As an analyst with over two decades of experience in financial markets, I find these recent Bitcoin trades intriguing and bullish. The substantial investment by institutional traders on CME, particularly ahead of the US presidential election, is reminiscent of the 2017 bull run that saw Bitcoin soar to unprecedented heights.

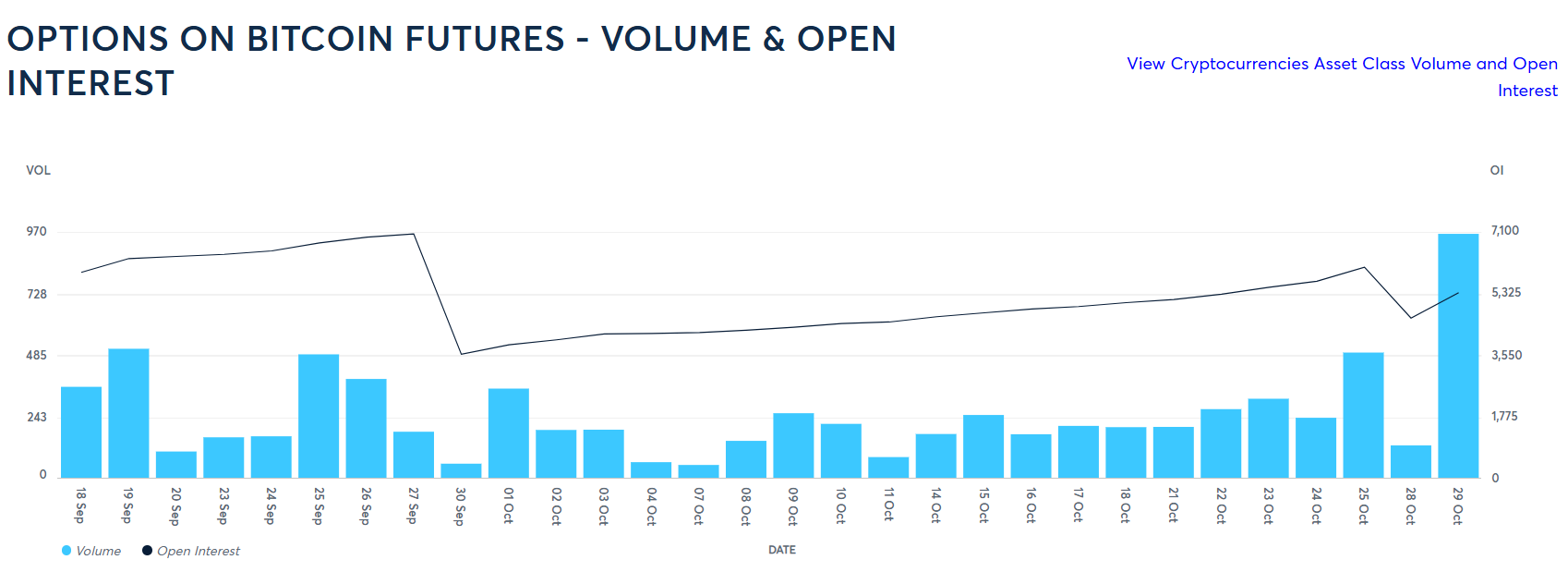

It’s predicted by institutional investors that the price of Bitcoin could reach $79,300 before November ends. This optimistic outlook is noticeable in the increased trading activity on the Chicago Mercantile Exchange (CME), where Bitcoin options are currently seeing some of their highest volumes as we approach the U.S. presidential election.

Bitcoin To Rise Above $79,300?

Joshua Lim, one of the co-founders at Arbelos Markets – a company specializing in liquidity provision across cryptocurrency derivative markets – recently offered insights regarding some significant trades that have been taking place. As he noted, trading volumes for CME Bitcoin options have reached some of their highest levels yet, prior to the upcoming U.S. election.

He highlighted two substantial transactions that occurred in the past week. On Friday the 25th, traders purchased 1,875 Bitcoin units of the 29-November $70,000 strike calls. In options trading, a call option gives the buyer the right, but not the obligation, to purchase an asset at a specified strike price before the option expires. In this case, the strike price is $70,000, meaning the buyers are betting that Bitcoin will exceed this price by the end of November. Lim detailed that at the time of the trade, “$8.3 million of premium was paid, $147,000 of vega, $65 million of delta.”

On Tuesday, 29th November, another substantial trade was made involving the acquisition of 3,050 Bitcoin call options with a strike price of $85,000. Lim mentioned that the premium paid for this trade was approximately $4.6 million, the vega was around $173,000, and the delta was about $42 million at the point of transaction.

Investments of $8.3 million and $4.6 million suggest a significant commitment, showing faith in Bitcoin’s potential growth. The high vega points towards traders anticipating considerable market fluctuations, potentially huge ones near the US election. Delta signifies the projected change in an option’s price with a dollar shift in the value of the underlying asset. High delta values of $65 million and $42 million suggest substantial sensitivity to Bitcoin’s price swings.

In simpler terms, the combined estimated worth of these positions, which represents the value of the underlying assets depicted by the options, totals around $350 million. Notably, Deribit, being the biggest cryptocurrency options exchange globally, considers this amount substantial.

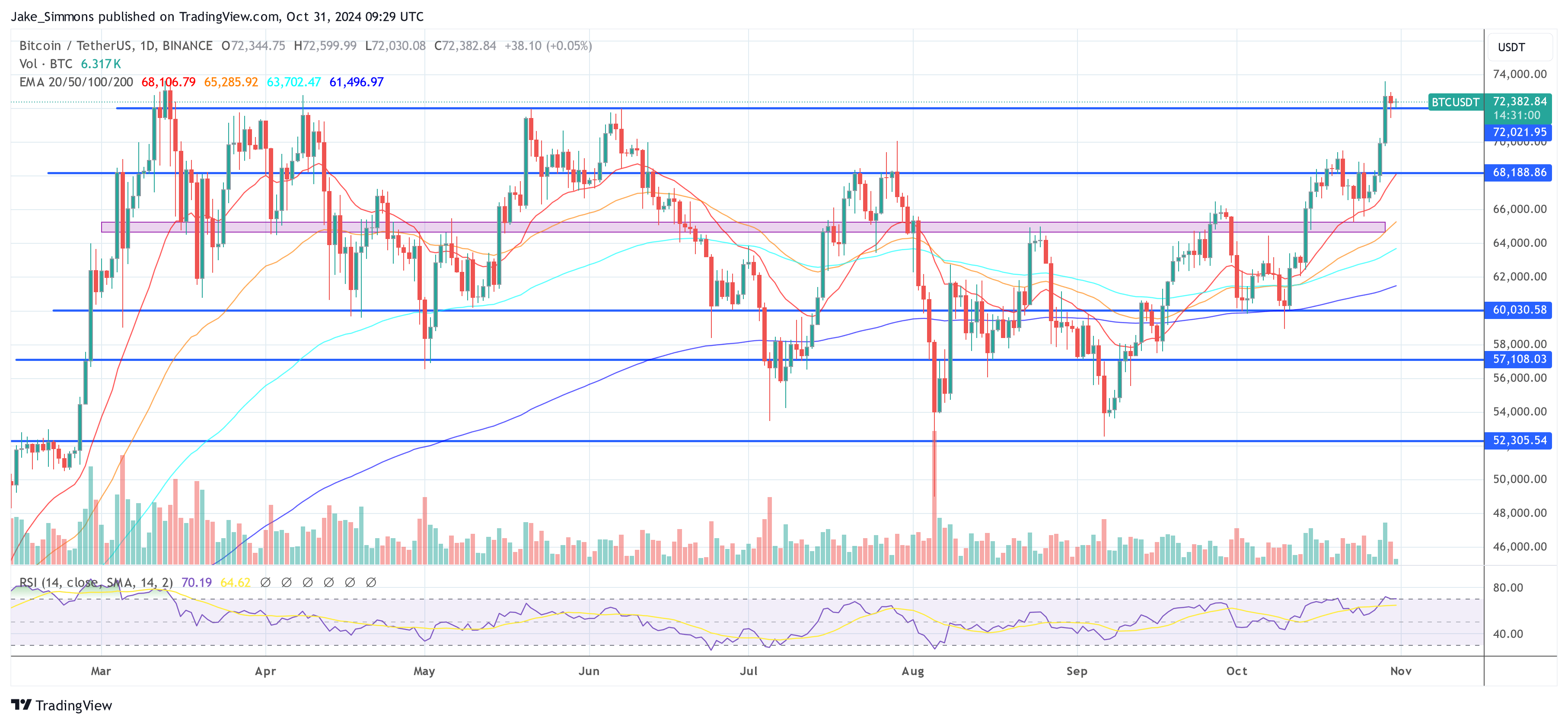

To break even on these positions, the Bitcoin price must climb over $79,300 before the options expire. At that point, the traders will start seeing profits as this level is approximately 16% higher than the price at which these trades were made.

Lim stated, “Heavily optimistic approach towards the upcoming election, and it’s encouraging to notice institutions adopting such positions on CME. This could possibly indicate an increase in liquidity within the crypto derivative markets as the asset class evolves and becomes more established.

It’s quite significant when these transactions are happening. Given that the U.S. presidential election is just around the corner, financial instability in markets could spike, potentially influencing the entire Bitcoin and cryptocurrency sector. Generally speaking, most analysts predict a Trump win would be positive for Bitcoin prices.

At press time, BTC traded at $72,382.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

2024-10-31 16:34