As a researcher with experience in the cryptocurrency market, I’m keeping a close eye on recent developments regarding Bitcoin and the Mt. Gox exchange. The concern over potential bearish effects from Bitcoin outflows from Mt. Gox is valid, but let me provide some context based on market dynamics and historical trends.

Yesterday, there were notable Bitcoin withdrawals from the Mt. Gox exchange, causing concern among some market observers regarding possible negative price implications. An analyst shares their perspective on this development.

Mt. Gox Has Made Several Bitcoin Transactions In The Last 24 Hours

Over the last 24 hours, numerous Bitcoin transactions originating from wallets linked to the insolvent cryptocurrency exchange Mt. Gox have been detected on the Bitcoin blockchain. Given that the exchange had declared its intention to reimburse its debtors, it is plausible that these transactions stem from the creditor repayment process.

Mt. Gox has transferred a total of 137,890 Bitcoins, equivalent to approximately $9.4 billion at present cryptocurrency market values. This significant movement of coins has raised concerns among traders, as they ponder if these tokens will enter the market for trading, potentially intensifying the existing selling pressure.

The drop in Bitcoin’s value by approximately 4% within the last 24 hours has raised concerns due to recent news causing a negative reaction from the market. However, it remains to be seen if this downturn is a result of the announced withdrawals or just a temporary setback.

As a research analyst, I delved into the topic discussed in a recent X post and offered insights on the possible implications of upcoming Bitcoin (BTC) repayments for potential selloffs. Comparatively speaking, I explored how this event might stack up against previous BTC selloffs that have occurred in the market.

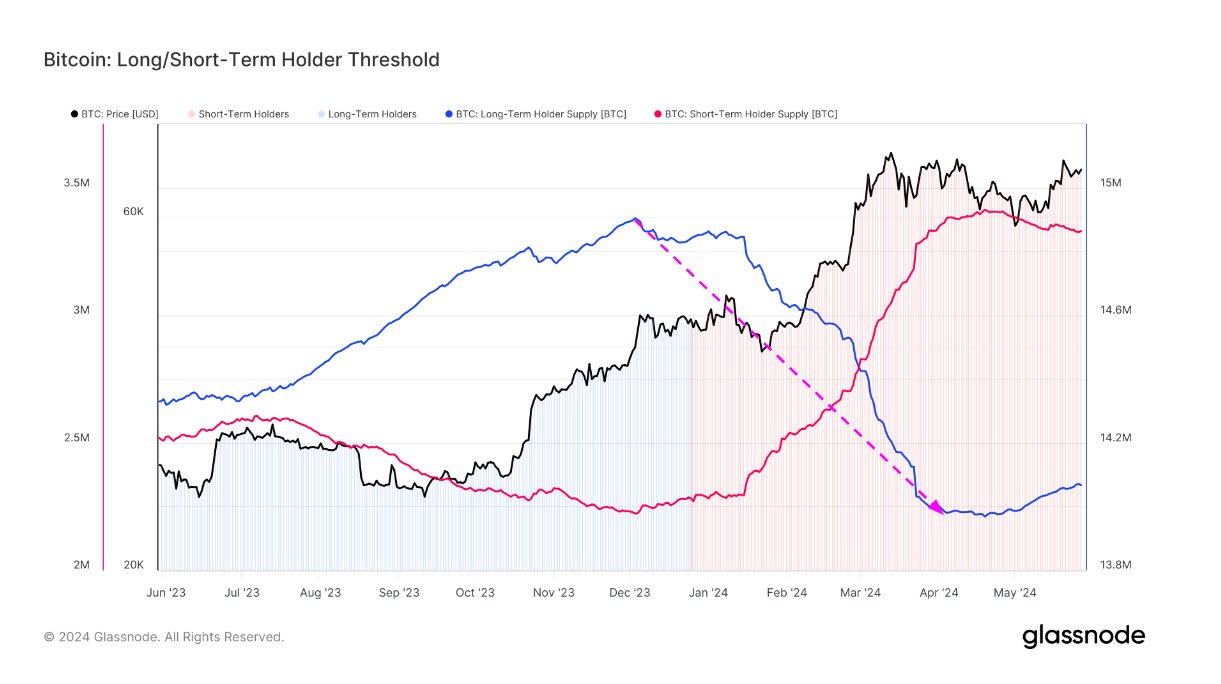

The event in question involving the distribution of Bitcoin (BTC) stems from the long-term investors (LTHs), who represent one of the two primary categories in the BTC market defined by length of ownership.

As a researcher studying the investment behavior of cryptocurrency holders, I categorize investors based on their holding periods. Those who have held onto their coins for over 155 days fall into my long-term holder (LTH) cohort, while those who purchased within the last 155 days are classified as short-term holders (STH).

LTHs, or Long-Term Holders, are known for their steadfastness in the market as they infrequently join in selling waves. Conversely, STHs, or Short-Term Holders, exhibit more volatile behavior and frequently sell off in response to sector developments.

The latest surge in the asset led some long-term holders to sell, as evidenced by the chart, revealing the reduction in their collective ownership.

The line representing LTH supply on the graph has remained relatively stable over the past couple of months. However, prior to this period, it had been decreasing consistently for approximately five months.

During this recent market downturn, large token holders (LTHs) disposed of approximately 1 million tokens. Around 340,000 Bitcoin (BTC) worth of these tokens were connected to outflows from Grayscale Bitcoin Trust (GBTC). Simultaneously, the price of the coin reached a new peak, suggesting that the market successfully absorbed this significant selling pressure.

Straten points out that the Mt. Gox refunds represent just a fraction of the amount sold off, as not all token recipients will opt to sell immediately. And even if they do, it’s unlikely they would do so simultaneously.

Despite this situation, Bitcoin might remain unfazed if the supply distribution doesn’t dampen its current robust demand.

BTC Price

As a crypto investor, I’ve witnessed Bitcoin surpassing the $70,000 mark, but following the unsettling news regarding Mt. Gox, the price has dipped to around $67,700.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-05-29 05:11