As a seasoned crypto investor who has navigated multiple bull and bear markets since entering this wild digital frontier back in 2017, I find myself increasingly drawn to the dominance that Bitcoin is displaying at present. The past ten days have been a testament to its resilience amidst the market’s turbulence.

Currently, the financial market is experiencing high levels of instability due to significant periods of accumulation for the two leading assets, Bitcoin (BTC) and Ethereum (ETH). Despite this turbulence, Bitcoin has shown superior performance in the last ten days, proving to be a standout amid the ups and downs.

The ETH/BTC graph shows a noticeable change right now. At present, one Ethereum is equivalent to approximately 0.043 Bitcoins, which is its lowest since April 2021, indicating that Bitcoin currently holds more sway within the cryptocurrency market.

In recent months, there’s been a noticeable trend that investors favor Bitcoin over Ethereum as prices fluctuate, according to crucial data. Although the market might seem tranquil now, history has shown us that situations can change suddenly. Thus, it’s essential to analyze on-chain data and fundamentals to predict possible future shifts.

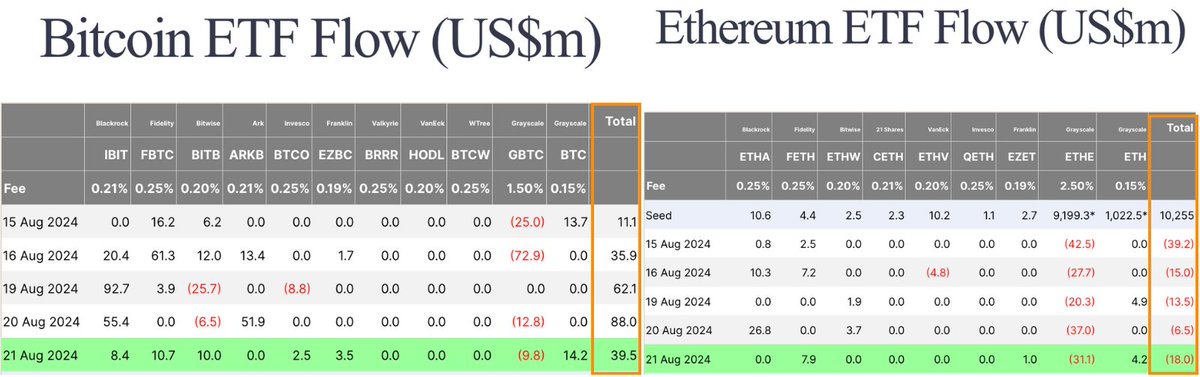

ETF Flows Showing Bitcoin Dominance

It appears that more and more traditional investors are favoring Bitcoin over Ethereum, as demonstrated by key information from Farside Investors, a London-based investment firm. Based on their data, there have been five consecutive inflows into Spot Bitcoin ETFs, while Ethereum ETFs have experienced five days in a row of outflows.

Some people think that the withdrawal of funds from Ethereum ETFs is being caused by selling pressure from Grayscale, but analyst and investor Lark Davis disagrees. He notes that approximately one third of all Ethereum is already outside of Grayscale’s $ETHE ETF, suggesting instead that the outflows are more likely influenced by broader market trends rather than Grayscale’s impact on the market.

BLACKROCK NOW HAS MORE CRYPTO THAN GRAYSCALE

As an analyst, I’m observing a significant shift in the crypto landscape. Blackrock has surpassed Grayscale in terms of on-chain holdings, positioning itself as the leading ETF-associated player within the digital asset realm that we often refer to as Arkham.

Blackrock: $22,143,715,559

Grayscale: $21,996,062,828— Arkham (@ArkhamIntel) August 22, 2024

As a seasoned investor with years of experience navigating the crypto market, I have witnessed firsthand Bitcoin’s unquestionable dominance over other digital currencies, particularly Ethereum. In times of uncertainty and volatility, traditional investors often flock to Bitcoin as their safe haven, favoring its stability and reputation for resilience. This trend is not only a testament to Bitcoin’s enduring popularity but also an indicator of the confidence that investors have in it. My personal experience aligns with this observation, as I too have found myself turning to Bitcoin during periods of market turbulence, seeking the security it provides amidst the stormy seas of the crypto market.

BTC Technical Levels To Watch

At this moment, Bitcoin’s value stands at approximately $61,280. Since August 8, it has been in a holding pattern, fluctuating between the resistance level of around $62,729 and the support level near $56,138 over a 4-hour period. This stage of sideways trading has left the market on tenterhooks as investors eagerly anticipate the next major shift.

As a researcher analyzing Bitcoin (BTC), I’ve found that a bullish confirmation can be achieved when BTC manages to surpass the $63,000 mark and conclusively close above its daily 200 Moving Average (MA). This significant indicator often serves as a support during bull markets, but flips to resistance during steep corrections. Overcoming this level would suggest a potential prolongation of the bull market. The daily 200 MA is a vital tool for discerning the overall trend direction, and crossing above it could be an indication of things to come.

It’s clear that Bitcoin currently holds a significant position in the market, but keep in mind that its dominance might not persist indefinitely. Markets are fluid, so changes in public opinion or broader economic factors can reshape the scene at a moment’s notice.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-08-23 15:05