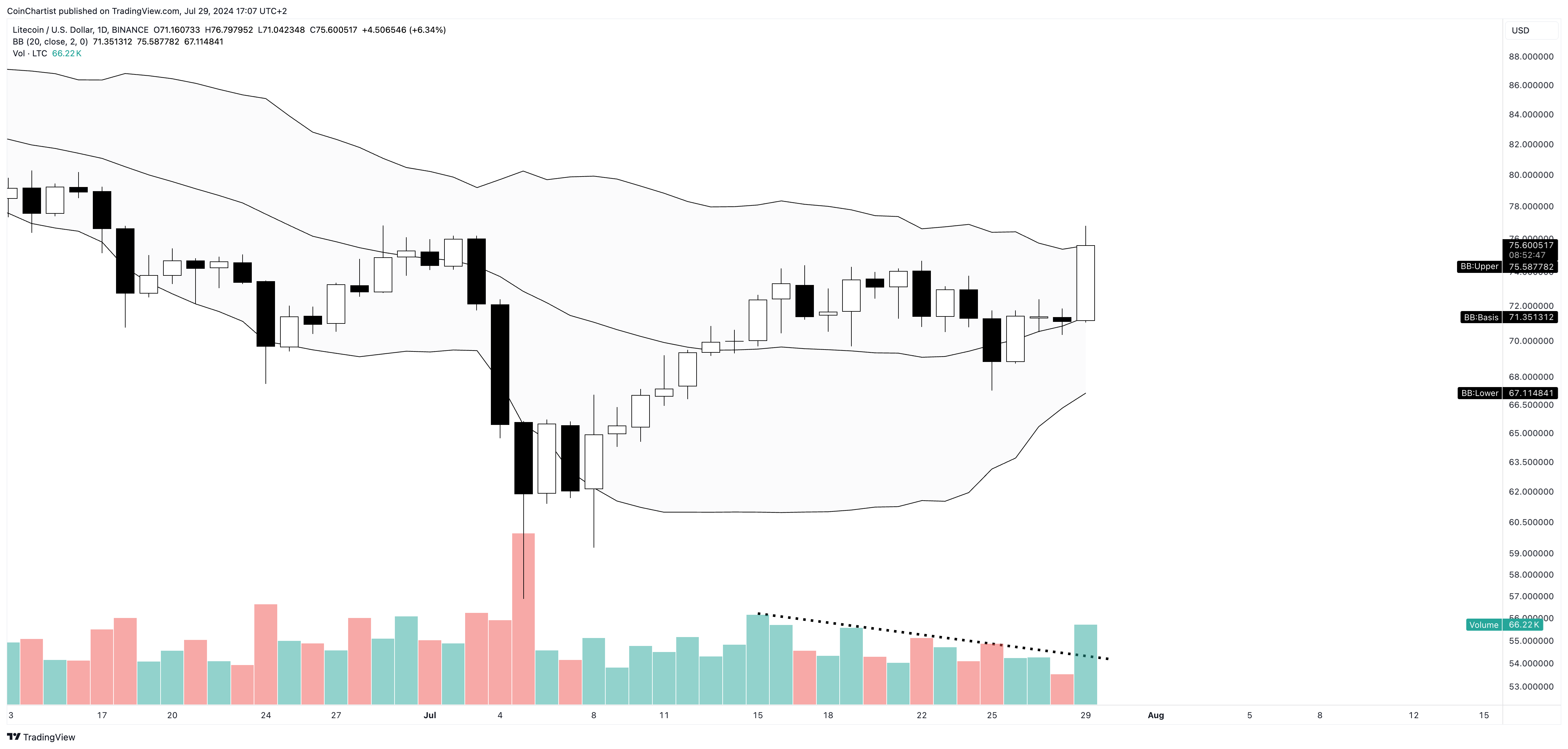

As a long-time crypto investor who has witnessed the meteoric rise and subsequent downturn of Litecoin since its glory days in 2017, I can’t help but feel a glimmer of hope with today’s sudden surge. The 6% intraday rally in LTCUSD is not only capturing my attention but also generating a potential buy signal based on the Bollinger Bands.

Litecoin stands out in the crypto market, experiencing a 6% rise within a day, whereas Bitcoin remains unchanged. The significant one-day increase in LTC-USD could potentially trigger a buy signal based on the Bollinger Bands indicators. What could this imply for Litecoin? This surge might be an early indication of a more optimistic trend to come.

Possible Buy Signal Setup Lights Up In Litecoin

Over the past few years, holding Litecoin has been particularly challenging for investors. However, in the second half of 2017, Litecoin experienced an extraordinary surge, earning the nickname “silver to Bitcoin’s digital gold.” During this nine-month period, Litecoin saw a remarkable increase of more than 10,000%, which catapulted it into the top ten cryptocurrencies by market capitalization.

Since that time, there have been significant developments. Currently, Litecoin ranks eighteenth in terms of market capitalization, barely managing to maintain its spot among the top twenty cryptocurrencies. Over the past seven years, since the 2017 bull market, the altcoin has predominantly moved laterally, causing frustration for many investors.

There may be better times coming up soon, based on the technical analysis of the LTCUSD market using the Bollinger Bands indicator. A potential buy signal is emerging.

All About The Bollinger Bands And How To Use Them

Bollinger Bands aren’t merely technical indicators; they function as a comprehensive trading system. Their main role is to measure market volatility, with the bands constricting when volatility is minimal. When the bands start broadening out, it signals that volatility is making a comeback.

Additionally, the Bollinger Bands have the capability to trigger buying and selling signals based on the position of the price in relation to the upper and lower bands. Each band is established at a distance of +2 standard deviations from the middle line, which represents a 20-period simple moving average.

The theory holds that only robust and enduring price actions manage to break through the upper or lower boundary. A 6% spike in LTCUSD today pushed it beyond the upper Bollinger Band threshold. Crossing above the upper limit is crucial for confirming a buy signal, especially when accompanied by heightened trading activity. The descending volume trend has been disrupted, making this an additional positive sign for initiating a purchase.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-07-29 18:22