As a seasoned researcher with years of experience analyzing financial markets, I have witnessed countless trends and shifts that have shaped investment landscapes. The current correlation between Bitcoin (BTC) and U.S. stocks has caught my attention, as it seems to be following an unusual yet intriguing pattern.

Recently, there seems to be an inverse relationship between Bitcoin (BTC) and U.S. stocks, where Bitcoin tends to move in the opposite direction of traditional markets. This contrast has sparked interest among analysts and investors, particularly as Bitcoin and the broader crypto market undergo consolidation. Interestingly, past instances of this correlation switching from negative to positive have typically indicated a bullish outlook for Bitcoin.

From my perspective as a researcher, observing the evolving interplay between Bitcoin (BTC) and U.S. stock markets is increasingly significant due to the hurdles they both face. This intricate dance could offer invaluable clues about the market’s direction. Investors are keenly attentive, as a shift might signal a promising breakthrough for Bitcoin, potentially heralding a new phase in its growth trajectory.

Bitcoin Data Suggests Potential Uptrend

As an analyst, I’ve noticed a growing inverse relationship between Bitcoin (BTC) and the U.S. stock market, specifically the S&P 500 (SPX). Lately, this pattern has become more pronounced, as evidenced by my recent visual comparison of BTC/USDT futures with SPX prices, much like what Daan on X did.

His analysis shows that while traditional markets like the SPX have experienced a swift recovery, Bitcoin has not followed suit. This divergence underscores the decoupling between these two markets, with Bitcoin lagging behind the broader stock recovery.

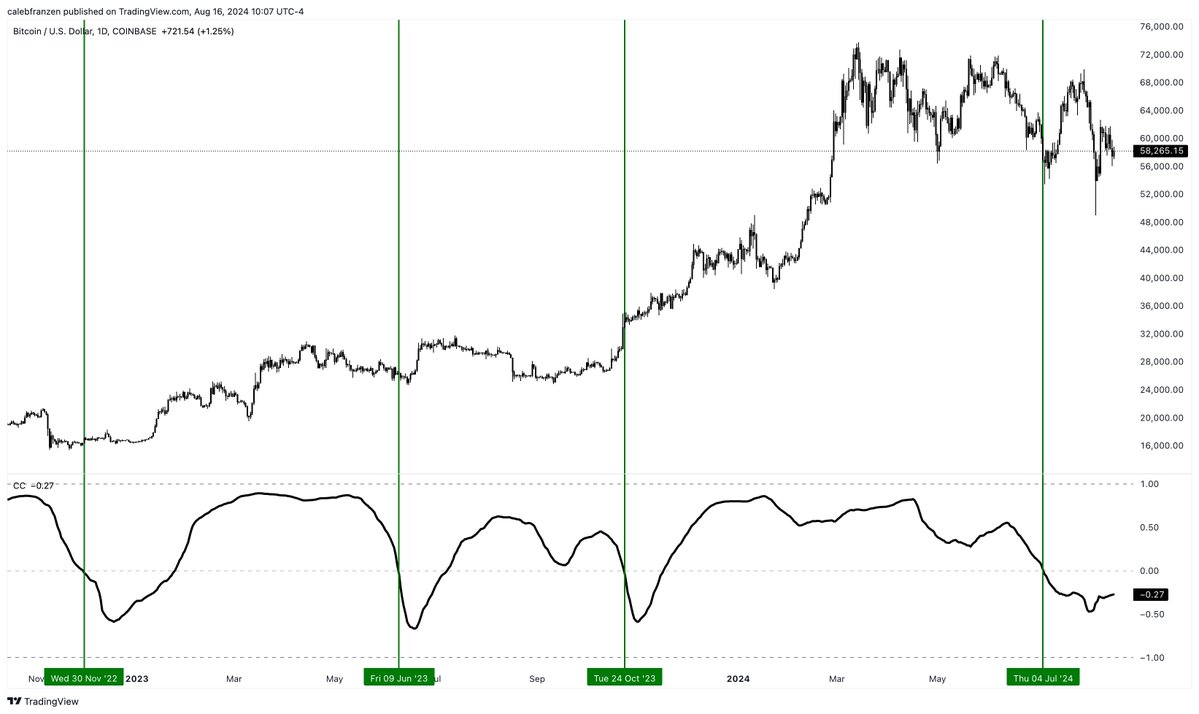

A notable analyst, Caleb Franzen, highlighted an intriguing pattern, presenting data showing a weakened connection between Bitcoin and significant stock indices, like the Nasdaq-100 ($QQQ). More specifically, Franzen underscores that the 90-day correlation between these two markets is currently at -27%, indicating that as tech stocks rebound, Bitcoin has been trending in the opposite way. This inverse relationship could suggest distinct market behaviors.

During times when Bitcoin’s performance contradicts that of stocks, it doesn’t automatically mean good things are on the horizon. However, past trends show that favorable market movements can occur after such periods. The key for investors is to keep an eye out for a possible shift in this relationship – when Bitcoin starts mirroring the Nasdaq-100 ($QQQ) again.

Should the relationship between Bitcoin and tech stocks become more aligned positively, it might indicate a robust market condition and potentially an upward trend for Bitcoin. This change could serve as a valuable signal for determining optimal moments to invest in the market.

BTC Price Trading Below A Key Indicator

Currently, Bitcoin’s trade value is at $59,350, which falls beneath its crucial daily moving average (MA) of $62,915. This moving average is an essential tool used by many analysts to evaluate market trends. When the price of Bitcoin is below the daily 200 MA, it usually implies a downtrend or substantial correction. However, if Bitcoin trades above this level, it generally signifies market robustness and bullish energy.

To ensure Bitcoin’s bull run continues, it’s crucial for it to surpass its daily 200 Moving Average (MA) and maintain closing above this level. Doing so would suggest a possible change in direction, giving traders and investors a reason to believe that the bullish trend remains strong.

At present, Bitcoin is generally holding steady near the significant mental threshold of $60,000. The market continues to stabilize following a prolonged period of unpredictability and price fluctuations.

As a researcher analyzing Bitcoin’s price movements, I believe the bullish scenario could materialize if Bitcoin manages to breach the $63,000 resistance level. This breakthrough should not only allow us to reclaim the daily 200 Moving Average but also surpass the August 8th local high of $62,729. Such a development would signify a substantial recovery and suggest that the market is regaining its vigor, potentially paving the way for further growth.

If Bitcoin doesn’t manage to break through $57,500 in the near future, it might suggest an increase in downward pressure, possibly resulting in a drop below $50,000. The next few days will play a significant role in deciding whether Bitcoin can resume its upward trend or if we should expect more bearish conditions.

Cover image from Dall-E, charts from TradingView.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-08-22 01:16