As a seasoned researcher with over two decades of experience in the financial markets, I’ve witnessed numerous market cycles and trends. The current bull run in Bitcoin (BTC) has piqued my interest, as it parallels some of the patterns we saw during the 2016 and 2020 bull runs.

With Bitcoin (BTC) approaching the $70,000 threshold, there’s a lot of chatter within the cryptocurrency world about a possible jump to $100,000, along with an anticipated altcoin boom. Amidst this excitement, crypto expert Axel Bitblaze has offered insights on coin X, assessing whether Bitcoin can reach such heights by considering the necessary market conditions and triggers.

Bitblaze underscores the crucial part that liquidity plays in the crypto market, likening it to the engine that powers our space. As we look back at previous market surges in 2016 and 2020, he points out that these were primarily propelled by an escalating supply of liquidity. The question now is whether we can expect similar or even more substantial liquidity events to further boost Bitcoin’s value.

#1 Bitcoin Surge Set To Be Fueled By Stablecoins

At the heart of Bitblaze’s examination lies the present condition of the market for stablecoins. He refers to them as “the entry point into the world of cryptocurrencies,” emphasizing their crucial role within the crypto sphere. The combined value of all stablecoins, known as the total market capitalization, has soared to an impressive $173 billion, marking a new peak since the fall of TerraUSD (UST).

USDT (Tether) continues to lead the stablecoin sector, accounting for approximately 69% of the overall market cap with a value of $120 billion. Bitblaze notes the past relationship between Bitcoin’s price and USDT’s market capitalization, pointing out that from March 2020 to November 2021, the USDT market cap increased by 17 times as the price of Bitcoin climbed by around 16.5 times.

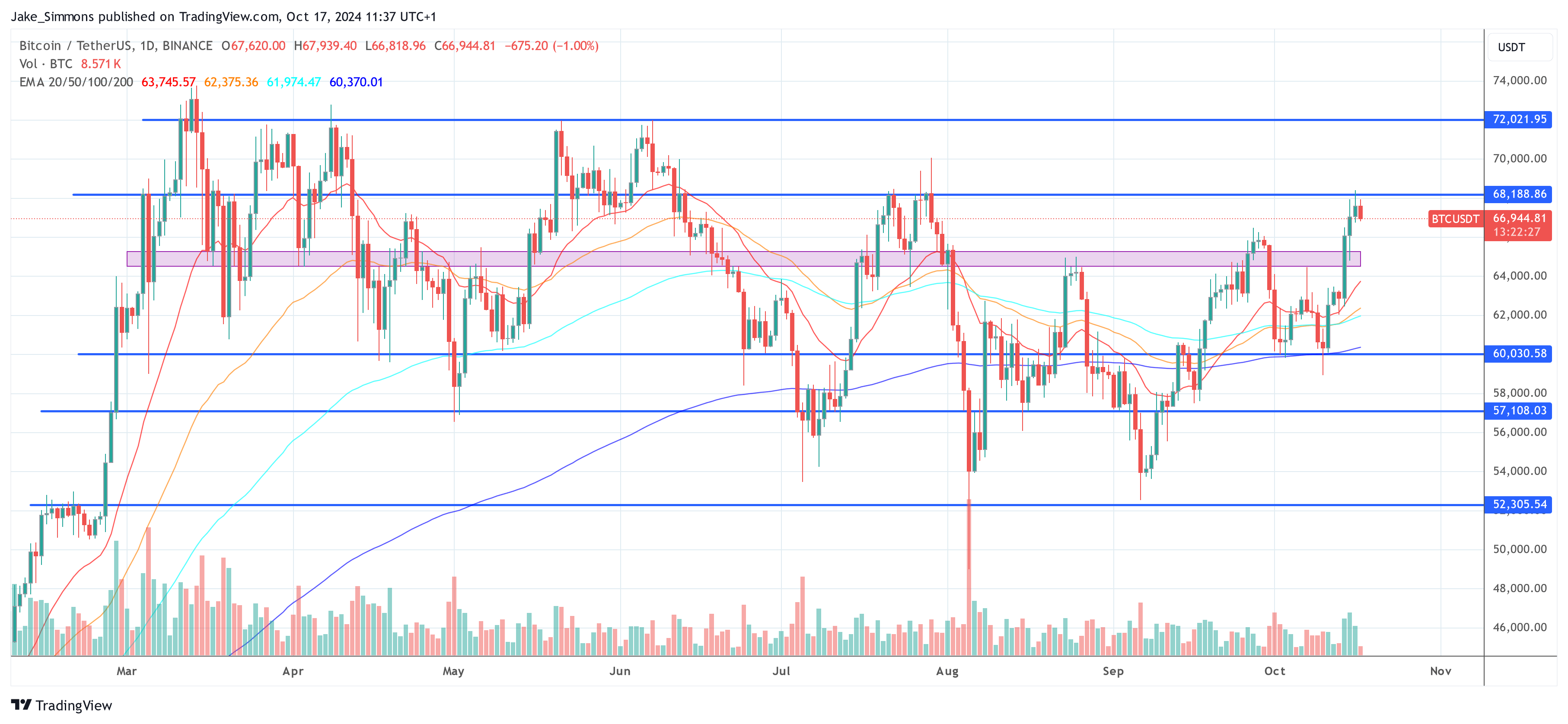

Despite the fact that USDT’s market capitalization has been increasing steadily since March 2024, Bitcoin’s price has remained fairly stable during this period. This suggests that there is a significant amount of liquidity sitting on the sidelines, ready to invest in Bitcoin and cryptocurrencies. The analyst posits that these funds will likely start moving into the market soon, don’t you think?

#2 FASB Rule Change

A crucial aspect to consider is the upcoming modifications in accounting regulations by the Financial Accounting Standards Board (FASB). At present, publicly traded corporations encounter difficulties in owning Bitcoin because of the current accounting practices that are not favorable towards it.

Bitblaze clarifies: “For instance, if a firm purchases 100 Bitcoins at $67,000 per coin, when the value of BTC dips to $60,000 and later spikes up to $68,000, the company must report this drop as their current holdings. This means they would have to record it as a loss, even though they are technically in profit. Such misleading financial reports can lead to decreases in share prices, making companies hesitant to invest in Bitcoin due to its potential benefits.

The forthcoming FASB rule modification, slated for implementation in December 2024, is primed to tackle this matter. With these new regulations, companies will have the opportunity to disclose the real worth of their Bitcoin holdings according to market rates at the conclusion of the reporting period. Bitblaze proposes that this change in regulation might encourage more businesses to integrate Bitcoin into their financial statements.

He uses MicroStrategy as an example, pointing out that since August 2020, the company has amassed 252,220 Bitcoins valued at $17.4 billion, yielding a profit of $7.4 billion today. Considering that S&P 500 companies together hold around $2.5 trillion in cash and cash equivalents – assets susceptible to inflation – Bitcoin emerges as an appealing, inflation-proof option.

#3 Expanding M2 Money Supply

In addition to exploring the broader economic terrain, Bitblaze focuses on the M2 money supply, encompassing cash, checking deposits, and other forms of readily convertible funds close to money. At present, this M2 money supply amounts to around $94 trillion, approximately 39 times larger than the cumulative value of all cryptocurrencies in circulation.

In simpler terms, Bitblaze mentions a study showing that for each 10% rise in the M2 money supply, Bitcoin price increases by 90%. Even though the M2 money supply has increased by about 3% above its all-time high, Bitcoin hasn’t managed to reach its peak value from 2021. This implies that a significant portion of the available liquidity remains unused.

At the moment, the M2 money supply is approximately 3% greater than its previous maximum, but Bitcoin has yet to surpass its 2021 high. With global interest rates decreasing and quantitative easing in place, fiat currency may become a less attractive investment option. As Ray Dalio stated, “Cash is Trash,” and this massive increase in money supply will likely flow into various asset classes, such as cryptocurrencies; according to the analyst’s prediction.

Beginning in November 2021, money market funds have expanded to an impressive $6.5 trillion as investors have been drawn towards the safety of Treasury bills due to increasing interest rates. Yet, with the Federal Reserve starting to reduce rates and hinting at further reductions, the returns on T-bills are anticipated to decrease substantially, potentially leading to a large withdrawal from money market funds.

Bitblaze anticipates that a decrease in T-bills yield may lead to a significant withdrawal of funds from money market funds, prompting investors to look for higher returns. This search might drive them towards riskier assets like Bitcoin and other cryptocurrencies, which Bitblaze describes as the “speediest horses” in a Quantitative Easing (QE) environment. He predicts that this trend could result in a significant influx of capital into the crypto markets.

In simpler terms, Bitblaze adds up different sources of available funds such as the M2 money supply ($94 trillion), money market funds ($6.5 trillion), cash held by S&P 500 companies ($2.5 trillion), and stablecoin market value ($173 billion). This sums to approximately $103.17 trillion, which is around 43 times larger than the current total value of all cryptocurrencies combined.

He further addresses skeptics, concluded: “For a $200 Billion inflow, only 0.19% of this account needed to enter crypto. For those who think this isn’t possible and 200B is too much, BTC ETFs had over $20B in net inflows despite sideways price action, no rate cuts, and no QE.”

At press time, BTC traded at $66,944.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-10-17 19:17