As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends that have shaped my understanding of investor behavior. The recent surge in Bitcoin to over $63,000 today is reminiscent of the 2017 bull run, and the underlying on-chain data suggests that we might be witnessing a similar pattern unfold.

It appears that significant investors are increasing their bets, as seen by Bitcoin‘s surge past $63,000 today. Market analysts have definitely noticed this trend. Interestingly, within the network, data shows potential signs of Bitcoin whale accumulation and the activation of inactive wallets, which could indicate a significant price increase in the future.

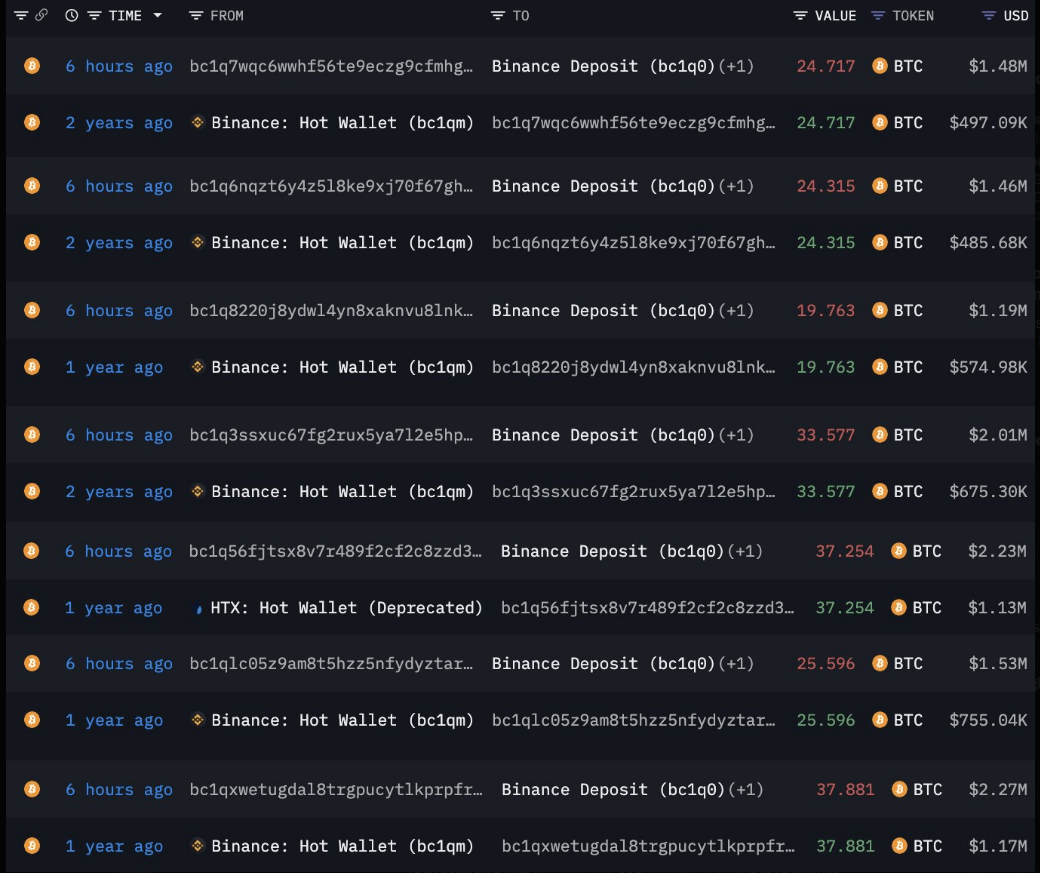

Ki Young Ju, the creator of CryptoQuant, noted an upsurge in Bitcoins being transferred to custodial wallets, which are primarily utilized by institutional investors for secure, long-term preservation. This trend suggests that large-scale investors might be preparing to capitalize on what they perceive as another significant price surge.

Whales are accumulating #Bitcoin.

Six days of accumulation alerts in a row. Primarily from custody wallet inflows.

Nothing has changed for Bitcoin; we’re in the middle of the bull cycle.

— Ki Young Ju (@ki_young_ju) September 18, 2024

Dormant Wallets Spring Back To Life

In recent times, we’ve seen a resurrection of Bitcoin wallets that had been dormant for some time. For example, approximately 203 Bitcoins, worth around $12.18 million, were moved from inactive accounts older than a year to Binance, resulting in a profit of about $6.89 million for one astute investor.

For more than ten years, the second wallet has remained untouched, containing approximately 146 Bitcoins. Currently, this amount equates to a staggering $8.09 million. In contrast, if sold in 2013, it would have fetched just $80,257 – an astounding increase of nearly 10,000%!

Whale Accumulation Signals Long-Term Optimism

The pattern of accumulation aligns with recent increases in Bitcoin’s price, leading some to believe that large investors, or “whales,” are anticipating further price escalations. However, Ju’s analysis implies that institutional investors remain optimistic about Bitcoin’s future potential, despite the market volatility experienced since March 2024.

The cost of a single bitcoin increased from an initial value of $58,909 in September to $59,530. Despite a temporary dip on September 6, where it reached its lowest at $53,940, the persistent buying activity by large investors (whales) and institutions caused the price to soar.

More Gains Expected: Technical Indicators

Currently, Bitcoin’s price at $63,637 shows strong signs of rising further, supported by technical aspects. The imminent intersection of the 50-day and 200-day Exponential Moving Averages suggests a more optimistic trendline ahead.

Additionally, the Relative Strength Index (RSI) is presently at 46.79, indicating that it has not yet surpassed the overbought threshold. This suggests that there’s still some headroom for the price to climb further before the market becomes excessively elongated or extended.

Inactive Wallets Stir Market Volatility

Maintaining Bitcoin’s value over the crucial 0.5 Fibonacci retracement point at approximately $57,688.42 strengthens the optimistic outlook, suggesting a possible upward trend.

Restoring inactive cryptocurrency wallets might cause market fluctuations as a result of the additional supply triggering reactions. Lately, crypto management company Ceffu moved large amounts of Bitcoin and Ethereum to Binance, sparking rumors of long-term investors cashing out.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2024-09-20 20:46