Litecoin (LTC) has seen a bullish recovery recently due to speculation that an LTC Exchange-Traded Fund (ETF) might be approved in 2025. This optimistic outlook, backed by Bloomberg ETF Analyst Eric Balchunas, has sparked excitement and revitalized enthusiasm among Litecoin investors.

Currently, Litecoin is trading at $134.5, with a 24-hour volatility of 14.6%. Its market capitalization stands at approximately $10.14 billion, while its volume over the past 24 hours reached $2.64 billion.

In the wider cryptocurrency resurgence, Litecoin is leveraging the positive trend, poised for an uptrend surge. Currently, the token aims at surpassing the symbolic $200 level.

Litecoin Price Analysis Signals Breakout Run to $161

Looking at the day-to-day graph, it’s clear that Litecoin (LTC) is experiencing a series of four successive upward candles, indicating a bullish trend. This surge in price has boosted LTC by approximately 50% from its weekly low at $92.51.

The upward trend has additionally shaped a curving base formation, known as a ’rounding bottom’ pattern, with a ceiling at approximately $138. Propelled by an overwhelming surge in purchasing demand, technical signs suggest a high probability of a breakthrough.

Each day, the Relative Strength Index (RSI) line is approaching the overextended zone, suggesting an increase in buying pressure or bullish trend. Additionally, the Moving Average Convergence Divergence (MACD) and signal lines have crossed bullishly, further supported by a rise in the histogram, which indicates a strong buy signal.

Based on trend analysis utilizing Fibonacci ratios, our short-term bullish projections for Litecoin suggest it may reach the psychologically significant level of around $150 and a potential resistance at approximately $165.18. If the overall market recovers further, the price might aim higher towards the 1.618 Fibonacci extension level, which could be approximately $208.

On the flip side, the 38.20% Fibonacci level at $121.54 acts as a crucial support.

On-Chain Metrics Support Bullish Momentum in Litecoin Price

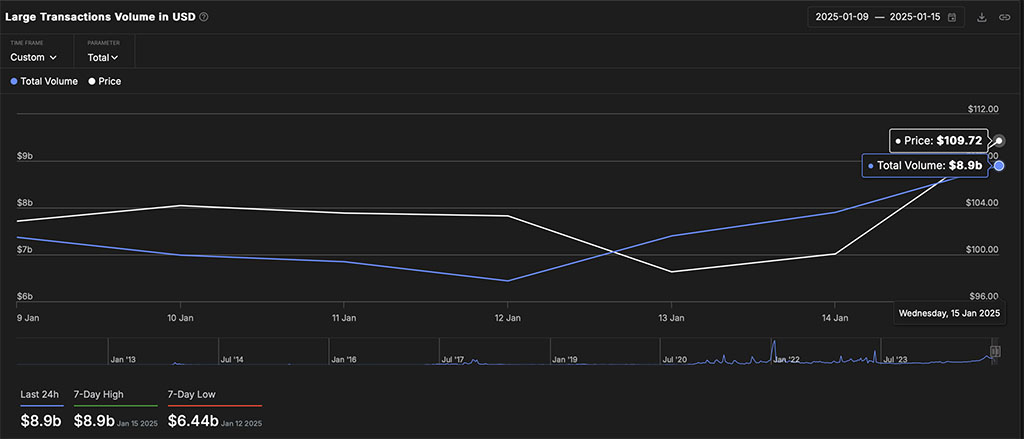

In addition to the optimistic price trend, the Litecoin network is experiencing growth, indicating rising activity and interest. The number of transactions has jumped from a weekly minimum of $6.44 billion to $8.9 billion, representing a $1.5 billion increase since January 9.

Over the last seven days, we’ve seen a rise in daily active addresses from approximately 337,630 to 353,820. Moreover, the number of addresses containing non-zero balances has grown, moving from around 180,000 to 193,510. This trend suggests a broader involvement in our network.

Or simply:

In the past week, we’ve witnessed an increase in active daily addresses from 337,630 to 353,820 and a growth in non-zero balances addresses from 180,000 to 193,510, indicating more people are participating on our network.

In other words, as the condition of Litecoin’s network continues to improve, it suggests that there could be an increase in its value since demand for the network is on the rise.

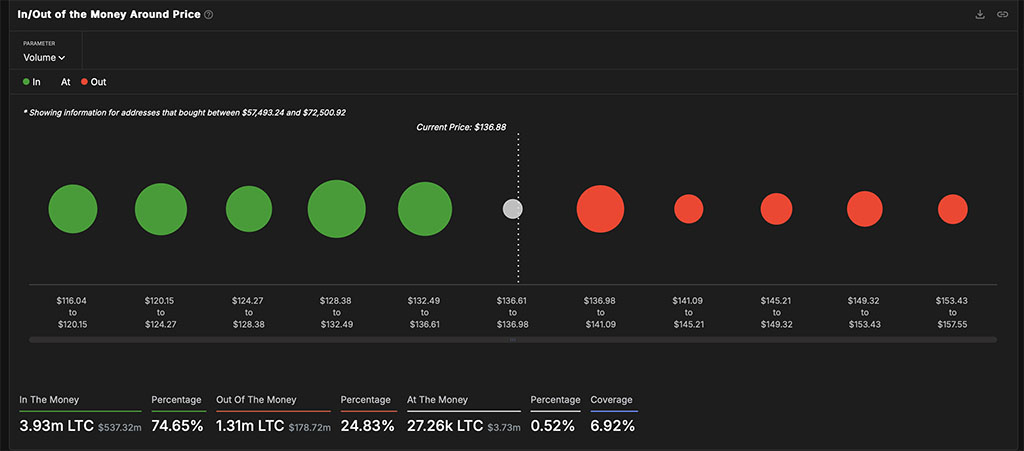

On-Chain Reveals Pathway to $150

Regardless of the ongoing optimism, an analysis of the in-between price levels shows a substantial amount of supply lying between roughly $136.98 and $141.09. This stretch poses a potential obstacle, as it’s estimated that around 50,000 addresses collectively hold approximately 604,490 Litecoins in this region.

Moving past these obstacles, it seems the journey towards $157.55 becomes more straightforward. If the recovery continues, Litecoin could potentially reach its long-term Fibonacci goal of $208.

As network usage increases, robust technical signs, and the possibility of Exchange-Traded Fund (ETF) anticipation boosting interest, Litecoin appears poised for an optimistic surge. Although a short-term resistance at around $140 could hinder the upward trend, broader market backing might propel Litecoin towards approximately $208 in the upcoming weeks.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2025-01-17 18:12