As a seasoned crypto investor with over a decade of experience in this volatile market, I have learned to take every prediction and analysis with a grain of salt. Peter Brandt’s prediction of a Bitcoin price crash to $78,000 is certainly bearish and intriguing, but it’s important to remember that even the most respected analysts can be wrong sometimes.

Having witnessed multiple market cycles, I know that Bitcoin has a knack for confounding even the most astute of analysts. While a head and shoulders top pattern may appear on the chart, it could always fail or morph into something else, as Brandt himself noted.

That said, it’s important to keep an open mind and stay vigilant when it comes to market analysis. I have seen firsthand how a bearish sentiment can quickly turn bullish in the blink of an eye. As such, I will be closely monitoring the Bitcoin price movement over the coming days and weeks, and adjusting my investment strategy accordingly.

On a lighter note, let’s not forget that Bitcoin was once worth pennies and now trades at over $90,000 – who knows where it might go next! As the saying goes, in crypto, anything is possible.

As a seasoned analyst with over four decades of experience in the financial markets, I have seen my fair share of market cycles and trends. Legendary trader Peter Brandt has recently shared his bearish outlook for Bitcoin, predicting that it could plummet to as low as $78,000. As someone who has closely followed the cryptocurrency market since its inception, I have witnessed its meteoric rise and subsequent corrections. While I respect Mr. Brandt’s analysis, I remain cautiously optimistic about Bitcoin’s long-term potential.

Mr. Brandt’s bearish sentiment is based on a variety of technical indicators that suggest a potential reversal in the market. However, I believe it is important to consider the broader macroeconomic factors at play, such as regulatory developments and institutional adoption, which could potentially counteract any bearish trends.

That being said, it is always prudent to exercise caution when investing in highly volatile assets like Bitcoin. Investors should be prepared for significant price swings and should only invest what they can afford to lose. As a trader, I always advise my clients to have a well-diversified portfolio and to never invest based on emotions.

In conclusion, while Peter Brandt’s bearish outlook for Bitcoin is certainly worth considering, it is important to take a holistic approach when evaluating any investment opportunity. By carefully weighing the technical, fundamental, and macroeconomic factors, investors can make informed decisions and navigate the volatile world of cryptocurrency trading with confidence.

Peter Brandt Predicts Bitcoin Price Crash To $78,000

In a recent post, Peter Brandt forecasted that the Bitcoin price might plummet to $78,000 based on a head and shoulders top pattern he identified. This experienced analyst pointed out that if this pattern fully develops, it could lead to a price drop towards this projected level. However, Brandt cautioned that the pattern could also potentially fail or transform into something different with an unexpected surge, or “thrust higher.

Peter Brandt, a renowned analyst, has pointed out that the current situation in Bitcoin pricing appears to be a ‘head and shoulders top pattern’. This isn’t a unique observation; crypto analyst Aksel Kibar has also identified a possible head and shoulders formation on the Bitcoin chart.

The expert warned that the current downtrend might cause Bitcoin’s price to fall towards $80,000. He further speculated that if this decline continues, it could push Bitcoin into a wider pattern that started with a break above $73,600. Yet, he added a note of caution, pointing out that the bearish trend can still be reversed if it fails to fall below its neckline, at which point the downturn would become more substantial.

cryptocurrency expert Ali Martinez recently presented a bearish prediction for Bitcoin’s value. He suggested that if Bitcoin falls below $93,600, it could potentially drop to around $80,000 or even as low as $70,000. Conversely, he noted that for Bitcoin to signal a price increase, it must surpass the $94,800 mark.

How It Could Play Out For BTC

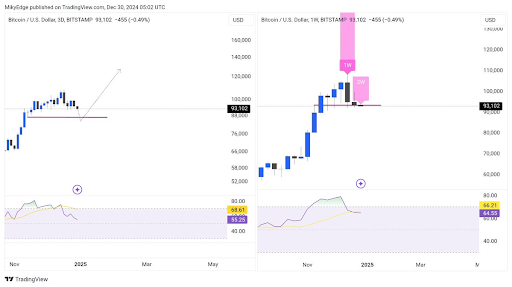

In a recent post on X, crypto analyst Mikybull Crypto shared his predictions about the future of Bitcoin. He suggested that Bitcoin may first experience a decline prior to reaching its peak in Q1 2025, which would mark the end of the current cycle. Interestingly, he also noted that the market volatility in 2025 could be greater than many investors currently anticipate.

According to the chart provided by the analyst and as forecasted by crypto expert Jelle, it’s possible that Bitcoin could peak at approximately $130,000, with a potential further rise to $140,000 within the next three months. Despite Bitcoin’s current mild price fluctuations, the analyst remains optimistic that its value will significantly increase in the near future.

As a crypto investor, I’m confidently predicting that the Bitcoin price will climb significantly within a few months, regardless of any potential short-term fluctuations. Even if BTC dips down to $87,000 at some point, it won’t deter its long-term growth trajectory.

Currently, as I’m typing this, Bitcoin’s value is being exchanged at approximately $93,600, marking a decrease of about 1% over the past day, based on information from CoinMarketCap.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-31 00:41