As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent trends unfolding in Litecoin’s market. The data points towards a sudden exit of small investors, which could potentially favor LTC’s price.

Recent on-chain activity indicates that smaller investors have been withdrawing their Litecoin holdings. This could potentially boost the value of Litecoin as it often occurs before price increases.

Small Litecoin Investors Have Been Displaying FUD Recently

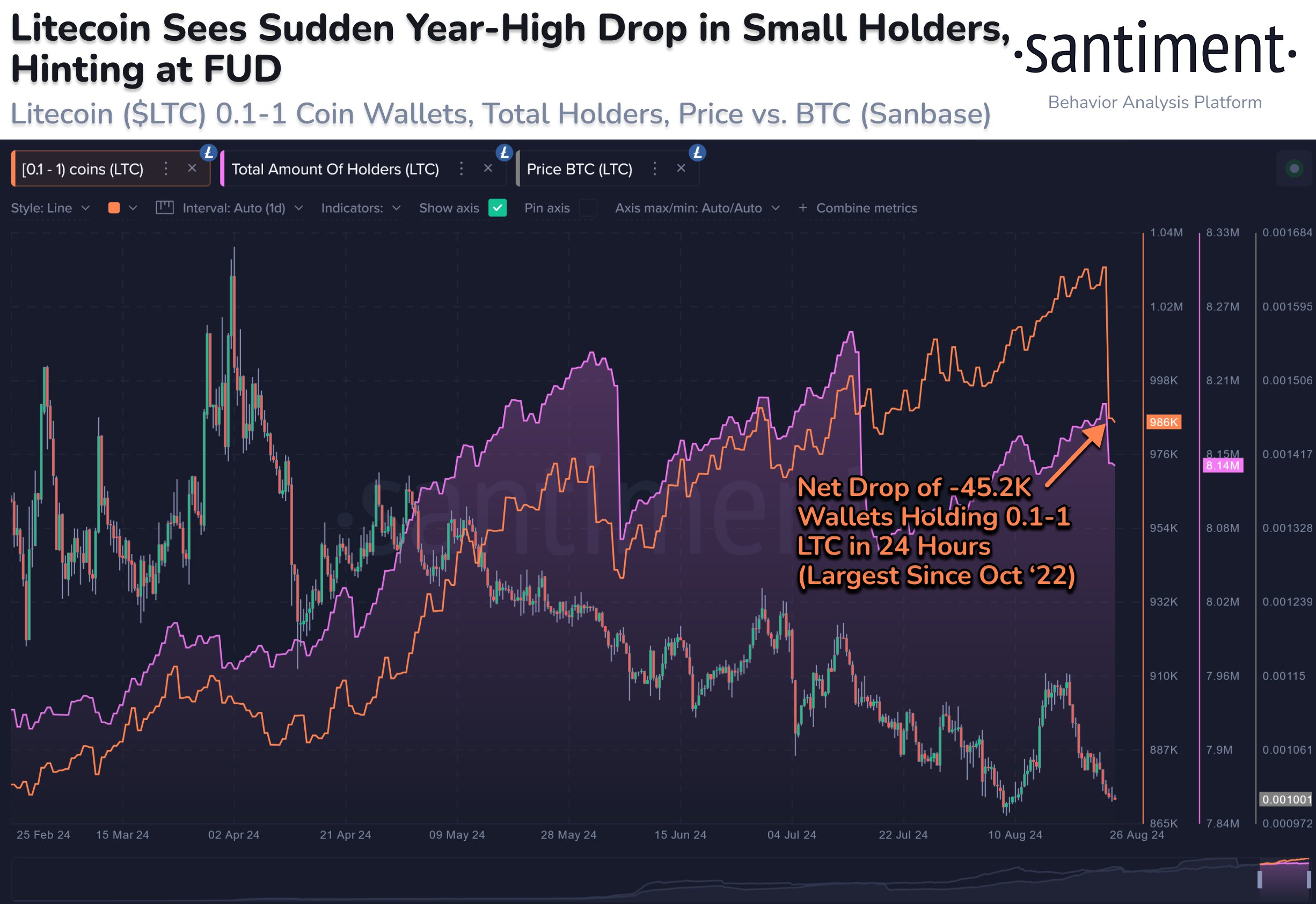

In a new post on X, the on-chain analytics firm Santiment discussed the latest shift in Litecoin’s userbase. A couple of relevant indicators are relevant here: Total Amount of Holders and Supply Distribution.

The first of these, the Total Amount of Holders, measures, as its name suggests, the total number of addresses on the LTC network carrying some non-zero balance.

As the value of this particular metric increases, we’re seeing an influx of new accounts with balances appearing on the blockchain. This suggests that the technology is being more widely accepted, a development that often signals positive momentum for the associated asset.

Conversely, a decrease in the indicator’s value might imply that certain investors are choosing to empty their portfolios, possibly as they aim to withdraw from the cryptocurrency market entirely.

Here’s a graph illustrating the progression of Litecoin Holder Count over the past couple of months:

According to the graph, there’s been a significant decrease in the number of Litecoin holders lately, which could indicate that numerous investors are choosing to exit their investment in this asset.

Although the reduction indicates some withdrawal from the network, the Total Number of Owners provides no insight into what category of investors might be offloading holdings here.

Here’s where we find the second key piece of information – the Supply Distribution. This measure gives us insights into the overall count of wallet addresses that are currently categorized within a specific group.

The provided graph shows that Santiment has included the Supply Distribution details particularly for investors holding between 0.1 and 1 Litecoin in their wallet balance. Given this relatively small quantity, those meeting these criteria would likely be individual or small-scale investors, often referred to as “retail investors.”

It’s clear from the graph that there has been a swift decrease in the number of Litecoin addresses in this particular range. To be more precise, approximately 45,200 retail addresses seem to have emptied out during this recent drop.

It seems that a significant portion of the drop in the total number of Holders might be attributed to smaller investors. Although selling could indicate a negative trend, the reality that these small-scale investors are surrendering their positions at this point might not necessarily be unfavorable.

According to the analytics company, “Small investors quickly moving away from a particular asset can sometimes signal that it’s about to become bullish again.” Whether this trend will cause a recovery in Litecoin is yet to be determined.

LTC Price

Currently, Litecoin’s value hovers near $62, representing a decrease of over 4% compared to its price seven days ago.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-28 05:10