As a seasoned researcher with a keen interest in blockchain technology and DeFi platforms, I find the expansion of Lido Finance onto Optimism particularly intriguing. Having closely followed the DeFi space since its inception, it’s fascinating to witness the growth and evolution of these platforms, especially one as significant as Lido Finance.

Lido Finance, the leading Defi platform in terms of asset management, is broadening its horizons. This liquidity staking platform announced that it’s making it possible to utilize its stETH token, which accrues value, on Optimism – a scalability solution for Ethereum.

Expansion to Optimism: What It Means

In a recent blog update, Lido Finance announced that their users can now enjoy daily staking rewards. Moreover, they stated that by moving their stETH tokens onto the Optimism platform, users can benefit from a smooth transition process and also explore various multi-chain possibilities simultaneously.

Expanding in accordance with its multi-chain approach, Lido Finance is now making its services available across various layer-2 platforms on Ethereum, such as Arbitrum. This move provides users with a more adaptable method to stake their ETH through stETH and wstETH. Additionally, since these Ethereum layer-2 solutions are intended for scalability, Lido Finance claims that all transactions will be cost-effective.

1) Option: Lido Finance is one of many services enabling users to deposit their ETH and generate returns through liquidity staking. This opportunity arises due to Ethereum transitioning from a proof-of-work mechanism to a proof-of-stake system in 2022, following the Merge event.

After turning off the proof-of-work system, the network transitioned to the Beacon Chain. Now, it’s these validators who are responsible for verifying and processing all transactions within this new chain.

As an analyst, I’d rephrase it as follows: To participate in validating transactions and earning part of the 3 ETH block reward and fees on this platform, one initially needed to lock in 32 ETH. This high threshold made it inaccessible for many users. However, the platform offers a solution by enabling users to stake their ETH without needing the 32 ETH required to run a full node themselves.

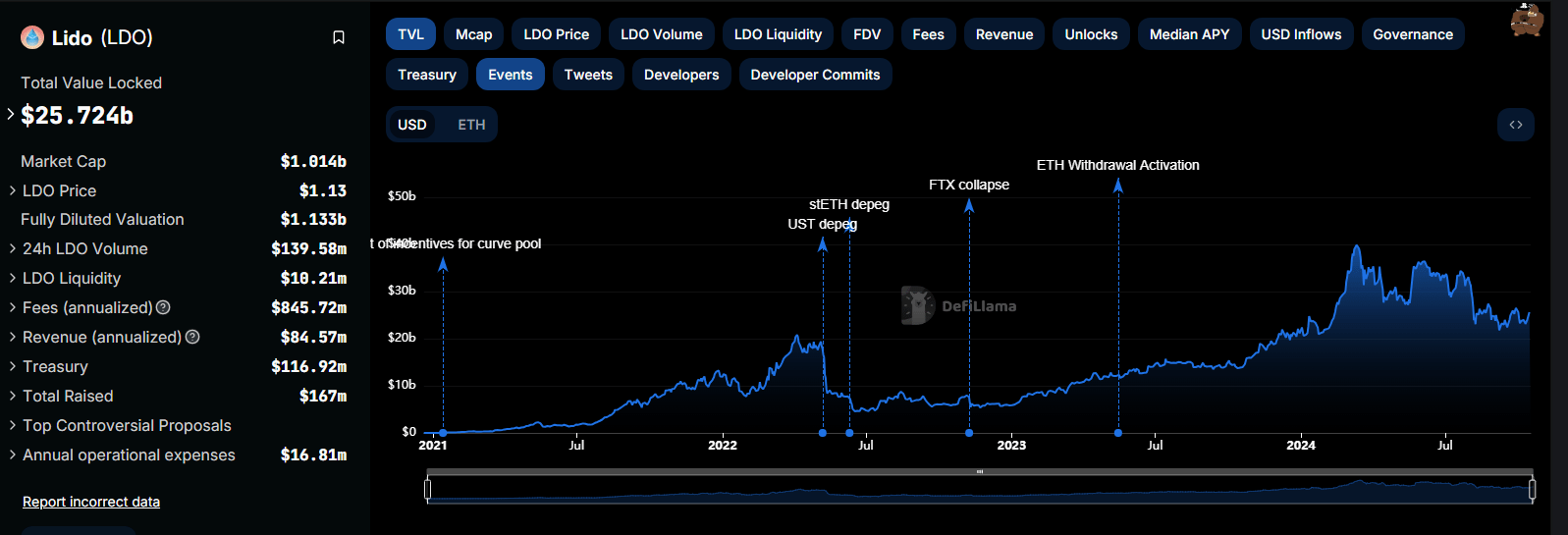

Lido Finance Manages Over $25 Billion, LDO Down 72% In 9 Months

As of October 16, DeFiLlama data shows that Lido Finance had a total value locked (TVL) of over $25 billion. Over the last year alone, the protocol has generated over $845 million in the last year and more than $1.8 billion since launching.

As a researcher, I find it fascinating that while the standard Ethereum mainnet protocol ensures its security, ETH holders on various layer-2 platforms such as Arbitrum, Base, Linea, and Scroll have the unique opportunity to directly stake their ETH from these off-chain solutions. This feature not only enhances the accessibility of staking for these users but also underscores the versatility and evolution of Ethereum’s ecosystem.

As an analyst, I’ve noticed that despite the expansion of Lido Finance’s ecosystem, the price momentum for LDO has been faltering. Even after the gains on October 14, the token hasn’t managed to surpass its September highs and turn around the losses it incurred over the past nine months. In fact, since peaking in March, LDO has plummeted by a staggering 72%.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-10-17 06:04