As a seasoned analyst with over two decades of experience in both traditional finance and digital assets, I have seen many cycles of market euphoria and despair. The current state of Litecoin (LTC) has piqued my interest, as it presents an interesting case study of investor sentiment and the dynamics between retail and institutional investors.

Recently, Litecoin (LTC) has encountered some challenges, as its market worth decreased by approximately 36% from its high point on April 1.

The consistent drop in value has sparked concern among traders and investors, leading some to ponder if the cryptocurrency can sustain itself over the long run.

“Shrimp Holder” Sell-Off Signals Waning Confidence

One of the most alarming developments for Litecoin in recent months has been the significant selloff by “shrimp holders,” a term used to describe smaller investors, in this case, those holding less than 1 LTC. According to data from Santiment, a leading on-chain analytics platform, these small-scale investors have liquidated over 45,200 LTC in recent weeks.

⚡️ Litecoin has not been lighting social forums on fire with its market value dropping -36% since its April 1st peak. A sudden liquidation of 45.2K net 0.1-1 LTC wallets indicate that small traders are finally capitulating out of the OG crypto asset. Small fish impatiently…

— Santiment (@santimentfeed) August 27, 2024

This surge in selling signals a rising unease among individual investors regarding Litecoin, with small-scale investors often representing the broader retail market. Their behavior offers insights into overall investor feelings. The significant withdrawal of funds from these smaller accounts implies that optimism about Litecoin’s future may be diminishing.

In this case, a common response to intense fear of continued losses among investors is known as panic selling. This happens when they choose to minimize their losses before things get worse. However, although some market experts see massive sell-offs like these as possible signs that a market may be approaching its lowest point, the current technical signals for Litecoin do not align with this positive outlook.

Declining Technical Indicators

Right now, Litecoin is approximately valued at $63. However, it’s currently under significant pressure because it’s below key moving averages, which have now turned into potential barriers for an increase. For Litecoin to potentially experience a positive turnaround, it would need to climb back up towards the $70 mark, as the 200-day moving average remains substantially higher than its current value.

The Momentum Indicator called the Relative Strength Index (RSI) currently stands at 44, indicating that Litecoin isn’t experiencing either extreme selling (oversold) or significant buying activity. Moreover, low trading volumes hint at a scarcity of new investors entering the market.

Institutional Interest Remains

In spite of the downward trend in the market, certain institutional investors remain bullish about Litecoin, as evidenced by Grayscale’s recent increase in its Litecoin holdings. This makes Grayscale’s current Litecoin holdings their highest ever, indicating that some large-scale investors continue to find value in Litecoin, while smaller investors seem to be selling off.

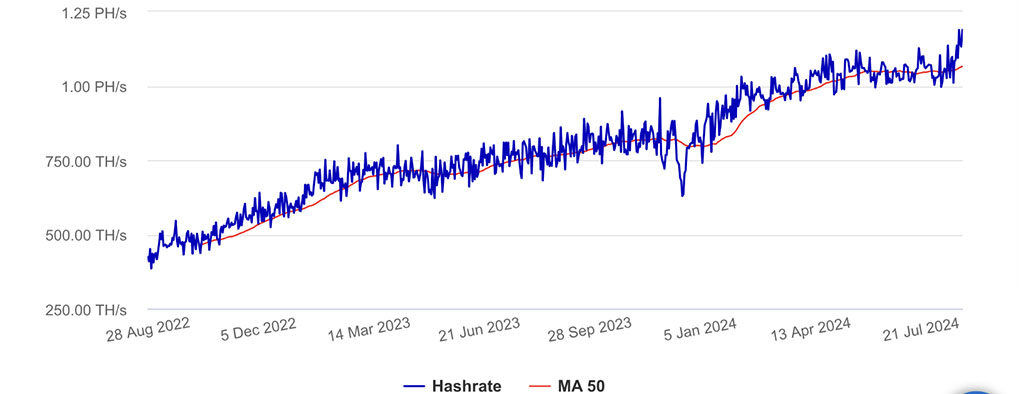

Moreover, the power of Litecoin’s network is growing significantly. The hashrate, a measure of its computational power, recently hit an unprecedented peak of 1.29 Petahash per second (PH/s). This growth suggests that miners remain dedicated to Litecoin, which may offer a strong base for its future potential.

Credit: PoolBay

Although these advancements could spark renewed attention among some investors, the future of Litecoin remains ambiguous. Wider economic issues and overall market sentiments are likely to have a substantial impact on whether Litecoin can rebound or persist in its declining pattern. At present, Litecoin finds itself in a tough spot, requiring a powerful trigger to regain investor trust and boost its market performance.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-08-27 17:24