As a seasoned crypto investor with several years of experience in the market, I find these recent on-chain metrics for Bitcoin to be incredibly bullish and indicative of an imminent parabolic breakout. The surge in network activity, as evidenced by the increase in daily active addresses, is a positive sign that more users are returning to the ecosystem and could trigger a significant price run.

The trends in Bitcoin‘s on-chain data remain optimistic, indicating that a dramatic surge in value for the leading cryptocurrency may be imminent. A noteworthy shift in network activity is the most recent positive sign, which could potentially boost Bitcoin further.

Bitcoin Sees Surge In Network Activity

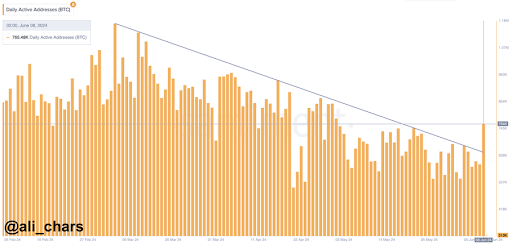

Expert: In a recent post on X (previously Twitter), crypto analyst Ali Martinez shared that the daily number of active Bitcoin addresses has surpassed a decline that started on March 5th. He mentioned that approximately 756,480 Bitcoin addresses have been in use during the past 24 hours. This trend is considered a “favorable indicator” indicating the possibility of an extended Bitcoin bull market.

This new development might lead to an influx of Bitcoin users re-entering the market, which in turn could boost its price. The increased number of daily active addresses is just one of several positive indicators suggesting a potential price rise for Bitcoin.

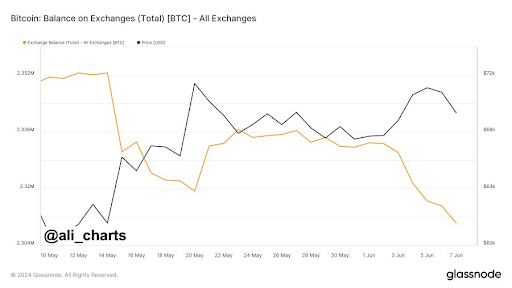

As a researcher studying the cryptocurrency market, I’ve observed an intriguing trend with Bitcoin’s supply. Lately, this digital asset has seen a sharp decrease in its availability on exchanges, reaching new record lows. This bullish sign indicates that investors are holding onto their Bitcoin rather than selling it in the short term. Consequently, the reduced supply available for trading could potentially alleviate any significant selling pressure on Bitcoin.

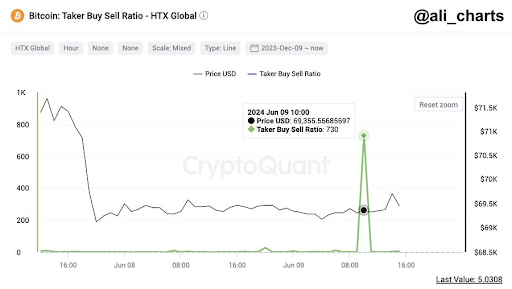

As a cryptocurrency analyst, I’ve observed a significant decrease in the amount of Bitcoin held on exchanges over the past week. Specifically, approximately 22,647 Bitcoins, equivalent to around $1.57 billion, have been withdrawn from these platforms. Furthermore, an intriguing development is the surge in the Bitcoin Taker Buy Sell Ratio on HTX crypto exchange, which has reached a high of 730.

As a crypto investor, I’ve observed an increasing trend in the number of buyers compared to sellers in the market, which is a positive sign. Martinez pointed out that this intense buying interest could potentially overpower bullish sentiment and lead us to a robust uptrend for Bitcoin. This buying momentum has the potential to significantly influence Bitcoin’s price, particularly if selling pressure remains weak.

Bitcoin’s Current And Future Outlook

Martinez has shared his perspectives on Bitcoin’s present situation and future prospects through a set of posts on his X platform. In one of these posts, he pointed out that Bitcoin’s price is now in a robust support area ranging from $69,380 to $67,350. Approximately 1.97 million wallets hold around 964,000 Bitcoins within this price range. For Bitcoin to maintain its bullish trend, it’s crucial that its value stays above this support level.

As the crypto analyst shared his analysis, he indicated that Bitcoin could reach new heights if it maintains its current bullish trend. He estimated that a potential local peak for Bitcoin might be around $89,200. However, Bitcoin is forecasted to climb even higher during this bull market cycle, surpassing the $100,000 mark according to analysts like Tarekonchain, who believe it’s highly probable that Bitcoin will eventually exceed its all-time high and reach new record prices.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-06-10 19:16