The US national debt has officially gone completely off the rails, now tipping the scales at a staggering $36.5 trillion. Naturally, this is putting some serious pressure on the US Dollar Index (DXY). If you think that sounds bad, just wait – some crypto analysts are now whispering (okay, maybe shouting) that this is the perfect time for capital to shift into risk-on assets like Bitcoin (BTC).

DXY Breakdown: Bitcoin’s Big Moment?

So, here’s the deal: according to the wizard of crypto analytics, Darkfost, the DXY has dropped to a historically weak level. Right now, it’s a whopping 6.5 points below its 200-day moving average (MA), which, by the way, is the biggest gap we’ve seen in the past 21 years. Take that in for a moment. The DXY has basically done the financial equivalent of tripping on its own shoelaces.

For those of you not in the know, the DXY measures the value of the US dollar against six major foreign currencies – think of it like a global popularity contest. If the dollar’s feeling down, the market tends to feel it too. It’s the ultimate mood ring for global investors.

Take a look at those juicy periods when the DXY was below its 365-day MA. Guess what happens right after that? Yep, you guessed it – Bitcoin tends to see some serious gains. Darkfost is all in on this idea:

“Right now, we’re in one of those phases where the DXY’s weakness could spark a new Bitcoin surge, but… don’t get too excited yet. The price hasn’t reacted just yet. It’s an early signal that liquidity might start flooding into the crypto market, but it’s not quite there.”

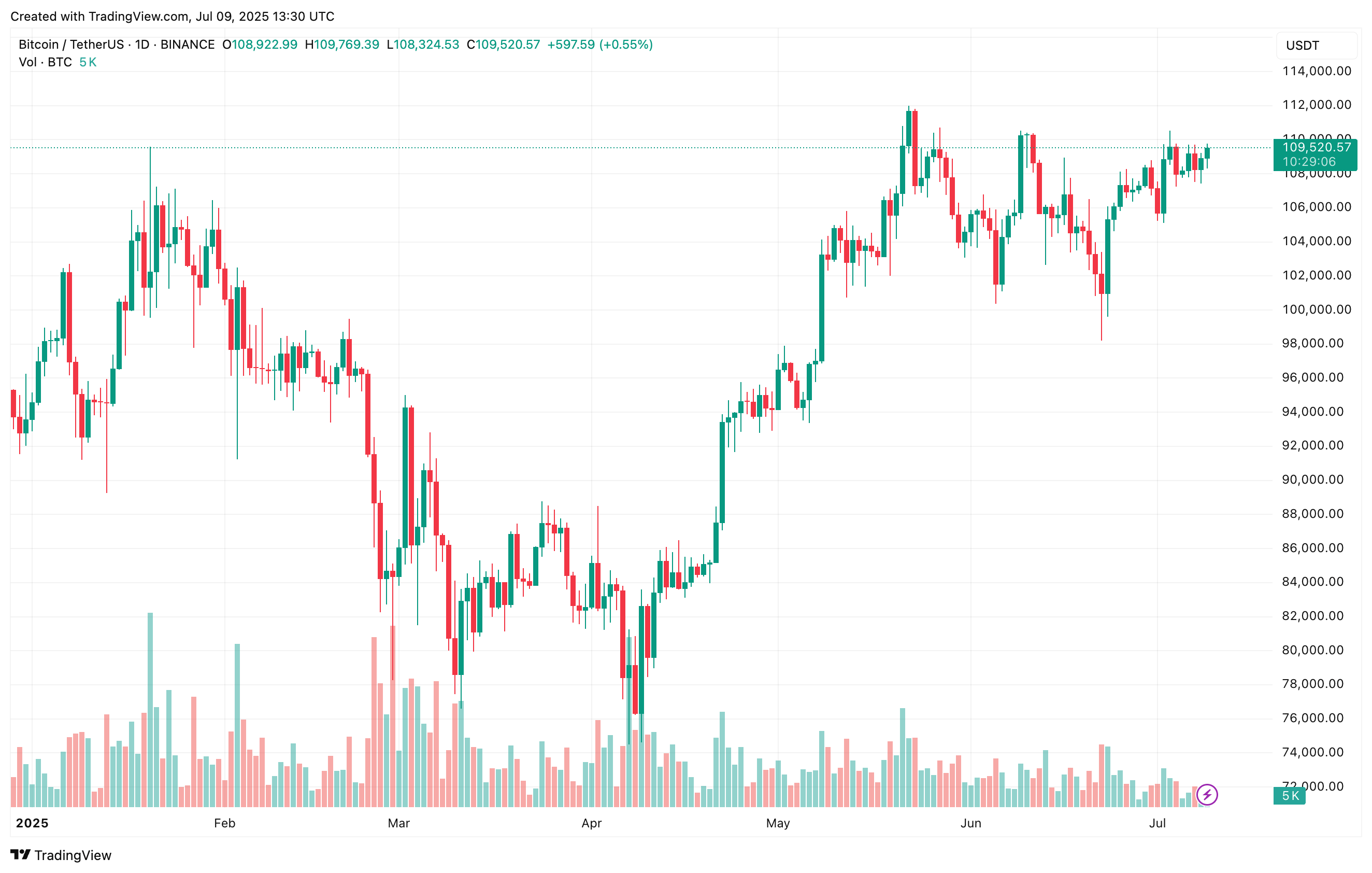

For the record, Bitcoin is sitting just 2.2% below its all-time high (ATH) of $111,814 from May 22. So, the big question is: will BTC finally break its previous record? If this chart is any indication, it’s looking pretty likely.

Warning: Bitcoin’s Road Ahead Isn’t All Sunshine

Now, before you get too carried away with thoughts of Lambos and beach houses, there are a few things to watch out for. Bitcoin’s Apparent Demand metric recently took a nosedive into the negative zone, which is a bit concerning. Also, some on-chain metrics are waving red flags, suggesting that Bitcoin’s rally may be running low on fuel.

it’s a bit like when the gas light comes on, and you’re still a few miles from the nearest station. Not exactly reassuring.

But, and here’s the kicker, Bitcoin is holding strong. Even though there’s been some selling pressure in the derivatives market, BTC has managed to dodge a serious breakdown below $100,000. Right now, it’s hovering around $109,520, which is up 0.7% in the last 24 hours. Nice try, bears!

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- How to Update PUBG Mobile on Android, iOS and PC

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

2025-07-10 09:47