As a seasoned crypto investor who’s weathered multiple market cycles since the early days of Bitcoin, I can tell you that this current dip is a reminder of the rollercoaster ride we signed up for. The decline in active addresses for both Bitcoin and Ethereum is concerning, but not entirely surprising given the broader market conditions.

Currently, there’s a significant drop in the cryptocurrency market, with both Bitcoin and Ethereum seeing a decrease in the number of active addresses. This downward trend that has continued throughout 2024 has sparked concern about the future of these prominent digital currencies. The potential impact on market movements could be substantial as investor excitement wanes.

Declining Active Addresses

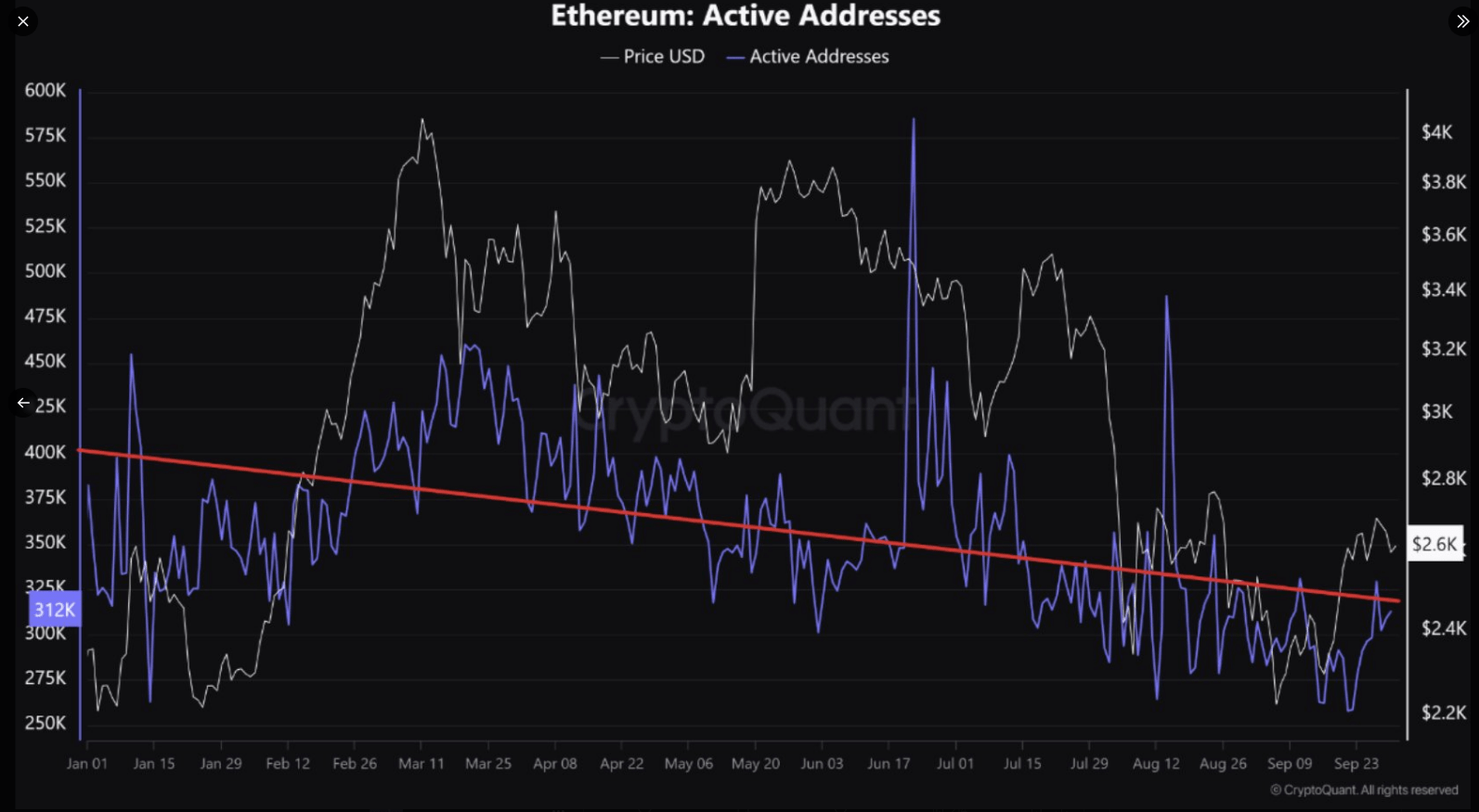

Based on recent data from CryptoQuant, the number of active Bitcoin addresses has decreased by approximately 1.17 million to around 855,000. Similarly, Ethereum’s active addresses have reduced by about 382,000 to roughly 312,000. This translates into a 27% drop in Bitcoin activity and an 18% decrease for Ethereum since the beginning of the year.

It seems like the main reason for this drop is that there aren’t many new investors joining the market. This is important because it’s the new investments that help keep things moving positively. With current players leading most of the trades, a lack of fresh capital can slow down the pace.

Since early 2024, active Bitcoin and Ethereum addresses have been declining

“For the bulls to dominate the market, the influx of new investors is a crucial condition.

1. Bitcoin 1.17M -> 855K

2. Ethereum 382K -> 312K” – By @burak_kesmeciFull post

— CryptoQuant.com (@cryptoquant_com) October 1, 2024

Despite high expectations that the approval of spot ETFs would boost blockchain activity, this hasn’t been the case so far. However, there are still many investors active on the blockchain who might have anticipated such developments. On the other hand, the Federal Reserve’s ongoing quantitative tightening is draining market liquidity, making conditions even more challenging.

Market Sentiment And Future Prospects

As a researcher delving into the Ethereum market, I’ve noticed signs suggesting a potential recovery could be on the horizon amidst the current challenges. For instance, the funding rate on Ethereum has stayed positive over the past week, indicating an increasing number of investors are favoring long positions. This trend suggests that despite the continuous downturn in Ethereum’s price, a significant portion of the market remains hopeful about its future performance.

BTC and ETH addresses decline: BTC drops to 855K, ETH to 312K in 2024

Beginning in 2024, the count of operational Bitcoin and Ethereum accounts has persistently decreased. The number of Bitcoin accounts plummeted from approximately 1.17 million to about 855,000, whereas the Ethereum accounts dropped from roughly 382,000 to…

— CoinNess Global (@CoinnessGL) October 1, 2024

It’s quite intriguing to note that major Ethereum holders have been hoarding their assets instead of cashing out. This shift from 311,950 outflows to 139,390 outflows indicates they are optimistic about the future of this altcoin. Typically, those who behave in such a manner anticipate a quick price recovery.

As a researcher delving into Bitcoin’s dynamics, I’ve noticed a significant drop in the Exchange Flow Multiple. This metric sets apart short-term inflows and outflows from those occurring over an extended timeframe. The decline suggests that current trading activity is markedly lower than typical historical averages.

Bitcoin & Ethereum: Broader Perspective

The bitcoin market is navigating a tricky path influenced by geopolitical issues and legal adjustments. Lately, these factors have made investors more wary. For example, despite Ethereum dropping to around $2,390 due to market fluctuations, Bitcoin has managed to stay above $61,100 without significant change.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-04 00:40