Since Tuesday, Bitcoin has experienced significant selling pressure after breaking through the $100K barrier with strength. However, this surge in price, which had many investors anticipating a more stable bullish structure for Bitcoin, soon reversed, causing the price to dip as low as $92,500. This sudden drop has raised concerns among investors about the short-term trajectory of the crypto market’s dominant player.

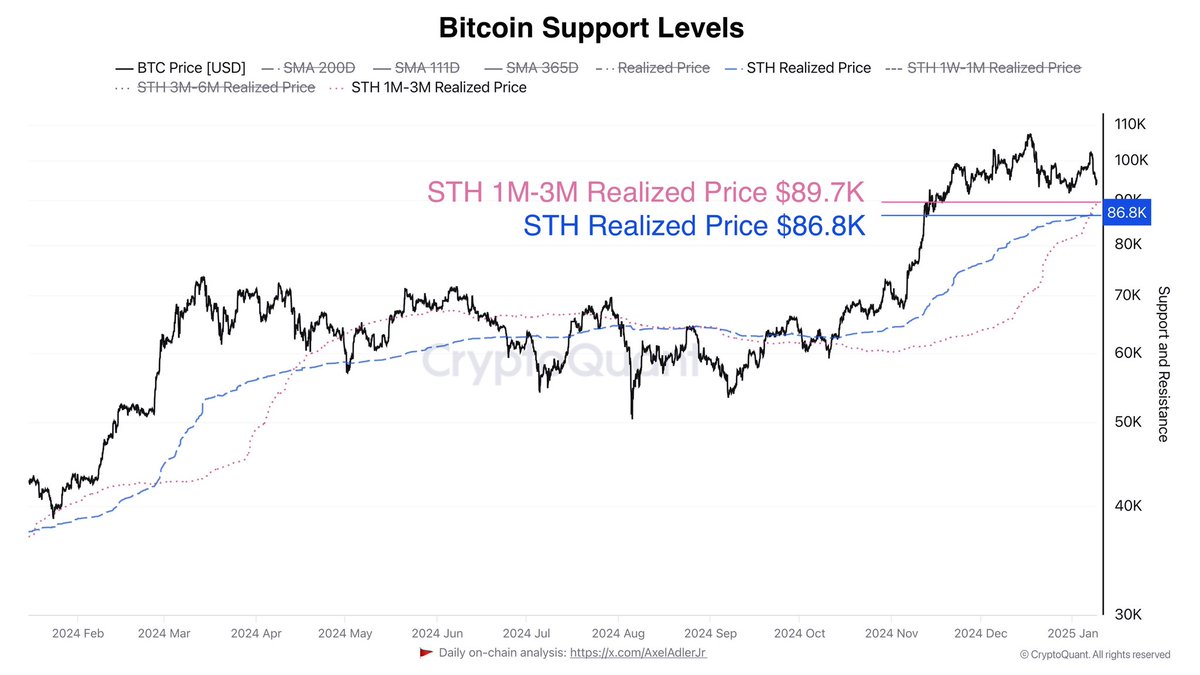

Top analyst Axel Adler has provided important details about X, emphasizing on the potential support levels for Bitcoin. As per Adler’s analysis, the key areas to focus on are around $86,800 and $89,700, which represent the realized price of short-term holders. This data indicates that Bitcoin may be approaching a substantial area with increased demand, potentially witnessing accumulation if the selling pressure decreases.

As Bitcoin hovers around these points, the market is on edge for indications of recovery. It’s unclear if Bitcoin will bounce back from this dip or continue its downturn. Yet, the current support zones might mark a shift, providing a base for buyers to rebuild strength and potentially regain control.

Bitcoin Consolidates Between Key Levels

Currently, Bitcoin is going through a crucial period of consolidation. Its price is moving between approximately $100,000 and $92,000. Although it has briefly gone over the $100,000 level, maintaining its momentum has been challenging, leading some to worry about a possible drop to areas with less demand. Both investors and analysts are keeping a close eye on this price range, hoping that Bitcoin will regain strength below the $90,000 point.

More recently, analyst Axel Adler has offered valuable insights regarding X, highlighting potential support levels for Bitcoin. As per Adler’s analysis, the current Short-Term Holder 1M-3M Realized Price stands at approximately $89,700, while the broader Short-Term Holder Realized Price is around $86,800.

These stages signify crucial price points where Bitcoin might find the impetus for its upcoming surge. If there’s a drop in price to these spots, it could draw in new purchasers, potentially leading to a turnaround situation.

During this critical phase, Bitcoin’s future direction hinges on whether it manages to stay above or regain important levels around $92K. If it does, it could pave the way for further growth. However, if there’s a dip into lower support zones, it might present a valuable chance for long-term investors to accumulate more Bitcoin. The upcoming days will be instrumental in determining whether Bitcoin can find stability and gear up for another bullish surge.

BTC Faces Critical Support Test Below $95,000

Currently, Bitcoin is at approximately $93,400, finding itself in a delicate situation since it’s seeing growing risk as it lingers below the $95,000 threshold. After a quick climb above $100,000 earlier this month, the bullish momentum faltered, and they couldn’t maintain the price above this significant psychological barrier. This fall has left Bitcoin exposed to potential additional drops, with investors keeping a close eye on crucial support zones.

To restore its push forward, it’s vital for Bitcoin prices to surpass $95,000 again. If this level is retained, it will further require overcoming the $98,000 resistance to solidify a bullish consolidation and demonstrate market robustness. Until these milestones are achieved, there remains uncertainty, as the current price range suggests neither side has gained definitive control yet.

As an analyst, I find myself observing the crucial role of the $92K support level, which currently functions as a temporary shield against potential short-term downturns. Should this level be breached, Bitcoin could encounter lower demand areas around $85K – a vital region that might draw in buyers and potentially restore price stability. The coming days are of significant importance as we watch Bitcoin either rally back or face the possibility of a more substantial correction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

2025-01-10 05:10