As a crypto investor with some experience under my belt, I find the recent analysis on Bitcoin’s market conditions during its latest high and the 2021 peak quite intriguing. The distinction between long liquidations dominating over short ones in the current rally versus the trend observed in the previous bull run is a crucial insight for any investor looking to make informed decisions.

As a crypto investor, I’ve noticed some intriguing insights from an analyst regarding the latest Bitcoin price spike. Unlike the 2021 bull run peak, this recent high has been accompanied by distinct market conditions.

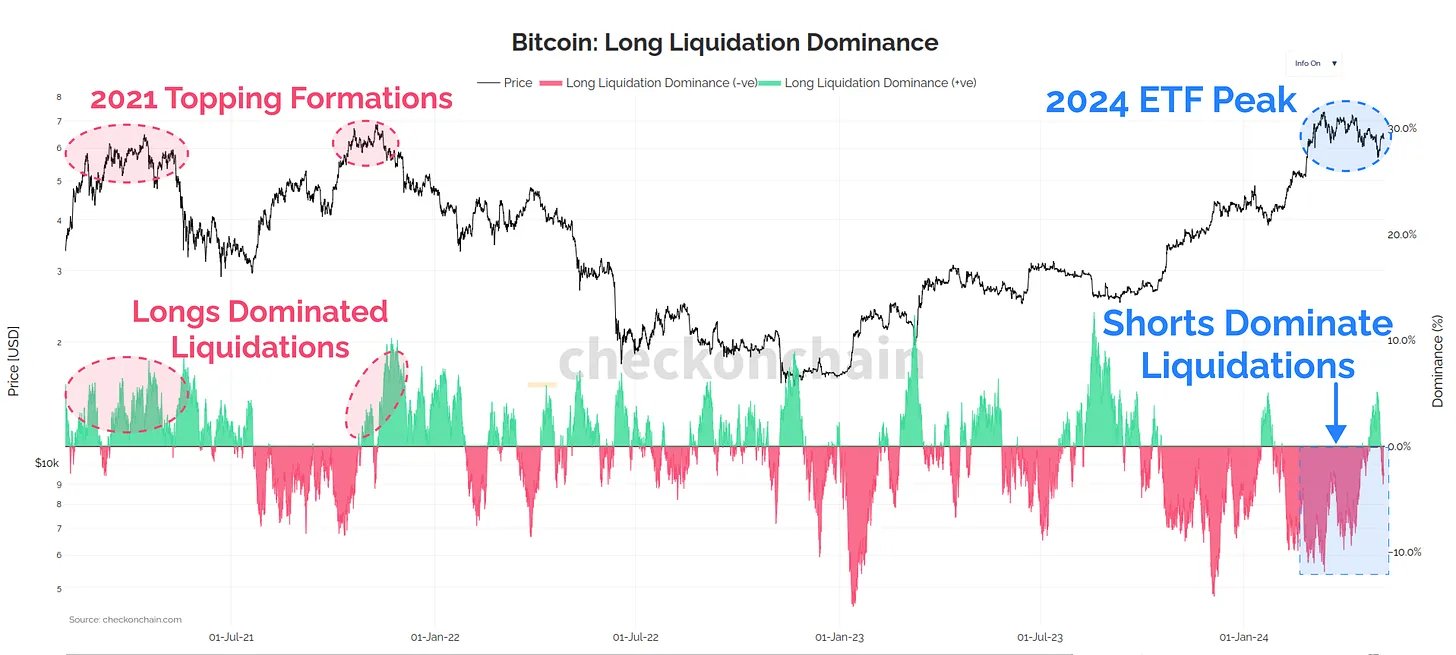

Bitcoin Liquidations Have Been Short-Dominated In Recent Market High

In his recent update on platform X, on-chain specialist Checkmate highlighted an intriguing distinction between the latest 2024 price high, which emerged following substantial spot Exchange-Traded Fund (ETF) investments, and the 2021 peak.

As an analyst, I’ve noticed a significant shift in trends within derivatives markets. In the past few years, the prevalence of long liquidations has increasingly outpaced short ones, as evidenced by the chart below:

In simpler terms, “liquidation” in this context means forcibly ending a derivatives contract on an exchange when it sustains significant losses.

As a researcher studying financial markets, I’ve observed that the likelihood of a contract being liquidated increases as asset prices become more volatile. In periods of significant price movements, whether it be sharp rallies or crashes, a large quantity of liquidations can accumulate in the market.

As a researcher studying the cryptocurrency market trends, I’ve observed an intriguing pattern from the chart. With this year’s rally in cryptocurrencies, short investors taking positions on a decline have suffered significant losses. This outcome is expected since surges in price result in accumulating losses for these investors. Consequently, the rapid growth we’ve witnessed would have pushed numerous short contracts towards liquidation.

It’s intriguing to note that despite the persistent upward trend in the market, investors remained skeptical and frequently placed bets against it, indicating their doubts about the continuity of the rally.

Even during the recent plateau at the peak, this trend has persisted: short selling transactions have surpassed long ones, causing a net loss despite a decrease in price.

From my analysis of the graph, it’s clear that the Bitcoin market behaved differently during the 2021 peaks compared to other periods. Specifically, long positions were being closed out as the price peaked in both the first and second halves of 2021.

During those stages, investors grew excessively eager and solely wagered on uninterrupted growth, disregarding signs of a slowdown in the asset’s performance. This intense greed did not seem to dominate the market during the bull run.

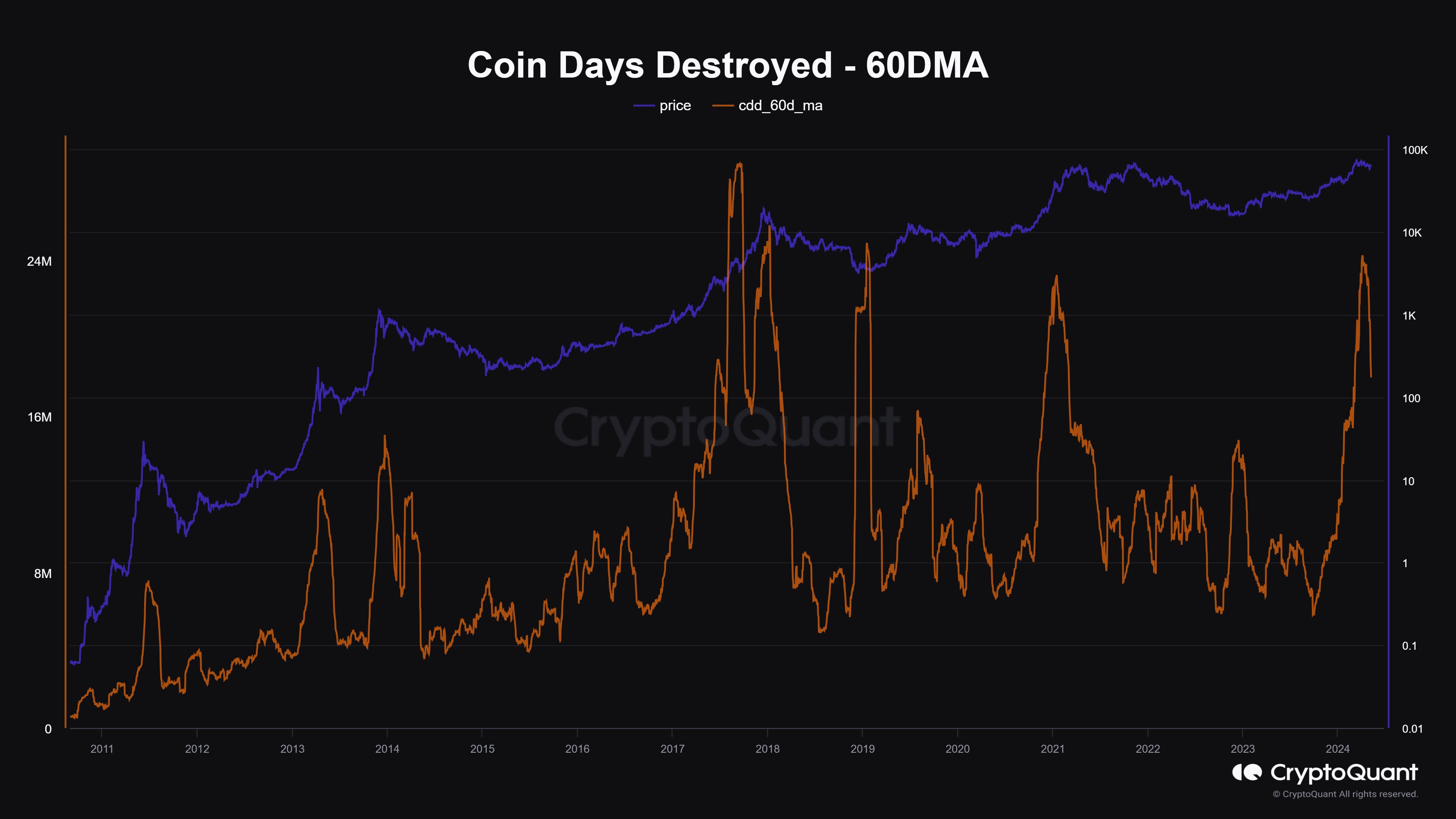

In a recent analysis posted on X, Maartunn noted that although the present Bitcoin surge varies from past rallies in this particular aspect, there are indications of a similar trend based on another marker, which aligns with patterns observed during prior peak periods.

As a cryptocurrency investor, I’m keeping a close eye on the Coin Days Destroyed (CDD) indicator. This metric provides valuable insight into the current activity level of dormant coins in the market. Lately, I’ve noticed that CDD has reached unprecedented heights, signaling a significant movement of previously inactive coins.

“According to Maartunn’s observation, the number of Bitcoin’s “Coin Days Destroyed” may have reached its highest point. Historically, Bitcoin’s price tends to peak around the same time. However, it is important to note that this was not the case with the 2021 peak which formed months after the metric peaked.”

BTC Price

At the time of writing, Bitcoin is floating around $62,200, up more than 5% over the past week.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-10 06:04