As a seasoned researcher with a decade-long journey tracing the intricacies of financial markets and cryptocurrencies, I find myself observing the Bitcoin market with a blend of fascination and concern. The current state of the top crypto is reminiscent of a rollercoaster ride, where exhilarating highs are followed by nerve-wracking lows.

Since hitting over $73,000 in March 2024, Bitcoin‘s market performance has been disappointing, not living up to expectations as it’s experienced ongoing consolidation and a string of drops that have left some investors disheartened.

Presently, Bitcoin has dropped approximately 22.7% since its peak in March, causing some investors to ponder if it’s the beginning of a prolonged downturn in prices, often referred to as a bear market. This drop has led to a decrease in investor confidence, prompting financial analysts to reconsider Bitcoin’s short-term potential and future prospects in the digital market.

Bitcoin Price Continous To Struggle, Why?

According to analysts at IntoTheBlock, a data analysis firm, they’ve recently disclosed some intriguing findings about topic X, indicating shifts in public opinion. Earlier today, one of their posts highlighted this change in sentiment.

Bitcoin’s price continues to struggle, showing little signs of strong recovery. Earlier optimism about a bull run has given way to increasing doubt, as both individual and large-scale investors seem to be losing interest.

The analysts asked, “is this just a quiet phase or the start of a prolonged bear market?”

To respond to this query, IntoTheBlock initially examined the difficulties with Bitcoin’s price and the elements influencing its sluggish price fluctuation.

The market intelligence platform indicated that the potential for a worldwide economic downturn, often referred to as a “macro landscape,” is quite significant. This uncertainty casts a cautious shadow over investments considered high-risk, such as Bitcoin.

It’s been observed that while some anticipate interest rate reductions imminently, such reductions might not have an immediate positive impact on Bitcoin and other digital currencies. In the meantime, it seems that the overall economic landscape will persist in shaping market attitudes and investors’ trust.

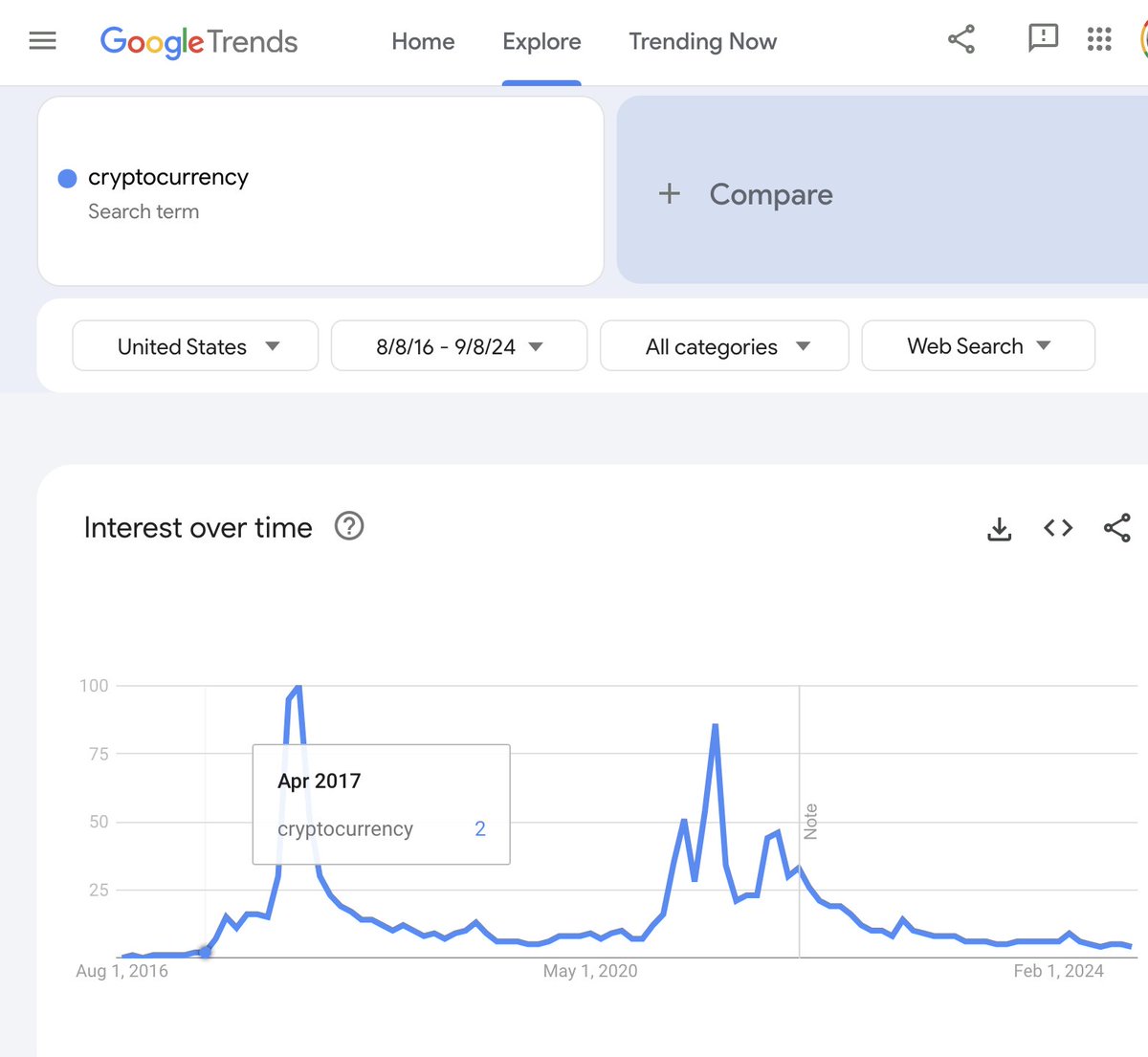

As a researcher, I’ve noticed a significant drop in the enthusiasm for cryptocurrencies over the past few months that I’ve been closely observing. This decline is something I find intriguing and worth investigating further.

Based on data from a market analysis tool, it appears that there’s been a substantial decline in searches about Bitcoin and other virtual currencies. This trend suggests a decrease in the general public’s curiosity or engagement with these assets.

It seems that even top cryptocurrency trading platforms such as Coinbase are experiencing drops in their app rankings, pointing towards a decrease in user interaction with the crypto market. This trend is also seen in on-chain data, where the creation of new Bitcoin wallets has slowed down, hinting at less participation in the market.

Should You Panic?

As an analyst at IntoTheBlock, I’ve been observing the recent market downturn with a keen eye, and it seems we might be witnessing similarities to Bitcoin’s price action in 2019. This observation is based on certain patterns we’ve noticed, suggesting potential parallels that could influence future price movements.

Based on past Bitcoin halving trends, it appears that we might be witnessing another post-halving dip, similar to what occurred previously. Analogies are being drawn to 2019, where market activity also decelerated after reaching a peak. Following this period, the market underwent an extended consolidation phase before resuming its bullish trend. Is it possible that we’re following a comparable path now?

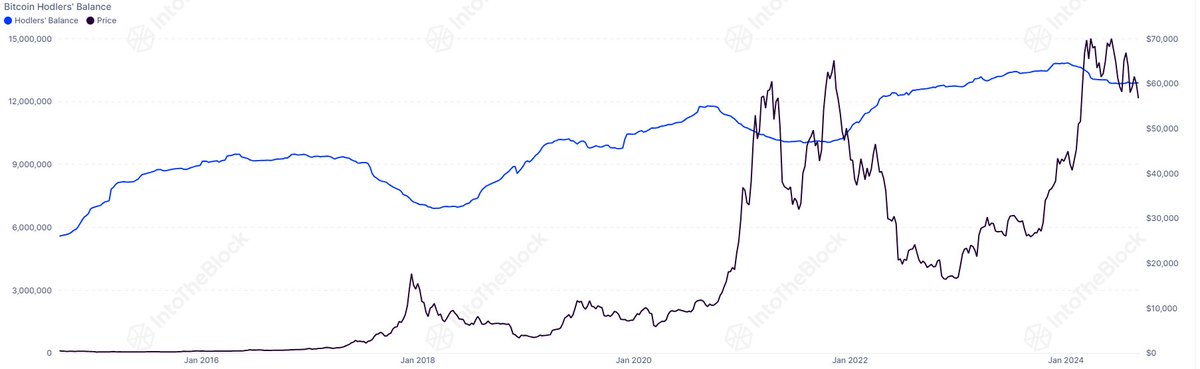

According to IntoTheBlock’s analysis, “the data from longer investment periods paints a distinct picture.” Specifically, they pointed out that the amounts held by long-term Bitcoin investors have recently reached record lows, mirroring trends observed following market peaks in past cycles.

As suggested by IntoTheBlock, this might indicate an extended period of Bitcoin’s price reduction, which could possibly postpone any substantial price increase.

The analysts observed that although the market is filled with doubts, they couldn’t find any clear-cut solutions. In summary, their findings were:

By examining historical patterns and present information, we remain receptive to various scenarios. It’s essential to focus on both the on-chain data and broader economic trends as they play a crucial role in predicting future events.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-09-11 10:17