As a seasoned analyst with years of market observation under my belt, I must admit that Chainlink (LINK) has caught my attention once again. The recent surge of over 10% in just a few hours is not something to be taken lightly, especially after two weeks of sideways action.

In recent hours, Chainlink (LINK) has experienced a rise of more than 10%, currently trading at $11.39. This substantial increase follows a period of about two weeks where the price remained relatively stable, suggesting a possible change in direction for its momentum.

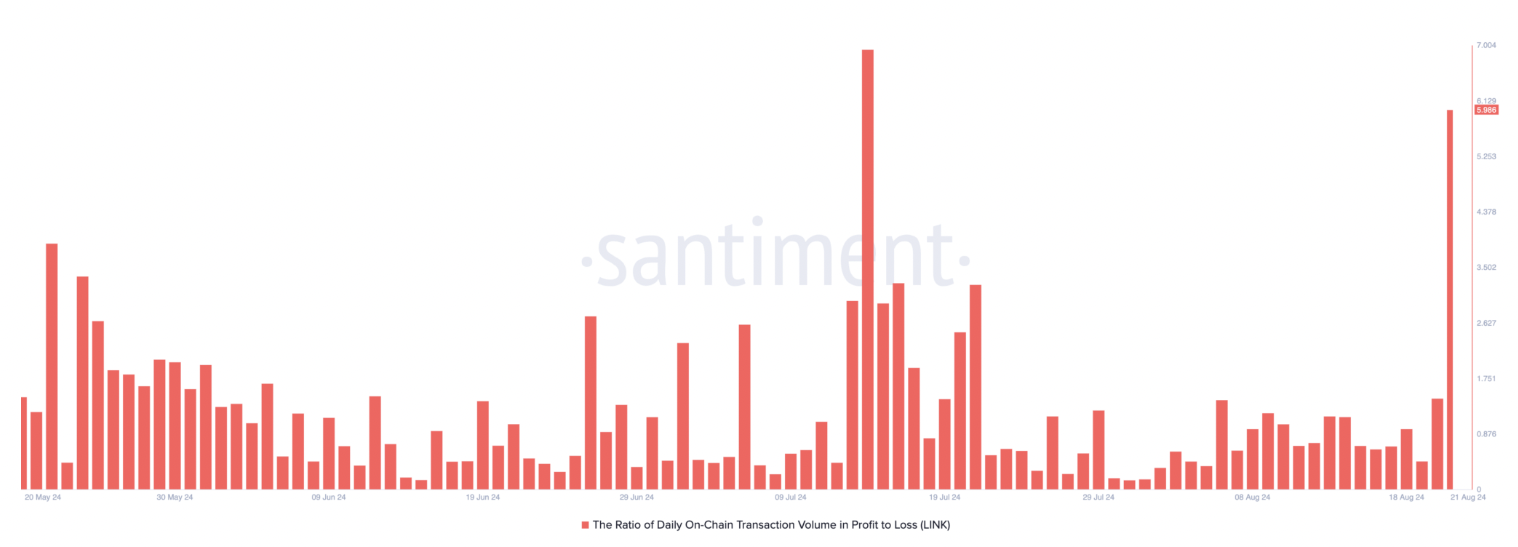

With LINK experiencing a surge, data from Santiment – a well-known crypto data analytics firm – suggests that some short-term investors are cashing in their gains, seizing the opportunity presented by the latest price uptick.

Investor’s careful enthusiasm is underscored by their actions in capitalizing on the increasing value of LINK, which has encountered a technical barrier during its upward trend in the 4-hour trading period.

LINK’s On-Chain Transaction Volume Showing Profit-Taking

Today, LINK‘s daily volume of transactions between profit and loss has peaked since July 14, reaching a ratio of approximately 5.986. This suggests that nearly six profitable transactions occur for every one with a loss, suggesting that short-term holders are cashing out after the recent price increase. This high ratio indicates that investors are capitalizing on a significant price surge or relief rally, securing their gains as the market tests crucial levels.

The pattern of traders cashing in on profits shows the current trade interactions, as the value of LINK steadily climbs within the market. As the token approaches the $11.40 resistance level, there’s a sense of cautious optimism among investors. Traders are closely monitoring the fine line between potential advancements and possible corrections.

Observers will closely examine indications of either a prolonged surge or a possible change in direction as LINK nears this significant point. Whatever happens at this stage may significantly influence LINK’s short-term price movements, making it a pivotal moment for both traders and investors.

Technical Details: LINK Price In Critical Level

As I analyze the market data, I observe that the LINK token is currently trading at $11.31, having surpassed its previous local high of $10.83 set on August 8th. This breakthrough signifies an ongoing uptrend in the daily time frame for me. Notably, the price advancement came to a halt at $11.40, which aligns precisely with the 4-hour (4H) 200 exponential moving average (EMA). This technical indicator seems to hold considerable weight in lower time frames, as it appears to be acting as a resistance level.

In simpler terms, this marker serves as a flexible line that can either assist prices (support) or resist them (resistance), frequently signaling the direction of trends in shorter periods. When it comes to LINK, regaining this level is significant because it helps confirm positive price movements.

To keep the bullish trend going for Chainlink (LINK), the significant move should be to surpass the 4-hour 200 Exponential Moving Average (EMA) and aim for $13. If, on the other hand, LINK is unable to hold its ground above this marker, it could result in a revisit of the previous resistance at $10.83 and possibly a downturn towards the higher support level around $9.90.

Even though some day traders are cashing in their gains, this indicates a healthy profit-taking following a mild surge. The market’s recent behavior suggests it’s consolidating, with traders closely monitoring for the next significant move. As LINK approaches crucial thresholds, the upcoming days will play a vital role in deciding whether the upward trend persists or if a correction is imminent.

Cover image from Dall-E, Charts from Tradingview

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-08-22 21:40