As a seasoned researcher and market analyst with a deep understanding of Bitcoin’s price dynamics, I find the recent surge in Bitcoin exchange-traded fund (ETF) inflows intriguing. Having closely monitored the cryptocurrency market for years, I have seen similar patterns unfold before, often leading to significant price movements.

With increasing involvement of institutions in Bitcoin, there’s been a notable surge in investments through exchange-traded funds (ETFs) in recent days, piquing the curiosity of traders and analysts.

As a researcher conducting studies in the cryptocurrency market, I came across an intriguing observation shared by prominent trader Skew on social media platform X today. This analysis pointed to a potential risk emerging with the massive inflow of funds into Bitcoin.

Skew highlighted an intriguing observation he referred to as the “headline effect.” He explained that the substantial investment of over $500 million into US Bitcoin spot ETFs represents increasing institutional trust. However, this surge could potentially indicate an upcoming price adjustment.

Record High Bitcoin ETF Inflows Signal Market Shifts

The surge in interest for Bitcoin ETFs, most notably the BlackRock iShares Bitcoin Trust (IBIT), which attracted $526 million in investments on June 22, has been noticed recently. However, it’s important to recall that past occurrences of such heightened demand have frequently resulted in price drops.

Bitcoin ETF Flow (US$ million) – 2024-07-22

TOTAL NET FLOW: 533.6

(Provisional data)I. IBIT balances: $526.7

For all the data & disclaimers visit:

— Farside Investors (@FarsideUK) July 23, 2024

Skew pointed out that large volume trading days often signify market supply areas. In these regions, sellers have tended to re-enter the markets in search of price dips.

A significant increase in cryptocurrency inflows signifies a pivotal moment. It could lead to further gains if market conditions remain favorable, or trigger a downturn based on various factors highlighted by Skew.

According to Skew’s proposal in the analysis, maintaining the ongoing bullish trend depends on several crucial indicators.

A passive spot bid maintains consistency by limiting opportunities for spot buyers to capitalize on price drops. At the same time, persistent bidding from spot takers through existing supply is crucial to surpass the five-month supply threshold.

Another important factor is the ability of sellers to absorb the market demand. This is a key element that requires consideration in order to achieve new record-breaking prices.

While the large amounts of money flowing into Bitcoin are a positive indicator, according to Skew, this will put the market to the test as it assesses whether buying interest can sustain the current levels and overcome any selling pressures that may arise.

When IBTS reports large inflows of over $9 figure daily for Bitcoin ($BTC), it usually happens near supply zones in the market. This indicates a potential bullish trend.

somewhat a headline curse lol

So in terms of actually trading this, the obvious part is now does the market sustain this…

— Skew Δ (@52kskew) July 23, 2024

Impending Sell Pressure

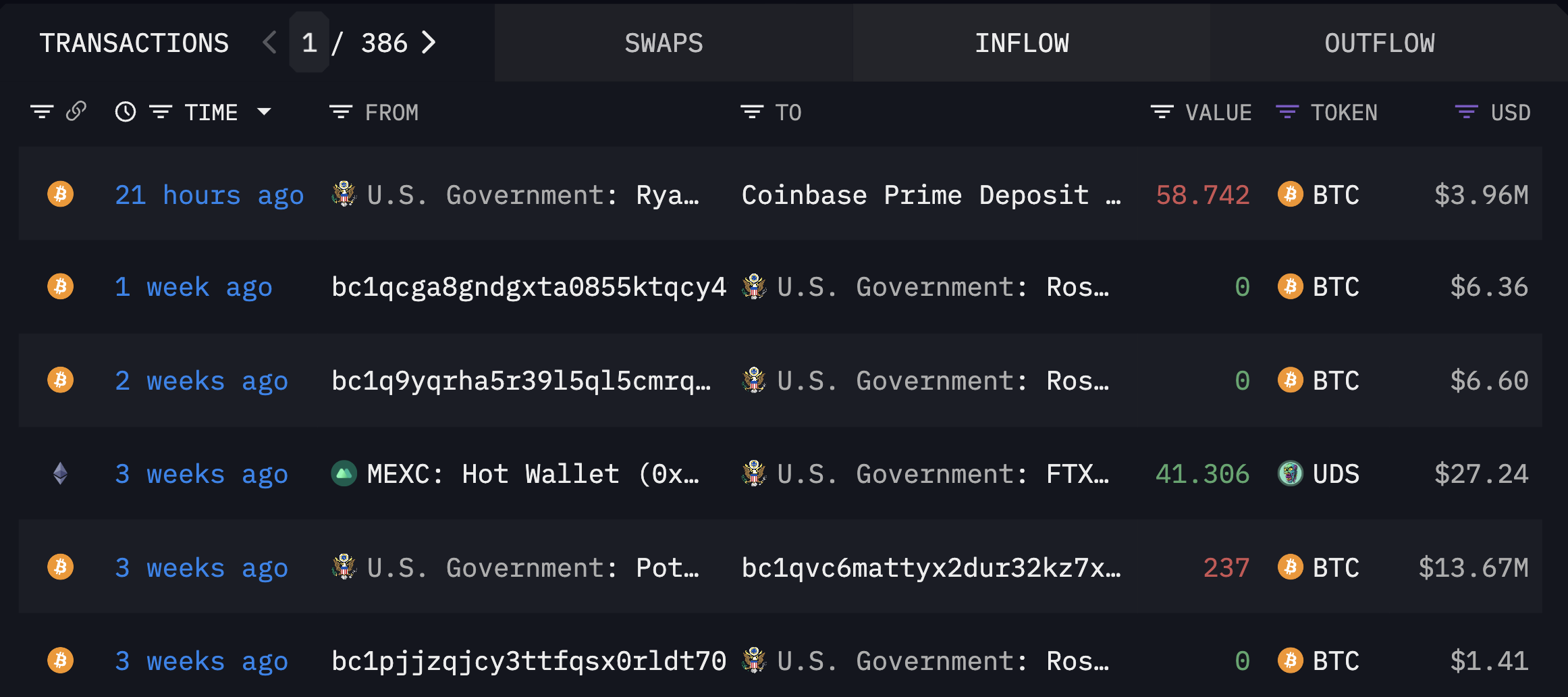

Regarding sell pressure, it was disclosed by blockchain analysis firm Arkham Intelligence that the United States government moved approximately $3.96 million worth of confiscated Bitcoin to Coinbase.

In addition to the potential selling pressure we’ve discussed, Arkham Intelligence has disclosed in a recent report on X that the defunct cryptocurrency exchange, Mt. Gox, is reportedly planning to continue offloading its Bitcoin. Yesterday, this exchange executed test transactions depositing small amounts of Bitcoin into four separate Bitstamp deposit accounts.

Despite potential selling forces, Bitcoin’s price remains above $65,000 for now. At present, the cryptocurrency is being traded at $66,981.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-07-24 07:34