Speculation about a potential authorization of a Litecoin Exchange-Traded Fund (ETF) sparked enthusiasm, causing LTC‘s price to surge by 18% within 24 hours to reach $118. First introduced as a Bitcoin alternative in 2011, this digital currency has garnered significant attention from both analysts and investors.

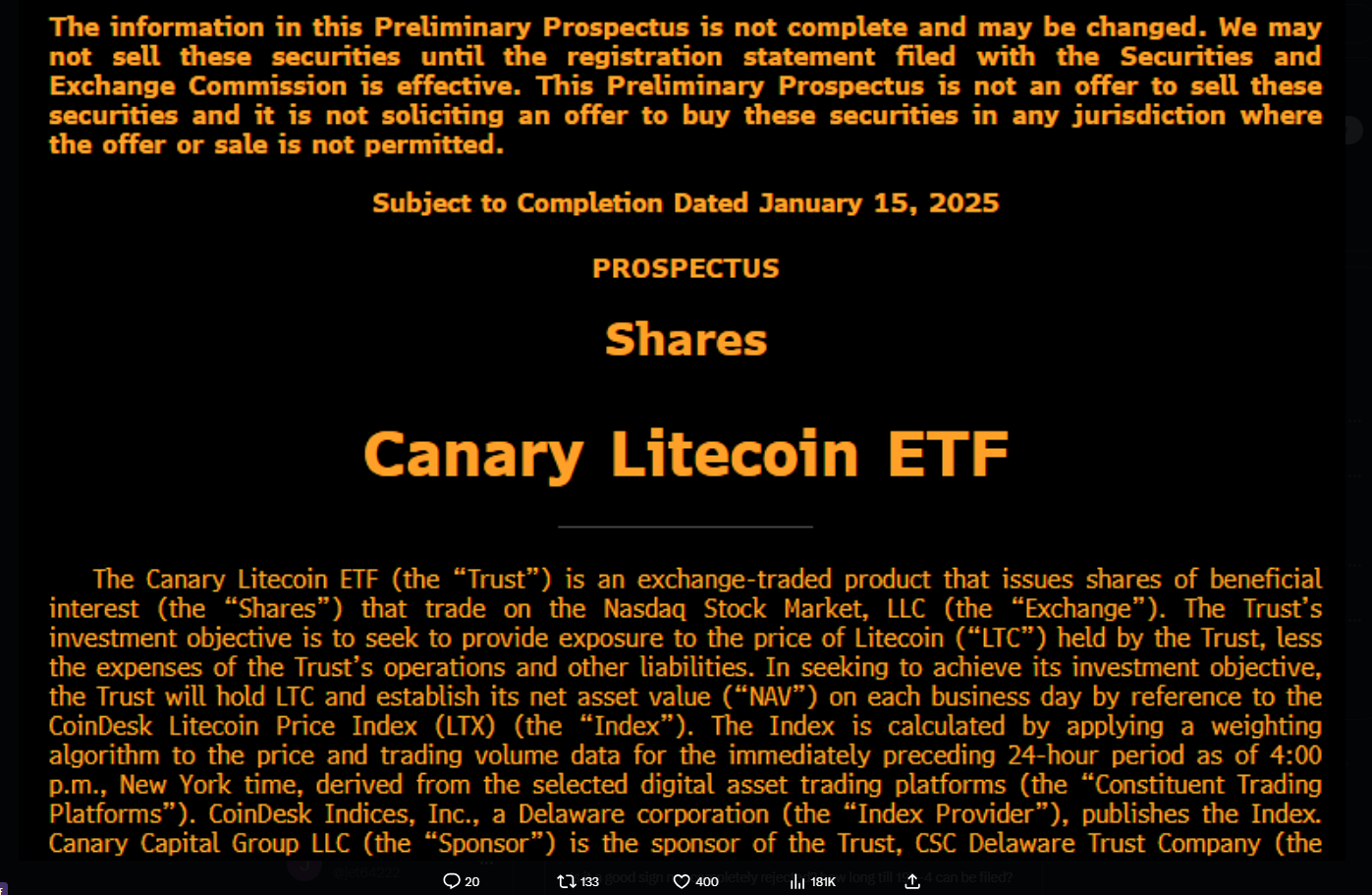

Canary Capital has taken a notable stride towards launching a Litecoin Exchange Traded Fund (ETF). They’ve recently submitted an amendment to their S-1 registration form with the U.S. Securities and Exchange Commission, which is often seen as evidence of ongoing talks with regulatory authorities.

For both market observers and crypto enthusiasts, this news has sparked a significant amount of optimism. The updated filing suggests that the SEC may be considering Canary’s application, offering hope for potential approval in the future.

Analysts Comment On Litecoin ETF Approval Prospects

According to senior ETF analyst Eric Balchunas of Bloomberg, it’s widely believed within the cryptocurrency community that a Litecoin ETF could be the next one to receive approval as the prime candidate for such an offering.

As a crypto investor, I acknowledge the uncertainties that come with the impending change in leadership at the Securities and Exchange Commission (SEC). The exact date of confirmation for the new commissioner is still undetermined, but the selection by President-elect Donald Trump of former SEC commissioner Paul Atkins, who is known to be crypto-friendly, has fueled optimism even more.

It appears there have been rumors about the Litecoin S-1 receiving feedback from the Securities and Exchange Commission (SEC). This seems to support our belief that Litecoin could be the next digital coin to receive approval. However, it’s important to note that a new SEC chair has not yet taken office, which is a significant factor to consider.

— Eric Balchunas (@EricBalchunas) January 15, 2025

According to James Seyffart, a Bloomberg ETF specialist like myself, this adjustment indicates that the Securities and Exchange Commission (SEC) might have provided some comments regarding their application.

NEW: The Canary Funds have recently updated their initial ETF application for Litecoin. While it doesn’t promise approval, this could suggest that the SEC is actively considering their filing. However, they haven’t submitted the 19b-4 statement just yet.

(A 19b-4 would actually start the potential approval/denial clock) h/t @isabelletanlee

— James Seyffart (@JSeyff) January 15, 2025

Investor Activity & Market Reaction

The introduction of a Litecoin Exchange-Traded Fund (ETF) could spark a significant response in the market. Notably, substantial owners of Litecoin have been steadily amassing this cryptocurrency: addresses holding over 10,000 LTC have accumulated an extra 250,000 LTC since January 9.

The surge in purchasing Litecoin today mirrors the pattern observed around early December. This suggests that major traders are significantly influencing the direction of Litecoin’s price movement. Notably, the trading activity has skyrocketed as well, with Litecoin’s 24-hour volume spiking by more than 240% to reach approximately $1.7 billion.

Should it be granted, a Litecoin Exchange Traded Fund (ETF) would mark a significant achievement in the digital currency’s history. In this scenario, Litecoin would find itself among Bitcoin and Ethereum as the select few cryptocurrencies boasting US-approved spot ETFs, thereby bolstering its market standing.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2025-01-17 03:40