As a seasoned crypto investor with battle-scarred eyes from the rollercoaster rides of this volatile market, I find the recent analysis on Bitcoin‘s MVRV Ratio by CryptoQuant’s Ki Young Ju particularly intriguing. The True MVRV, which takes into account transactionally active coins over the past seven years, gives us a more accurate picture of the market and its sentiment.

Based on the pattern observed in the Bitcoin Market Value to Realized Value (MVRV) Ratio, we can infer whether the ongoing bull market may be nearing its end or not.

Bitcoin MVRV Ratio Could Hint At Where BTC Is In Current Cycle

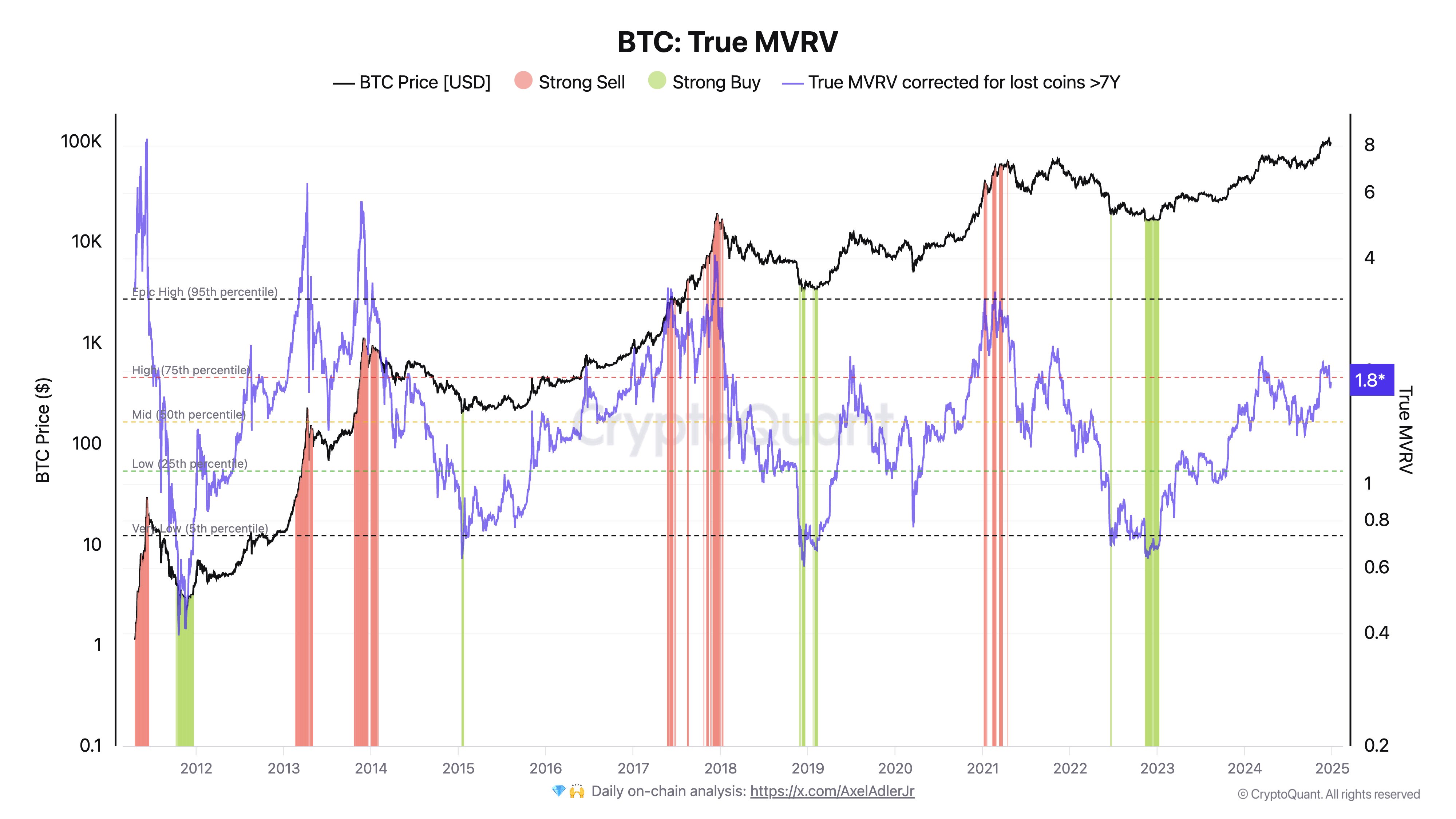

In his latest update on X, Ki Young Ju – founder and CEO of CryptoQuant – presented a graph illustrating historical trends in Bitcoin’s MVRV Ratio. The MVRV Ratio is an often-used on-chain indicator that essentially measures the relationship between the market value of BTC held by investors (or its total market cap) versus the value they originally invested (the realized cap).

If the ratio’s value exceeds 1, it suggests that investors overall are likely making a profit. Conversely, when the value is less than 1, it points towards more losses than profits in the market.

Young Ju’s shared MVRV Ratio is not the standard version, instead it’s a specialized one known as the “Real MVRV.” This adaptation considers only the coin data associated with transaction activities from the past seven years.

Older coins, specifically those more than seven years old, are likely gone for good, either because they’ve been overlooked or their associated wallet keys have been misplaced. Therefore, the True MVRV, which disregards such coins that might not re-enter circulation, offers a more precise representation of the sector compared to the standard version of this metric.

Here’s a graph displaying the historical progression of this specific Bitcoin metric:

Based on the graph shown earlier, the Bitcoin True MVRV has risen significantly during this market uptrend. This suggests that most investors have accumulated substantial gains in their Bitcoin holdings.

Historically speaking, as investors make larger profits from their Bitcoin holdings, they tend to increase their participation in a large-scale selling spree, motivated by the desire to secure those profits. Consequently, when the MVRV (Merton-Nensi Value Ratio) increases significantly, there’s an increased likelihood that a peak could be approaching for BTC.

Based on the graph, we can see that previous cycle peaks happened when the indicator crossed a certain line. At present, the value hasn’t yet approached this level during the current period.

The founder of CryptoQuant explains that despite the market, the total value hasn’t exceeded the realized value too much because approximately 7 billion dollars are flowing into the Bitcoin market on a weekly basis.

If the ongoing pattern resembles past cycles, it might imply that the current Bitcoin bull run still has some room to grow, given that the True MVRV is relatively high, but not excessively so.

BTC Price

Bitcoin has retraced its Christmas rally as its value is now back down to $95,700.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-26 22:16