As a seasoned crypto investor, I’ve learned to pay close attention to on-chain data and the behavior of whales in the market. The recent buying spree by Litecoin whales, as evidenced by the $230 million net inflows into their wallets, is a bullish sign for me.

Recently, large Litecoin investors, or “whales,” have purchased approximately $230 million worth of coins. This significant buying activity might signal an upcoming price rise for Litecoin.

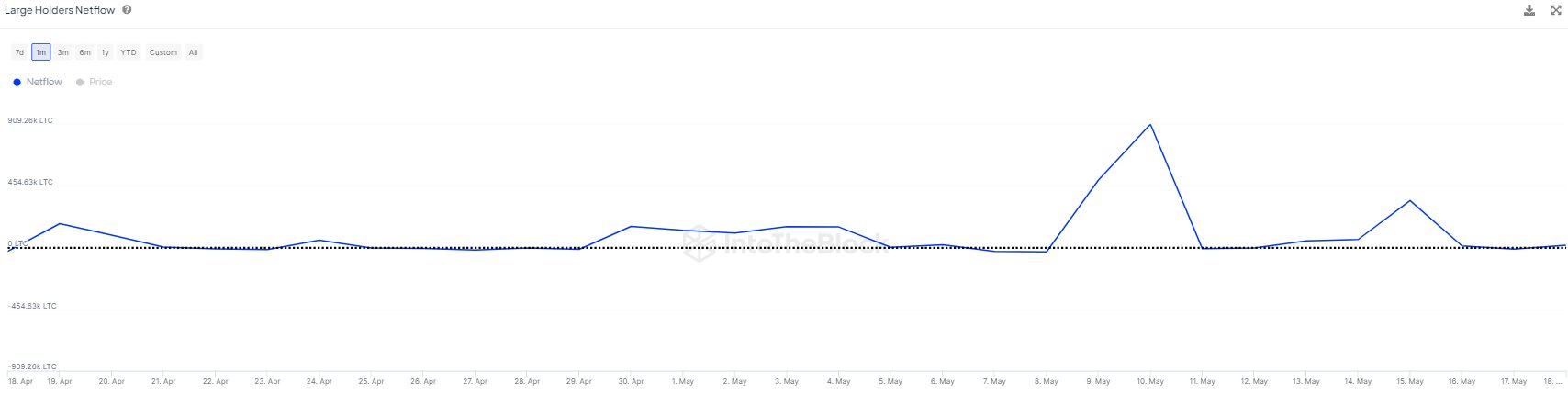

Litecoin Whales Have Been Making Net Inflows To Their Wallets Recently

Based on information from the market intelligence platform IntoTheBlock, there has been a significant increase in the amount of Litecoin being transferred to the wallets of major investors, or “whales,” during the last month.

The key on-chain metric to focus on is “Large Holders Net Flow.” This indicator monitors the net difference between Bitcoin flowing into or out of wallets controlled by investors holding over 1% of the total Bitcoin circulating in the market.

According to IntoTheBlock, “large holders” refer to significant entities in the asset’s network, often compared to whales due to their capacity to transfer substantial amounts of the asset quickly.

when the Large Holders Netflow registers a positive figure, it signifies that big-time investors are currently acquiring more coins than they’re disposing of. This purchasing activity could potentially boost the coin’s price due to its bullish implications.

From my perspective as an analyst, the presence of a negative indicator suggests that the whales may be disposing of their holdings at this time. This action could potentially lead to downward pressure on the asset’s price.

Here’s a chart illustrating the recent trends in the net flow of large Litecoin holders over the past month.

Based on the data presented in the graph, I’ve noticed that the net flow of Litecoin held by large wallets has predominantly shown positive values within this time frame. This observation implies that these whale wallets have primarily received more Litecoin than they have sent out, indicating a trend of accumulation.

Based on the data from the analytics company, these significant investors have amassed approximately 2.75 million Litecoin within the past thirty days. With the present value of the asset in the market, this hoard carries an impressive worth of around $230 million.

The indicator experienced a significant surge on the 10th of this month, as illustrated by the chart. On that day, large investors or “whales” purchased approximately 900,000 LTC, marking the highest daily acquisition since February. This represents around one-third of the total amount they have accumulated over the past month.

Large investors have recently purchased large amounts of Litecoin as the coin’s price has stabilized near its bottom after the mid-April market downturn. This indicates that these investors, or “whales,” believe the current Litecoin prices represent good buying opportunities.

It’s possible that this development is a positive indication for the cryptocurrency’s price growth. However, it’s important to keep an eye on the situation since a reversal in the indicator might signal a potential price decline instead.

LTC Price

Lately, Litecoin has been holding steady within its price range with the cryptocurrency’s value hovering near $84 at present.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-05-21 04:17