As a seasoned market observer with over two decades of experience under my belt, I find Loukas’ analysis both intriguing and convincing. His interpretation of Bitcoin’s current cycle aligns with my own observations, and his emphasis on cyclical patterns is something I’ve come to appreciate in my years of studying market trends.

Financial expert Bob Loukas has shared a fresh video breakdown named “No Bull.” In this video, he explores the present condition of the Bitcoin market, discussing escalating worries over whether the anticipated bull run might be called off.

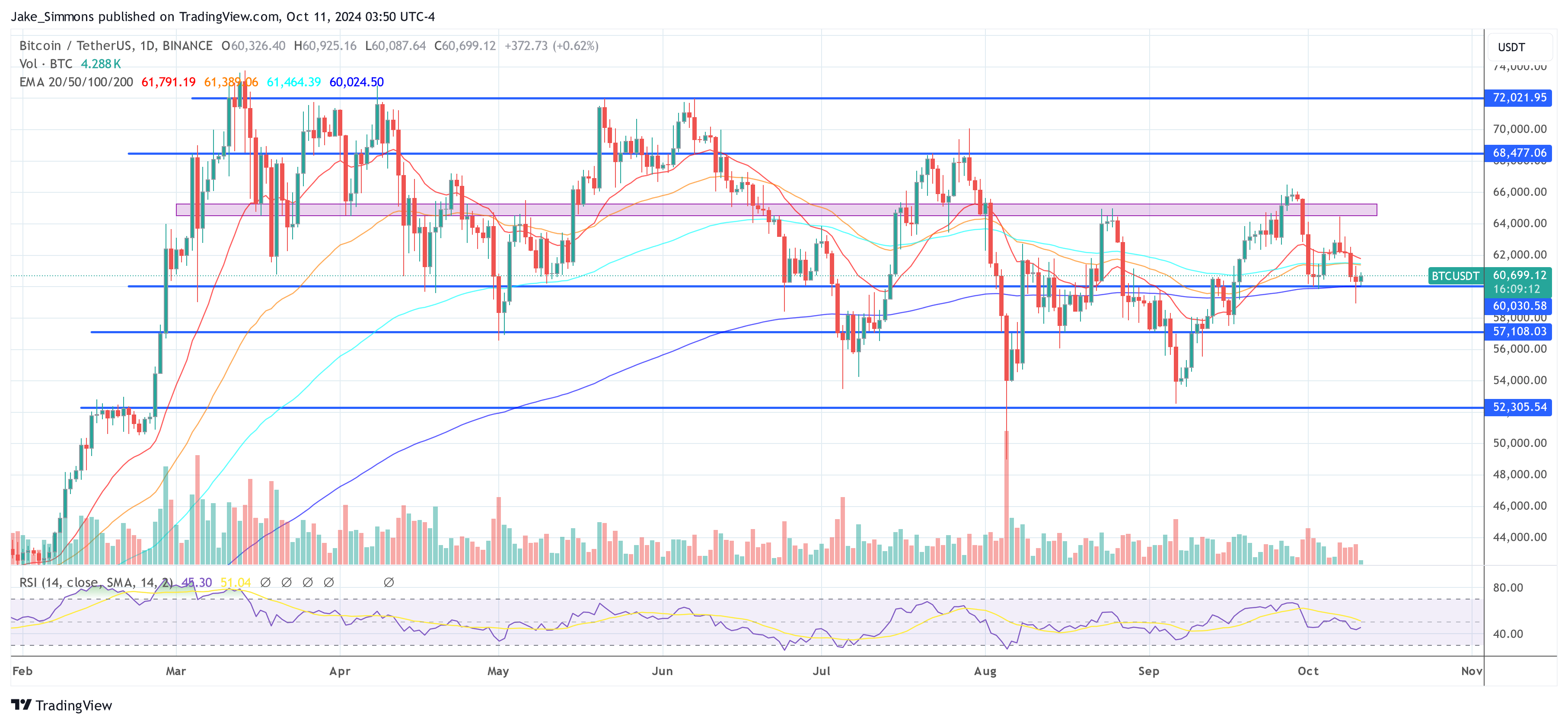

To begin with, Loukas recognizes that the Bitcoin price has been stable for a considerable duration. He notices an undercurrent of apprehension in the market, which is partly fueled by the delay in approval for the Bitcoin ETF and the fact that the halving event has already taken place without triggering substantial price increases.

Is The Bitcoin Bull Run Over?

Loukas points out an interesting contrast: although conventional markets thrive, with “the stock market hitting record highs week after week” and even gold recording significant new peak prices, Bitcoin struggles and most altcoins seem to be gradually fading away. He adds that the only coins that appear to be successful are the highly speculative meme-based cryptocurrencies, which has led to a negative outlook within the crypto sector.

In a different wording: Nevertheless, he views this evolution as “somewhat expected,” underscoring that even with these hurdles, Bitcoin remains “near its peak prices from the previous cycle.” Loukas perceives the eight-month price plateau in Bitcoin as a positive indication. “Eight months of stagnation can be quite optimistic if it aligns with the four-year cycle. The sentiment is favorable, it’s been rejuvenated; the fundamentals, macro factors, I believe they all look promising,” he expresses.

Loukas emphasizes that we’re approximately 23 months into the current market cycle, getting close to its 24-month or 2-year milestone which is expected to end around November-December 2026. He admits that there has been a significant amount of apprehension that seems to have arisen in this market, following a stretch of intense optimism and exuberance from the ETF approval leak in September-October 2023 until the peak in March 2024.

A significant concern, as stated by Loukas, revolves around Bitcoin not setting a new record high since March, and instead showing signs of lower peaks in monthly charts (also hinting at some lower troughs). This pattern has caused unease among investors who hesitated to join the market, hoping for confirmation, but ended up missing the opportunity to buy when prices were dipping, as the market continued an upward trend without pause.

He points out that many investors have “rolled into a bunch of altcoins in this later period that are now down 50, 60, 70%,” leading to a situation where, despite Bitcoin being “still up around 3x off the lows,” a lot of people feel they haven’t “extracted any sort of value out of this cycle” or have even “lost money over this period.” Loukas considers this scenario to be “quite normal from a cycle structure perspective.”

He points out that unlike usual market trends, this bullish period didn’t include a 30% drop at any point. Instead, the biggest drops were primarily time-based and amounted to approximately 20% from the peak to the trough before reaching a new high. This unusual behavior left many investors confused as they were expecting a dip to buy, but one never truly materialized.

As a crypto investor, I find myself reflecting on the current market consolidation as a crucial step to reset sentiment and pave the way for the upcoming phase of this four-year cycle. It’s striking to observe Bitcoin lingering around its position, approximately 20% away from the all-time highs it reached in the last four-year cycle peak back in 2021. This proximity makes it seem more primed than ever for the next phase of this four-year cycle.

He additionally points out similarities between past cycles, specifically mentioning that from Bitcoin’s lowest point in December 2018 until it reached a new peak price, this “took approximately 23 months to surpass the four-year cycle high.” In previous cycles, similar timelines were seen, with around 25 months and 22 months being the timeframes needed to reach new record highs. However, the current cycle managed to achieve this milestone “in only 16 months, significantly earlier,” a trend he attributes largely to the news about the ETF which brought buyers into the market earlier than usual in the cycle.

Loukas suggests that the swift pace of events has led to a situation where many different cryptocurrencies are being cycled or “rotated” frequently. This rotation benefits large, experienced investors (often referred to as “whales” and “old-timers”) who can “unlock” their investments and move on, while newcomers like institutional players and larger accounts have been amassing these coins during this period. He sees the current situation as a gradual process where the market will eventually wipe out the excessive optimism from the previous phase, thus creating a clear divide between one stage of the cycle and the current one—essentially a “mid-cycle correction.

When Will BTC Price Break Out?

In essence, Loukas continues to maintain a positive outlook: “Thus far in this four-year period, I don’t see anything that alters the course, nothing about the characteristics or framework that suggests to me that this phase is distinct from previous ones.

He cites several factors supporting his bullish outlook, including “massive inflows into Bitcoin, mostly institutional players,” and the absorption of large sell-offs by entities like “the German government” and “the US government,” which have not significantly impacted the price. Loukas emphasizes that “price is down only 20%; it’s held up well.” He also mentions that “the ETF is still there; it’s going to be pushed through the independent advisor channels,” and “the timing is there; the macro, the fundamentals are there.”

Loukas expresses great enthusiasm regarding the recurring patterns, stating that “the third year of each four-year cycle is where the remarkable events occur.” He clarifies that “the first year captivates everyone, laying a solid foundation. The second year may appear to slow down because it builds upon the gains from the first year. However, the third year is the peak or ‘mania’ year. As of next month, we’re approaching this ‘mania’ year.

He expects that within the next 90 days, we’ll move beyond our current holding pattern; we’ll break through to higher prices. If this occurs, he thinks Bitcoin won’t look back, predicting a stretch with mostly green (increasing) candles on the chart, and possibly just one or two instances of decreases (red candles). Although he doesn’t specify exact price targets, he suggests that reaching somewhere around $120,000 to $180,000 is a reasonable expectation.

Loukas highlights the importance of considering both “time and feelings,” striving for a shift happening around “the periods where past cycles have reached their highs.” This timing typically falls roughly at the 35-month mark following the last low. If this pattern holds true, the predicted peak would be around October of 2025, allowing for an additional 12 months to the projected or estimated peak. However, he reminds us that this timeline is not fixed and could potentially occur “three, four, five months earlier.” He also points out that market fluctuations can take various forms.

Looking ahead, Loukas acknowledges that the next two months are uncertain with several variables in play at present. He points out the upcoming US election on November 4th and notes that both Trump and the Republican Party have been actively promoting cryptocurrencies like Bitcoin, suggesting a positive market reaction should the GOP secure a victory due to their pro-crypto stance. However, he emphasizes that the identity of the winner is irrelevant in his opinion, as Bitcoin has consistently prospered even under governments that were initially skeptical or hostile towards it.

Loukas predicts that the market could “maintain a horizontal movement until November,” suggesting that any major shifts might not happen until after the U.S. election is over. He anticipates about three to four more weeks of sideways movement, and he finds it unlikely that the market will reach $70,000 or higher before the upcoming U.S. election.

At press time, BTC traded at $60,699.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-10-11 11:13