After the Bitcoin (BTC) halving occurred for the fourth time, significant shifts took place in the crypto market’s essential indicators.

Based on recent advancements, Charles Edwards, an accomplished market analyst and Capriole Invest’s founder, has made daring forecasts suggesting a significant transformation in the Bitcoin market.

Bitcoin Trading At ‘Deep Discount’

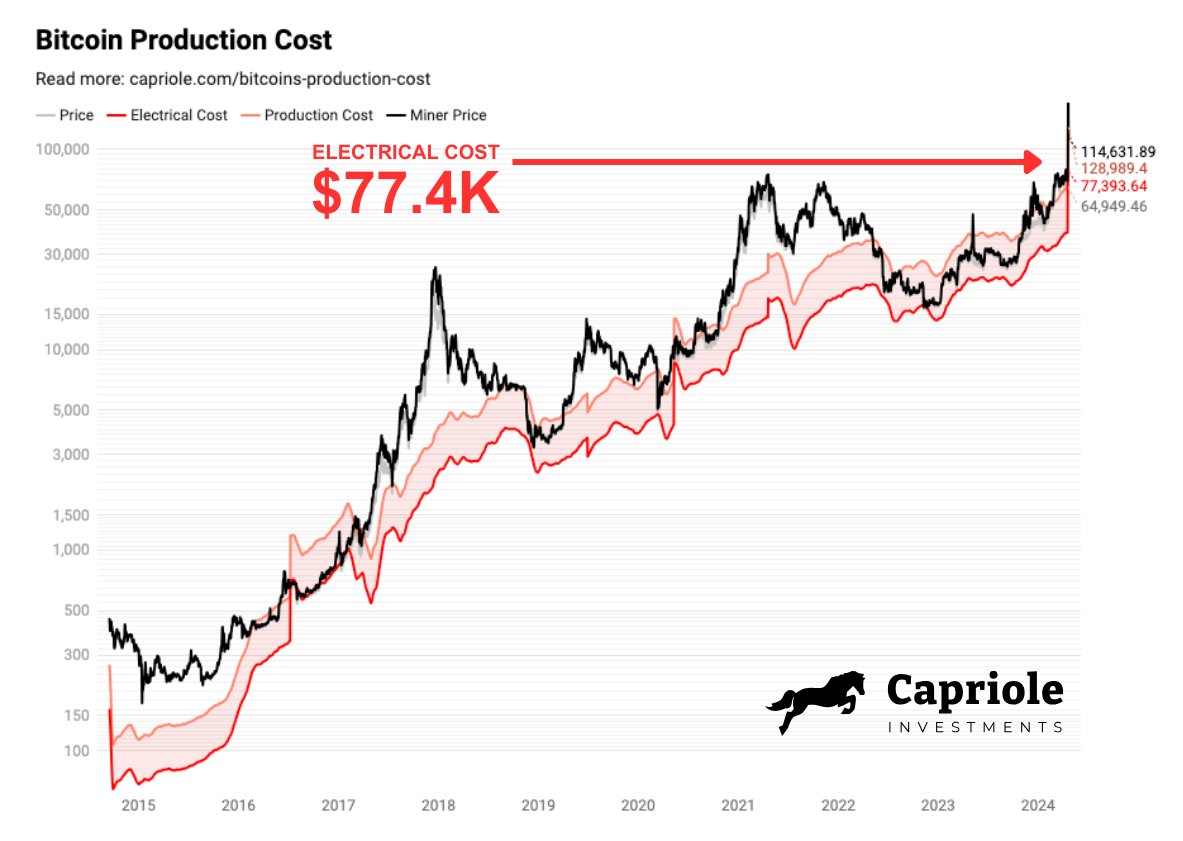

Edwards emphasizes that the electricity expense for mining just one Bitcoin has become extraordinarily high. He shares that this cost has surged to an astonishing amount of $77,400. This large sum represents the actual electricity bills incurred to operate the Bitcoin network and mine a new BTC.

One important measurement Edwards highlights is the Bitcoin Miner Cost, which peaked at an astounding $244,000 last Saturday. This measurement represents the combined reward and transaction fees that miners obtain upon mining a single Bitcoin successfully.

Significantly, during this period, miner prices experienced a substantial rise, reaching new heights. At the same time, transaction fees reached an unprecedented peak of $230, representing a nearly quadruple increase from their previous record high of $68 in 2021.

Based on the given data, Edwards proposes that Bitcoin’s current market price undervalues it. The reason being, the cost to mine Bitcoin is higher than its current selling price.

Normally, this phenomenon occurs every four years and lasts just a few days. As a result, the cost is expected to quickly regain and exceed this level, which is slightly under Bitcoin’s record high of $73,700, reached on March 14th.

Edwards proposes three potential outcomes following these recent trends. The first possibility is that the cost of Bitcoin dramatically increases.

Additionally, it’s possible that around 15% of miners could face closure due to unprofitable conditions. Lastly, according to Edwards, the typical transaction fee is anticipated to stay significantly elevated.

According to Edwards’ assessment of these metrics and possible situations, he confidently asserts that Bitcoin’s time below $100,000 is limited. It’s unclear yet which of the three possibilities will take the lead, but Edwards believes that a mix of these factors will boost Bitcoin’s value.

Optimal Buying Opportunity?

Since last Friday, Bitcoin’s price has shown stability around $60,000 despite brief dips due to heightened excitement for the upcoming Halving event.

According to crypto expert Ali Martinez’s assessment, the recent Bitcoin prices might have reached their lowest point, making it more probable for the digital currency to break through and surpass its upper resistance levels soon.

Based on Ali Martinez’s assessment, Bitcoin aspires to make $66,000 a significant level of support. It is indicated in data that around 1.54 million wallets collectively own about 747,000 Bitcoins at this price point. If Bitcoin manages to hold this support, it could potentially lead to more price advancement.

Martinez pinpoints important resistance points for Bitcoin’s price growth, ranging from $69,900 to $71,200. These areas act as formidable hurdles for Bitcoin’s bullish momentum, and there is a strong possibility that sellers might emerge at these price points, causing Bitcoin to encounter resistance.

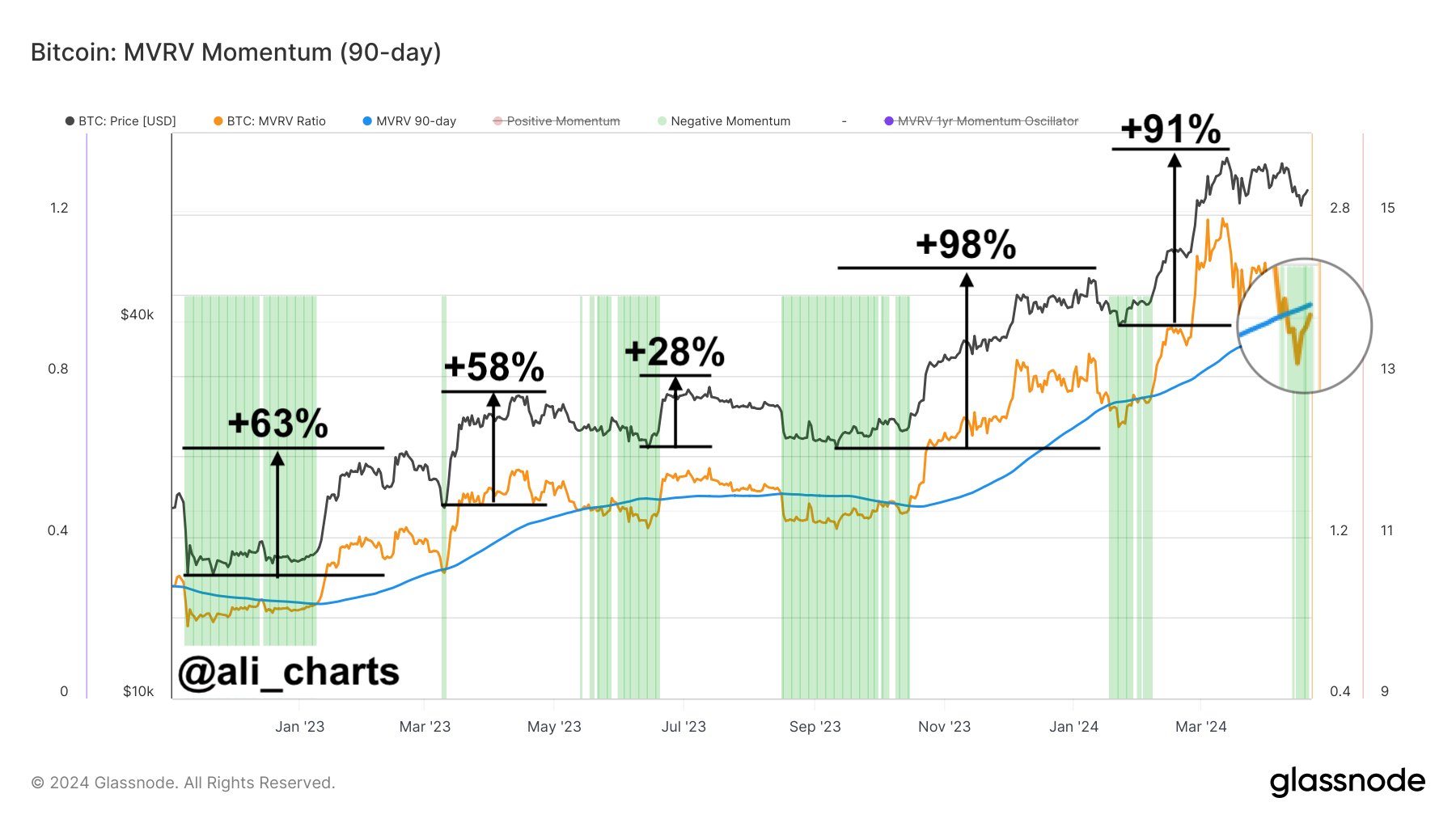

Furthermore, the analyst notes an intriguing trend in the Bitcoin MVRV ratio, which is depicted in the following chart. This indicator measures the difference between Bitcoin’s current market price and the price at which it was last sold, offering valuable insights.

According to Martinez’s analysis, when the Bitcoin MVRV ratio drops below its 90-day average, which is a metric he has tracked since November 2022, it typically signals a good time to buy. Remarkably, past purchases based on this indicator have yielded an average return of around 67%.

Based on Martinez’s assessment, considering the present market situation and the MVRV ratio analysis, it could be a good moment to think about purchasing Bitcoin. This perspective is backed up by historical trends and the possibility of substantial price growth.

BTC is trading at $66,100, up 1.6% in the past 24 hours.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-04-22 21:04