As an experienced financial analyst specializing in the cryptocurrency market, I find the recent trend in Bitcoin’s 365-day moving average (MA) Growth Rate to be an interesting development. The Growth Rate metric, as discussed by CryptoQuant author Axel Adler Jr, provides valuable insights into the relationship between Bitcoin’s Market Cap and Realized Cap, offering clues about potential price corrections.

As a crypto investor, I’d interpret this as: The data from an on-chain indicator indicates that Bitcoin isn’t showing signs of imminent price correction at the moment.

Bitcoin 365-Day MA Growth Rate Is Sitting Below Historical Overheated Zone

In a recent post on X, Axel Adler Jr of CryptoQuant explored the latest developments regarding the “Growth Rate” indicator for Bitcoin. This metric measures the gap between fluctuations in Bitcoin’s Market Capitalization and its Realized Capitalization.

In simpler terms, the Market Capitalization represents the total value of a cryptocurrency based on its current market price and the total amount in circulation. Contrarily, the Realized Capitalization involves a more intricate calculation, taking into account the historical prices at which coins were last moved or sold from their holders’ wallets.

The Realized Cap represents an on-chain valuation method for cryptocurrencies, considering the “real” worth of each coin in circulation equivalent to its last recorded transaction price on the blockchain.

As a researcher studying cryptocurrency data, I can tell you that every time a coin is traded, its current price at that moment becomes its new cost basis for the next transaction. Aggregating these prices across all coins in circulation gives us the total cost basis, which is what’s referred to as the Realized Cap. In essence, it calculates the current cost basis for each coin in the market.

As a researcher studying Bitcoin, I would describe the Realized Capitalization (Realized Cap) as the overall amount of money investors have invested in purchasing the digital currency. Consequently, fluctuations in the Realized Cap indicate the net capital inflows or outflows for Bitcoin.

The Growth Rate monitors the impact of adjustments in Realized Capital on Market Capitalization, essentially signaling the market’s responsiveness to shifts in capital inflows or outflows.

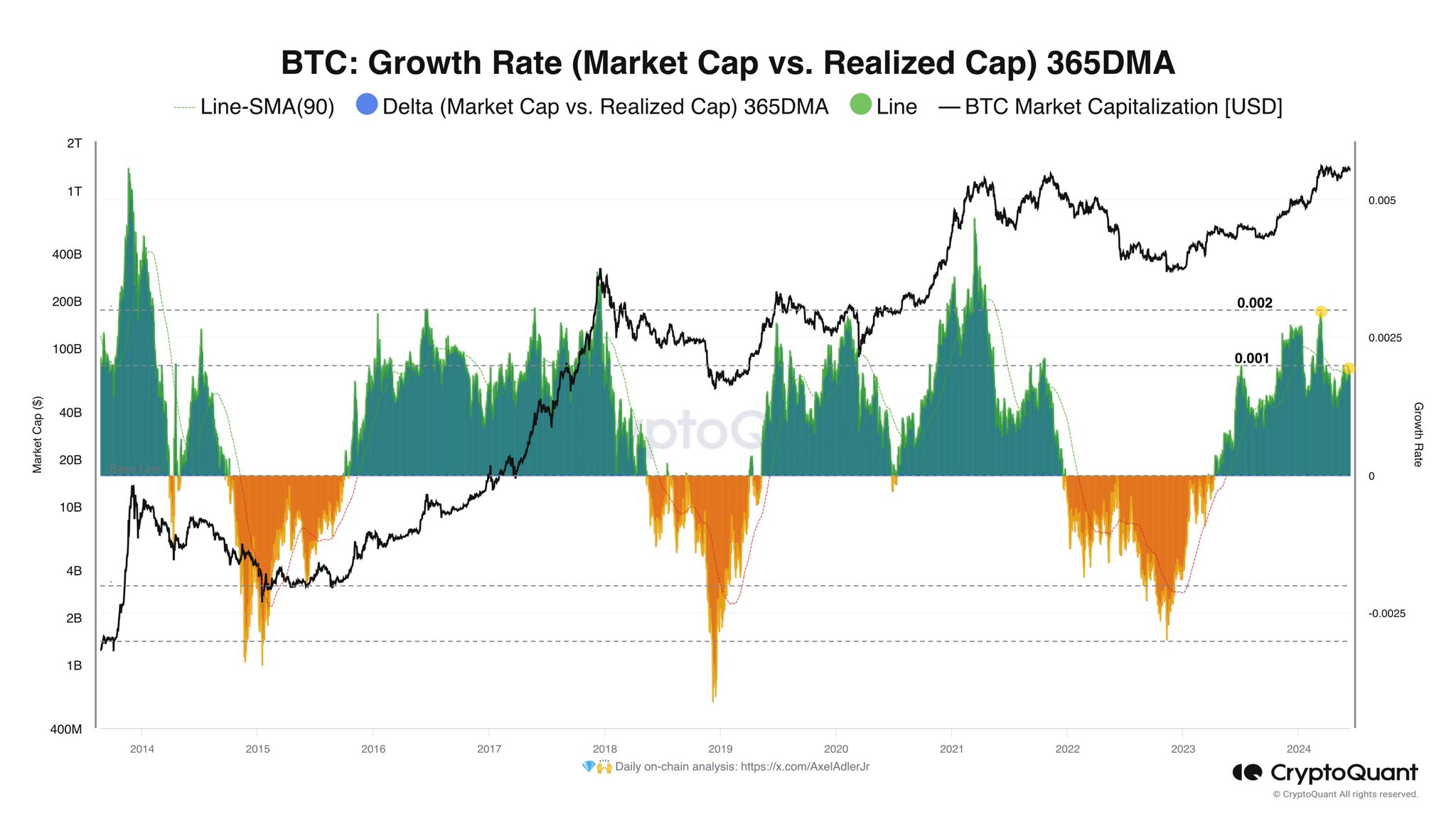

Here’s a chart displaying the development of Bitcoin’s growth rate moving average over the past ten years. The moving average covers a period of 365 days.

In the provided graph, the 12-month moving average of Bitcoin’s growth rate has remained positive since the beginning of 2023. This signifies that the market capitalization of Bitcoin is increasing at a greater pace than its realized capitalization during this period. When the indicator displays green values, it represents this faster growth.

As a crypto investor, I’m observing that the indicator currently hovers around the 0.001 mark, which is considered quite elevated. This implies that substantial buying pressure has been fueling the price surge in recent times.

As a researcher studying historical market trends, I’ve observed that during times of market exhilaration when Market Capitalization significantly surpasses Realized Capitalization, the likelihood of market peaks increases.

Based on the graph, it’s clear that the current levels of the metric are elevated. However, they have not yet surpassed the 0.002 threshold, which historically has prompted corrective actions.

In simpler terms, the Bitcoin record-breaking peak in March, which remains the highest so far during this rally, coincided with a significant increase in the growth rate.

BTC Price

Yesterday, Bitcoin dipped below the $67,000 threshold, but it bounced back and is currently trading above $69,300 once more.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-06-12 20:10