As a seasoned analyst with over two decades of experience in the financial markets under my belt, I find myself optimistically leaning towards the possibility of Bitcoin reaching the $70,000 mark once again. My journey through various market cycles has taught me that price action often follows patterns, and the recent breakout above the downtrending channel is a promising sign for BTC bulls.

Over the past two quarters, Bitcoin‘s price has faced a tough time climbing back above the $70,000 level, which has served as a strong resistance point for the leading cryptocurrency since July 29th. This resistance barrier was established following Bitcoin’s peak at an all-time high of $73,700 in March this year.

After that point, the market went through phases of price adjustments and stability, yet the current optimistic mood is fueling anticipation for another price surge as the year unfolds.

Could $70,000 Be Within Reach?

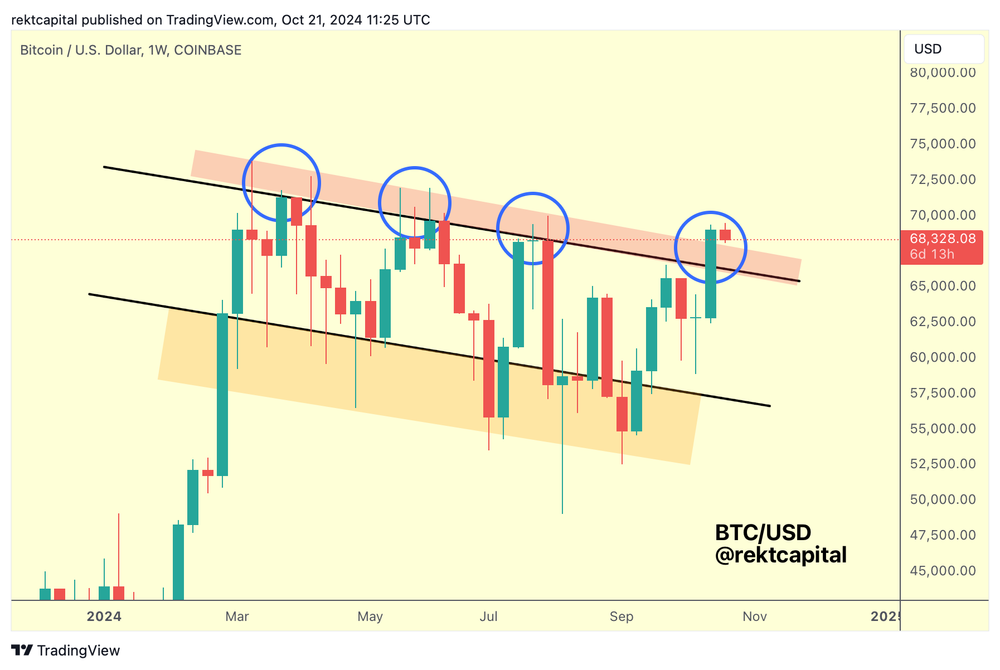

According to market expert Rekt Capital, Bitcoin’s current path shows an upward trend, with a possibility of reaching or even surpassing the $70,000 price level again.

Significantly, Rekt noted that Bitcoin breached a descending trendline following its rise above the $65,000 mark earlier in May, thereby negating a pattern of successive higher peaks that were set since mid-March.

This spike indicates that the prior decline is over. According to Rekt’s analysis, Bitcoin consistently struggled to surpass the channel’s resistance, but the latest weekly closure has altered market perceptions.

According to Rekt’s interpretation, Bitcoin is presently testing the level it previously considered as resistance at around $69,000. If this test proves successful, it might imply that the breakout has been confirmed, potentially leading to more upward price movement.

In simpler terms, Rekt clarifies that the recent test of lower resistance points might cause Bitcoin’s value to drop towards approximately $66,300 – this being the upper boundary of its channel. Previously, this level acted as a strong obstacle, stopping the price from advancing any further.

Rekt highlighted that the previous week’s results underscored the significance of this sector, since Bitcoin surpassed its lower high, potentially paving the way for an upward shift to higher values, provided the mentioned support remains intact.

Key Resistance Challenge Ahead For Bitcoin

If Bitcoin manages to touch its current support level again, the analyst predicts that the price could potentially rise towards the upper limit of around $71,500 in the future. This level represents a significant hurdle for Bitcoin, as it would be the first attempt to surpass the upper boundary of the recent accumulation phase since June.

In simpler terms, Rekt contends that if Bitcoin (BTC) manages to move upwards beyond its current resistance levels, it will suggest that this resistance is becoming less potent. This, in turn, could increase the chances of BTC reaching even greater heights.

Nevertheless, the query persists: how significant could a potential pullback be if Bitcoin is rejected at its current price range ceiling? In the past, dating back to mid-March 2024, Bitcoin has experienced more pronounced rejections, with drops of around 21% to 25%, on August 5 and September 6.

As I analyze the current market trends, it appears that Bitcoin is approaching a previous resistance area around $66,000, which could potentially flip into support. If this level is successfully revisited, it might pave the way for a substantial reversal towards the $70,000 milestone, further strengthening the bullish sentiment surrounding Bitcoin as it traverses these crucial price points.

Currently, Bitcoin (BTC) is being transacted for approximately $67,350, showing a decrease of 2% over the past 24 hours.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-22 09:04