As an analyst with over two decades of experience in the financial markets, I must say that the current state of Bitcoin and other cryptocurrencies is reminiscent of the dot-com bubble in 1999, albeit on steroids. The retail sentiment towards Bitcoin, as indicated by JPMorgan’s retail sentiment score, is off the charts, suggesting a level of frenzy that could potentially lead to a sharp correction.

After the US Presidential elections and Donald Trump’s win on November 5th, Bitcoin (BTC) and other cryptocurrencies have been experiencing significant surges. According to JPMorgan’s retail sentiment indicator, this market fervor indicates potential volatility in the near future for Bitcoin investors. Here are its key details:

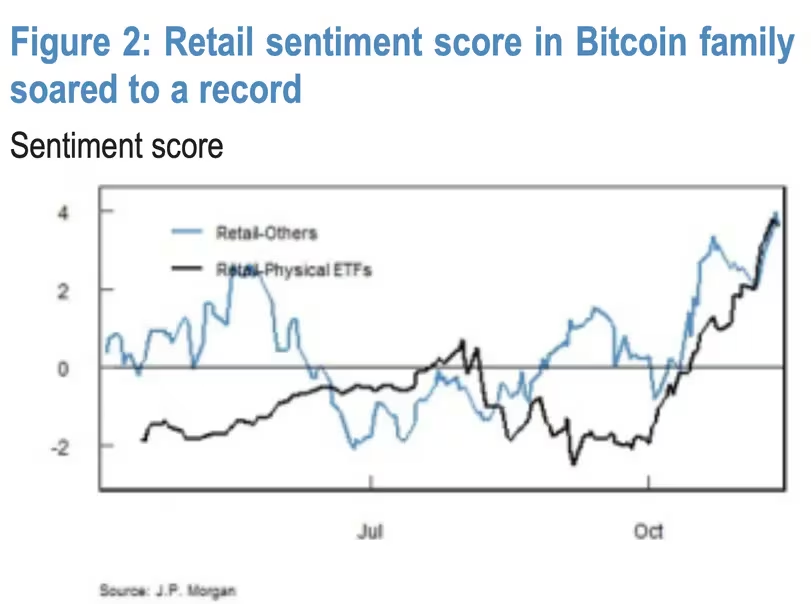

As a crypto investor, I’ve noticed a significant surge in retail sentiment towards Bitcoin recently, reaching an unprecedented high of 4, following the all-time high price of BTC surpassing $93,000 last week. This heightened interest is largely due to robust investments flowing into US-listed spot Bitcoin Exchange Traded Funds (ETFs). The retail sentiment score serves to evaluate the mood of individual investors regarding cryptocurrencies, particularly Bitcoin, by studying the activity across various BTC-related products such as spot ETFs. Last week, the JPMorgan equity research team shared with investors their observations on this trend, emphasizing the increased enthusiasm towards Bitcoin among retail investors.

In the Exchange Traded Fund (ETF) market, there was a significant increase in interest for Bitcoin ETFs after the election results, as indicated by IBIT’s rise of 3.4 standard deviations. Similarly, COIN saw an increase of 6 standard deviations. Notably, the enthusiasm for Bitcoin reached a multi-sigma peak across all types of ETFs related to Bitcoin.

Courtesy: JPMorgan

Over the last two weekdays, the exits from Bitcoin Spot ETFs noticeably increased. Additionally, heightened Bitcoin miner selling caused the BTC price to dip to around $87,000 before recovering back to $90,000 over the weekend. This suggests that both bulls and bears are fiercely competing at this point in time.

Bitcoin Holder MicroStrategy (MSTR) Also Sees Bullish Action

Additionally, MicroStrategy, a company that holds Bitcoin, has experienced a significant surge, reaching unprecedented record highs. Interestingly, the MSTR stock price has consistently been higher than the value of Bitcoin for some time now, and this trend persists due to increased demand as a result of Bitcoin purchases made by the company in large quantities.

The options market associated with MicroStrategy Inc’s (NASDAQ: MSTR) shares, a significant Bitcoin owner, showed exceptionally optimistic behavior, mirroring the vigorous trading usually observed close to market high points.

On a Wednesday, the one-year 25-delta put-call skew dropped drastically by -26.7%. This means that call options, which are typically used to protect against or profit from rising prices, were being traded at a much higher cost relative to put options, which provide protection from price drops. Data obtained from Market Chameleon was recently published by the anonymous analyst Markets&Mayhem on platform X.

Despite a significant decrease in skewness to -11.8% by the end of Friday, there remains a strong inclination towards upward investments. The cost of Bitcoin call options is significantly higher than put options, but the gap between them has been gradually shrinking.

The skew in MSTR is extremely optimistic and seems to suggest a significant drop may not occur unless Bitcoin keeps rising at an extraordinary rate. However, it seems to be experiencing a slight dip from its peak for the moment.” – Markets&Mayhem

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-11-18 12:42