As a seasoned researcher with years of experience in the dynamic world of crypto, I find Fenbushi Capital’s recent move to be intriguing. Having witnessed numerous bull and bear markets, I can’t help but see a hint of strategy or perhaps a bit of FOMO (Fear Of Missing Out) behind their decision to transfer four tokens, including AAVE and COMP, to Binance.

It seems that Fenbushi Capital, a venture capital firm focusing on blockchain technology, has decided to liquidate some of its holdings. They transferred four tokens such as Aave (AAVE) and Compound (COMP) to Binance, suggesting they might be planning to sell these assets to realize their gains or mitigate potential losses if the market rises in value.

Fenbushi Capital Cashing Out? Sends AAVE, UNI, SNT, and COMP Tokens To Binance

Following a string of lower prices after the crypto market peak, particularly in Q1 2024, there’s a widespread belief that Bitcoin and Ethereum prices are poised for recovery. If Bitcoin surpasses $70,000 and Ethereum climbs above $3,000, shedding recent vulnerabilities, they may boost other less liquid altcoins, such as those Fenbushi selected to list on Binance.

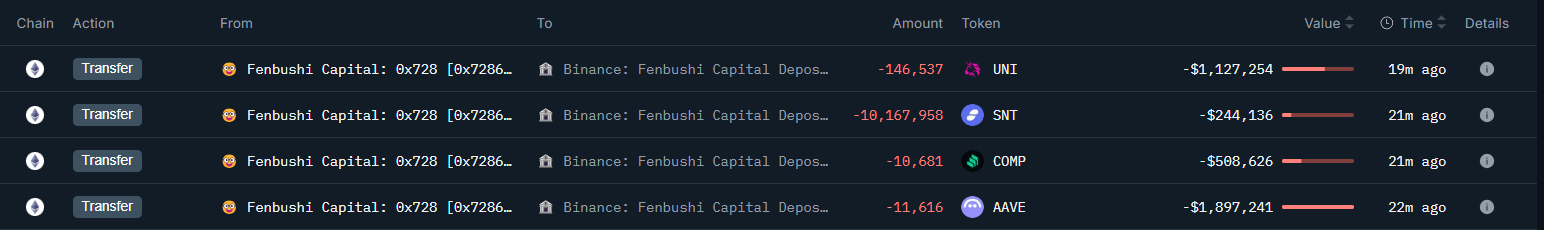

Based on blockchain information, a Venture Capital firm moved 146,537 UNI valued at approximately $1.12 million, around 10.1 million SNT worth roughly $244,000, 10,681 COMP equivalent to around $510,000, and 11,616 AAVE totaling about $1.89 million to Binance. If they sold all these tokens at current market prices, the Venture Capital would have made over $1.20 million in profits.

Among all their assets, their holdings in AAVE (African American Vernacular English) have yielded them over $1.1 million in profits. On the other hand, they are currently experiencing losses with their COMP tokens at current market rates. COMP is the native governance token of Compound, a lending platform.

As a researcher, I acquired these digital tokens approximately two years ago, around 2022, following the peak of many of them during the previous DeFi and NFT-fueled market surge. Interestingly, there was no public statement from me detailing the reasons behind my decision to offload most of these DeFi tokens onto an exchange at that time.

DeFi Rising And Protocols Building: Wrong Timing To Exit?

Moving coins to a centralized exchange might indicate a lack of confidence in the cryptocurrency market, which can be interpreted as negative or bearish. Given the current climate of the crypto world, Fenbushi’s recent action has raised questions and may potentially halt the upward trend.

Based on DeFi Llama’s data, the combined worth of funds locked in various Decentralized Finance (DeFi) platforms currently surpasses $88 billion. At current exchange rates, this total value has increased by more than 100% compared to the lowest points of 2022, which were approximately $36 billion.

Among these, Aave, Uniswap, and Compound represent some of the most substantial decentralized finance (DeFi) platforms currently in operation. Aave has a staggering asset management volume exceeding $12.7 billion, while Uniswap commands over $4.8 billion.

As an analyst, I’ve noticed a significant surge in the total value locked (TVL) within DeFi, but it’s not just about the numbers. The key players are actively growing and evolving. For instance, Uniswap, a decentralized exchange, is gearing up to launch its v4, which promises exciting updates in the near future. On the other hand, Aave, the lending platform, has been aggressively courting new users. By late September, Aave had amassed nearly $20 billion in user deposits, further solidifying its influence within DeFi.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-02 05:46