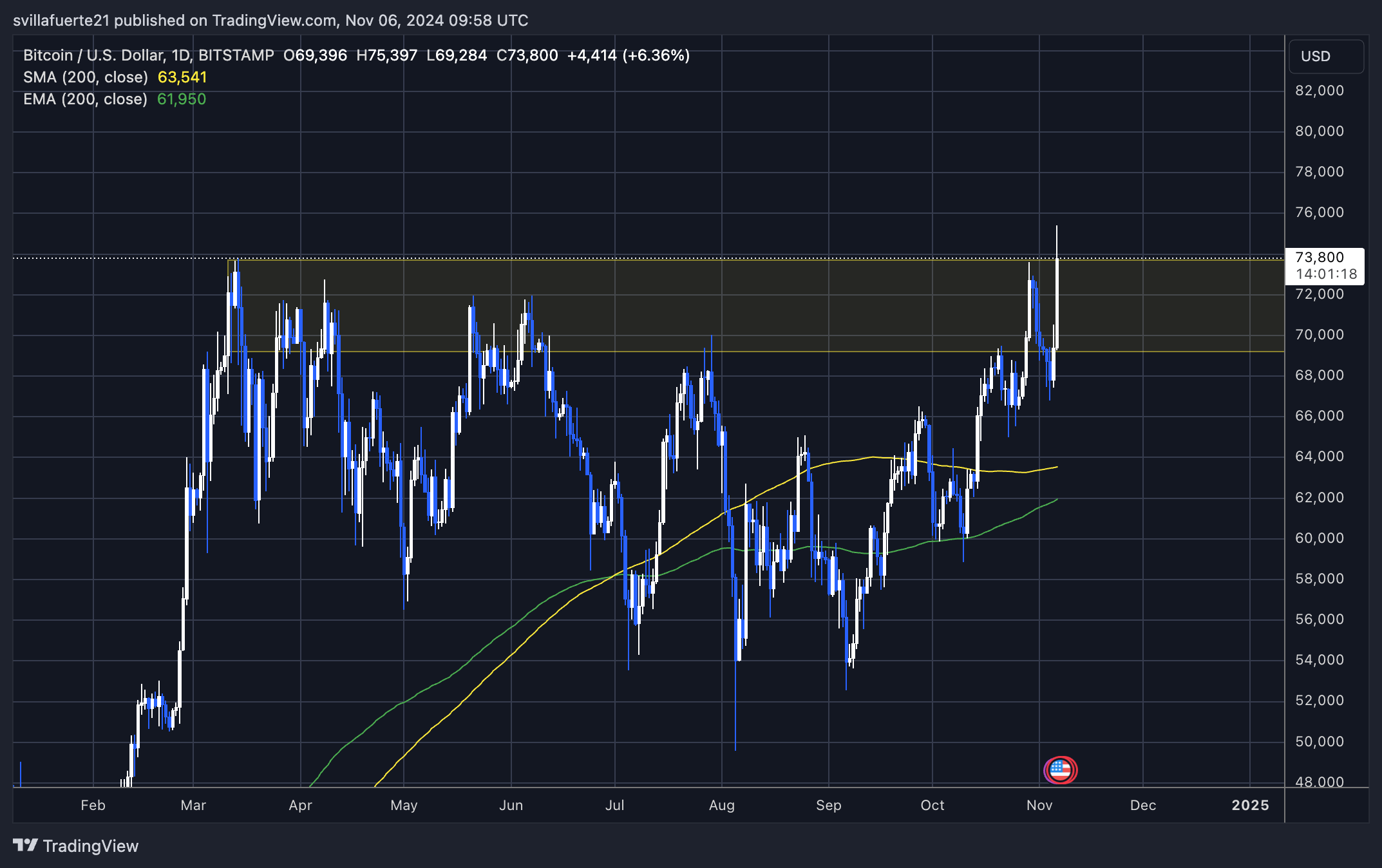

The price of Bitcoin currently stands at approximately $73,800, surpassing its previous record highs and hitting a new maximum of $75,300. This surge has propelled Bitcoin into unexplored realms, a phase often indicative of significant increases as the bullish trend gains traction.

The question is whether Bitcoin can sustain its rise beyond its previous all-time high of $73,800, an important level that could potentially push it to even higher records if held effectively. But, it’s crucial to note that this surge coincides with a particularly unstable week, as investors anxiously await the Federal Reserve’s forthcoming meeting, which could bring increased market volatility.

The Federal Reserve’s interest rate decision could introduce a level of uncertainty that might slow down or even cause Bitcoin’s price to drop below $70,000 if the outcome differs from what the market anticipates. As Bitcoin moves through its current stage of determining its worth, investors are keeping a close watch on crucial price points.

Keeping prices above approximately $73,800 bolsters the positive outlook for Bitcoin, whereas any price drops would challenge support levels and test investor’s resolve during market instability. As volatility is anticipated this week, it could significantly impact Bitcoin’s future direction in the coming months.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-11-07 01:54