As a seasoned analyst with years of experience under my belt, I find myself constantly intrigued by the ever-evolving world of cryptocurrencies. And when it comes to Bitcoin, the granddaddy of them all, I always pay close attention to the insights of experts like Maximilian von Schultze-Kraft.

The recent dip in Bitcoin’s price from its record high of $108,353 on Tuesday to approximately $96,000 (representing a 11.5% decrease) has sparked widespread debate about whether the ongoing bull market might be approaching its zenith. To alleviate growing apprehension, Rafael Schultze-Kraft, one of the co-founders of Glassnode, an on-chain analytics company, shared a series of tweets outlining 18 different on-chain indicators and models. “Is the Bitcoin peak here?” Schultze-Kraft inquired, before delving into his comprehensive analysis.

Has Bitcoin Reached Its Cycle Top?

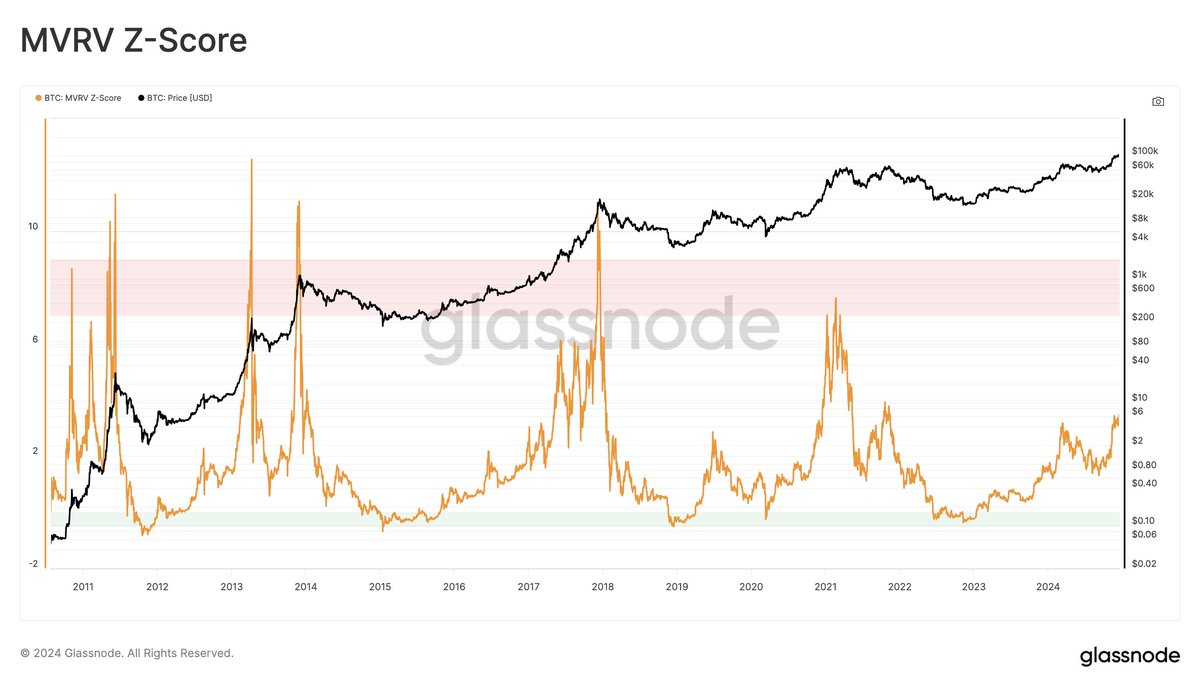

1/ Unrealized Profit Ratio (MVRV): This long-standing indicator, known as MVRV, assesses profitability by comparing a market’s current value against its realized value. Traditionally, readings exceeding 7 have pointed towards overheated market conditions. As Schultze-Kraft observed, the current reading is approximately 3, indicating there’s still potential for growth. This implies that, in terms of overall unrealized profit across the market, we’re not yet seeing levels typically linked to market peaks.

2/ MVRV Pricing Thresholds: These thresholds are determined by the duration MVRV has stayed at its extreme points. The upper threshold (3.2) has been breached merely about 6% of trading days in the past. Currently, this upper limit corresponds to a price point of $127,000. With Bitcoin currently at approximately $98,000, the market hasn’t yet reached a zone that, historically, has indicated significant peak formations.

3/ Long-Term Holder Profitability (LTH-NUPL): Long-term investors, or LTHs, are seen as more steady market players. Their Net Unrealized Profit/Loss (NUPL) score is currently at 0.75, moving into what Schultze-Kraft calls the “euphoria zone.” He noted that during the 2021 cycle, Bitcoin experienced a roughly 3x increase following similar levels, although he emphasized that this isn’t necessarily predicting a repeat occurrence. Typically, the tops of historical formations displayed LTH-NUPL readings above 0.9. Therefore, while the metric is high, it hasn’t yet reached the extremes seen in past cycles.

Significantly, Schultze-Kraft conceded his findings could be underestimated since the 2021 cycle peaked at profitability values slightly lower than previous cycles. He suggested he had anticipated these profitability indicators would touch upon slightly higher figures. This could indicate a potential decrease in peak levels across subsequent cycles. It’s crucial for investors to understand that historical highs might become less pronounced as time progresses.

4/ Annual Realized Profit-to-Loss Ratio: This metric compares the total gains against the total losses experienced over the past year. Values above 700% in the past have been indicative of cycle tops. At approximately 580%, it’s still showing potential for further increase before reaching typical levels associated with market peaks.

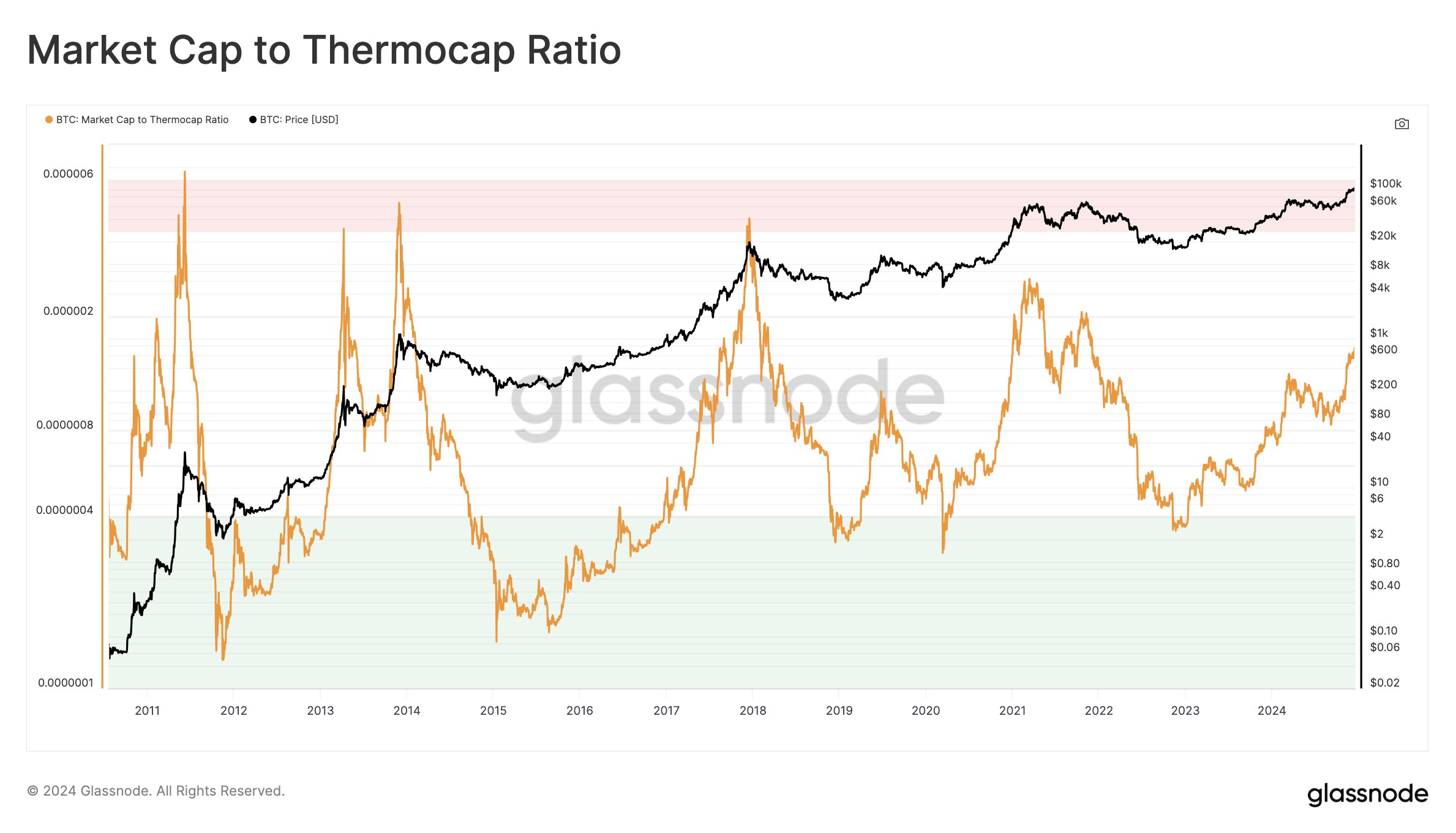

5/ Ratio of Market Cap to Thermocap: This is an early on-chain indicator that calculates Bitcoin’s total market capitalization relative to its cumulative mining cost (Thermocap). Historically, this ratio’s extremes have corresponded with market peaks. While Schultze-Kraft suggests exercising caution without specifying exact target ranges, it’s worth noting that the current ratio is far from previous extremes. The market still falls short of past thermocap multiples that signaled overheated conditions.

6/ Thermocap Multiples (Ranging from 32 to 64): Over time, Bitcoin’s peak value has typically been around 32-64 times the Thermocap. As Schultze-Kraft pointed out, we are currently near the lower end of this range. Reaching the upper band in today’s market conditions would put Bitcoin’s total market cap at approximately $4 trillion. Given that our current market capitalization ($1.924 trillion) is much lower, it implies a significant potential for growth if past trends continue to hold true.

7/ The Investor Tool (2-Year SMA Multiplied by 5): This Investor Tool takes the average price over the past two years of a particular asset and multiplies it by 5. It then uses these figures to identify potential peak zones. As Schultze-Kraft pointed out, this currently stands at $230,000 for Bitcoin. However, since Bitcoin’s current price is significantly lower than this value, the tool has not yet clearly signaled a top.

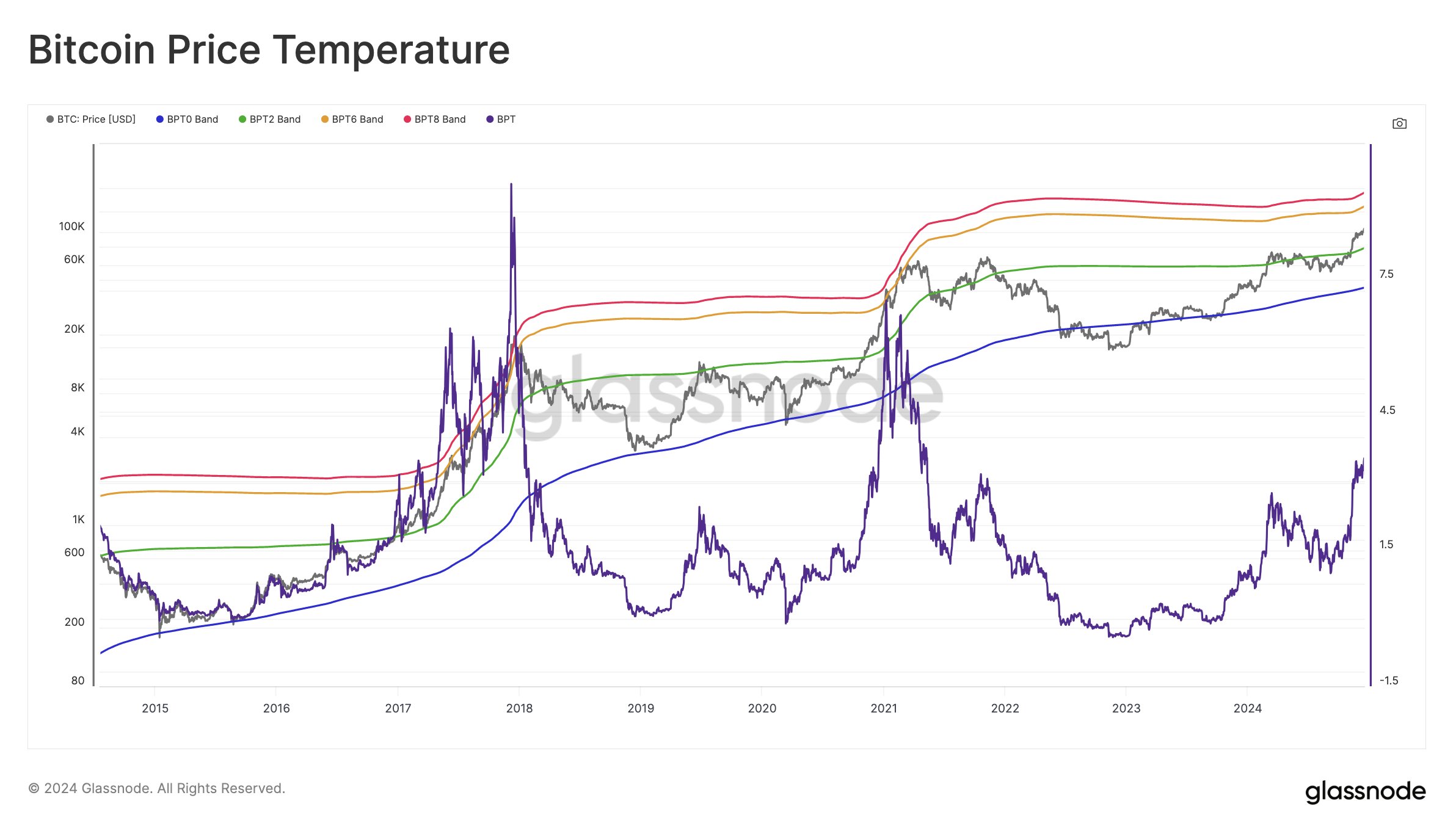

8/ Bitcoin Price Thermometer (BPT6): This tool calculates price fluctuations based on variations from a 4-year moving average to detect cyclical price highs and lows. In past market upswings, BPT6 has been attained, and the current level is approximately $151,000. At present, Bitcoin’s value of $98,000 falls below the levels historically linked with excessive market heating.

9/ Market Mean & AVIV: The Market Mean represents an alternative method for calculating cost basis. Similar to MVRV, AVIV evaluates how much the market deviates from this average. In the past, peaks have exceeded approximately 3 standard deviations. Currently, the value associated with this measure is around 2.3, while the current reading stands at 1.7. Schultze-Kraft suggests that there’s potential for further growth, as the market has not yet reached its historical extremes based on this metric.

10/ Low/Mid/Top Cap Models (Delta Cap Derivatives): These models, utilizing the Delta Cap metric, demonstrated lower values during the 2021 period, never reaching the ‘Top Cap.’ Schultze-Kraft advises exercising caution when interpreting these models due to the dynamic nature of market structures. At present, the mid cap level hovers around $4 trillion, approximately doubling current levels. If historical trends continue, this could indicate substantial growth potential before reaching levels typical of past market peaks.

11/ Value Days Destroyed Multiple (VDDM) is a metric that measures the rate at which long-held coins are being sold compared to their annual average. In the past, values significantly above 2.9 suggested that many older coins were being heavily sold, typically during the later stages of bull markets. Currently, it’s at 2.2, meaning it hasn’t reached extreme levels yet. Schultze-Kraft commented that there may still be room for more selling among long-term holders before they fully cash out due to profit-taking.

12/ The Mayer Multiple Measure: This measure contrasts the price with the 200-day Simple Moving Average. Historically, overbought situations have occurred when the value surpassed 2.4. At present, a Mayer Multiple exceeding 2.4 roughly equates to a price of around $167,000. As Bitcoin hovers below $100,000, this milestone remains unattainable at the moment.

13/ The Cycle Extremes Oscillator Diagram: This combination employs several binary markers (MVRV, aSOPR, Puell Multiple, Reserve Risk) to indicate market extremes at the moment. Since “2 out of 4 are active,” it implies that only half of the tracked conditions for an overheated market have been met. In the past, tops were associated with all signals being triggered. Consequently, this chart indicates that the cycle has not yet reached the intensity level of a full-fledged peak.

14/Pi Cycle Top Indicator: This is a price-based signal that has been used historically to pinpoint cycle peaks by examining the relationship between short-term and long-term moving averages. As of now, the shorter moving average is positioned significantly lower than the longer one ($74k vs. $129k), suggesting no crossover and hence no classic top signal, as stated by Schultze-Kraft.

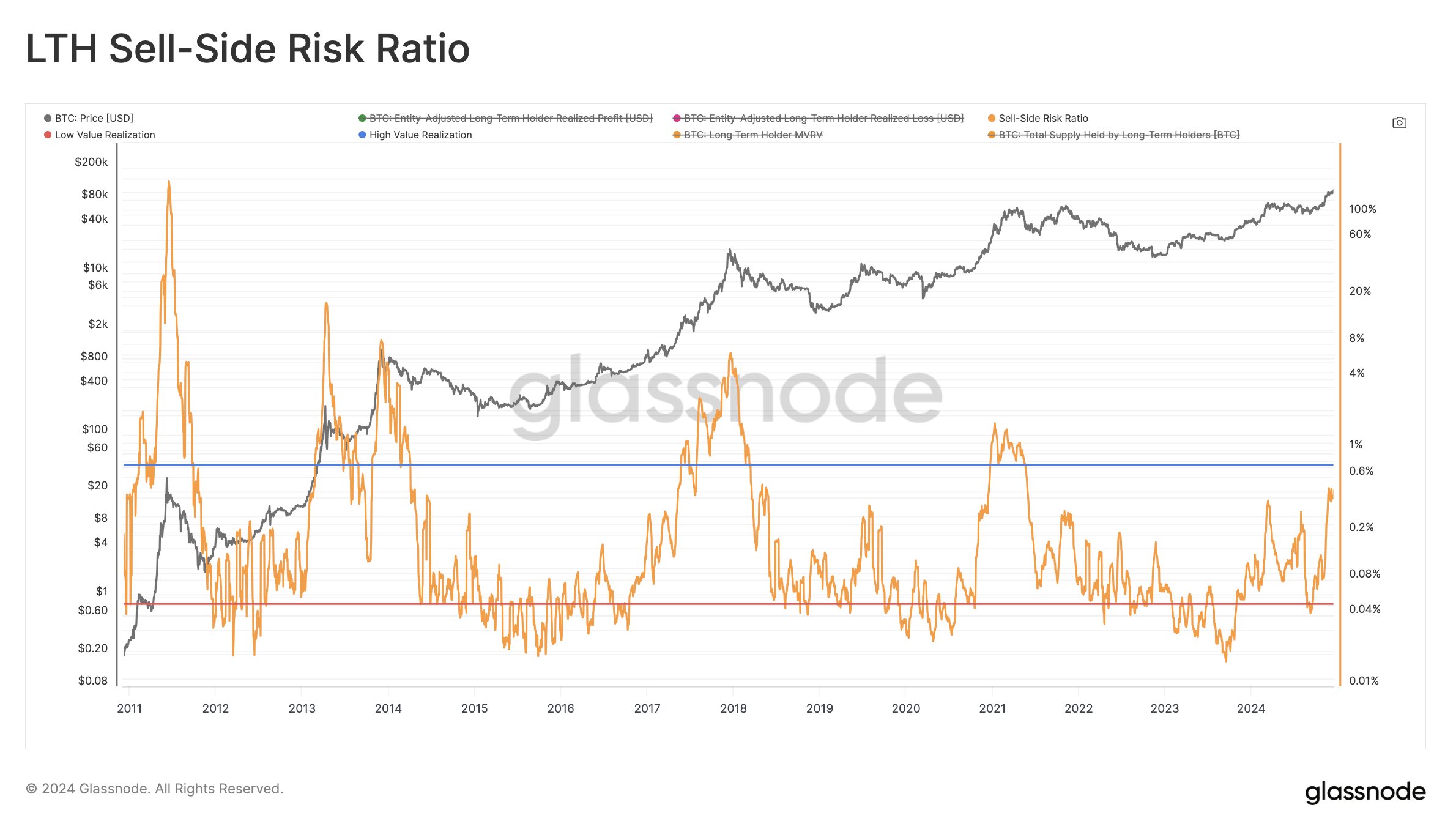

15/ Sell-Side Risk Ratio (LTH Version): This measure contrasts total realized gains and losses with the market’s actual capitalization. High figures typically coincide with volatile, advanced bull markets. Schultze-Kraft noted that values above 0.8% are intriguing, and we’re currently at 0.46%. This suggests that, even after some profit-taking, the market hasn’t yet reached the intense sell pressure zone often seen near market peaks, indicating potential for further growth.

16/ Long-Term Holder Inflation Rate: Schultze-Kraft referred to the Long-Term Holder Inflation Rate as one of the most pessimistic charts he’s seen. Although he didn’t specify exact target values or limits in this passage, he emphasized that it indicates a need for caution. Keep a close eye on this indicator because it could suggest increased distribution from long-term investors or other potential challenges.

17/ Short-Term Holder Spent Output Profit Ratio (STH-SOPR): This measurement gauges the tendency of brief-term investors to cash out their profits. As Schultze-Kraft pointed out, it’s currently at a higher level, but it’s not consistent and prolonged yet. In simpler terms, while short-term players are cashing out some profits, the data doesn’t indicate the frequent, intense profit-cashing seen near market peaks.

18/ SLRV Indicators: These indicators follow the patterns of short-term and long-term realized value trends. Typically, when these moving averages reach their peak and cross over one another, it signals a market shift. As per Schultze-Kraft’s analysis, at this point in time, neither moving average has peaked or crossed over, suggesting that there is no indication of a market top yet, but beware of potential bearish signals at rounded tops and crossover points.

As a crypto investor, I understand the importance of considering multiple indicators when making decisions, rather than relying on isolated metrics. Schultze-Kraft stressed this point, advising us to always seek out confluence – or the convergence of different pieces of information – for a more informed perspective. He admitted that the list he presented is not exhaustive and that Bitcoin’s rapidly evolving ecosystem – which now includes ETFs, regulatory clarity, institutional adoption, and geopolitical factors – may make historical comparisons less reliable. In essence, while we are limited to working with historical data, this cycle could take a unique shape, but it is all we have at our disposal for now.

Despite Bitcoin’s market demonstrating signs of increasing excitement and potential profitability based on multiple indicators, it has yet to reach the excessive levels that were characteristic of previous market peaks. Measures like MVRV, profit ratios, heat-related metrics, and various price-based models largely point towards further growth, albeit one indicator, LTH Inflation Rate, serves as a warning. Some composite indicators are only partially activated, while established peak signals such as Pi Cycle Top have yet to activate.

At press time, BTC traded at $96,037.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-20 17:11