As a seasoned crypto investor with a knack for recognizing potential, I find the recent moves by Injective highly intriguing. The integration with Fetch.ai and ASI is a game-changer, not just for Injective but for the broader DeFi landscape. The sheer volume of votes in favor of this partnership speaks volumes about its significance.

Recently, the decentralized finance (DeFi) focused protocol, Injective, has taken significant steps forward. Not only does it offer high transaction speed and affordable rates, but it also shields traders from Maximal Extractable Value (MEV) bots. Additionally, the platform has been forging strategic alliances with other prominent entities in the field.

Injective Integrates With Fetch.ai And ASI

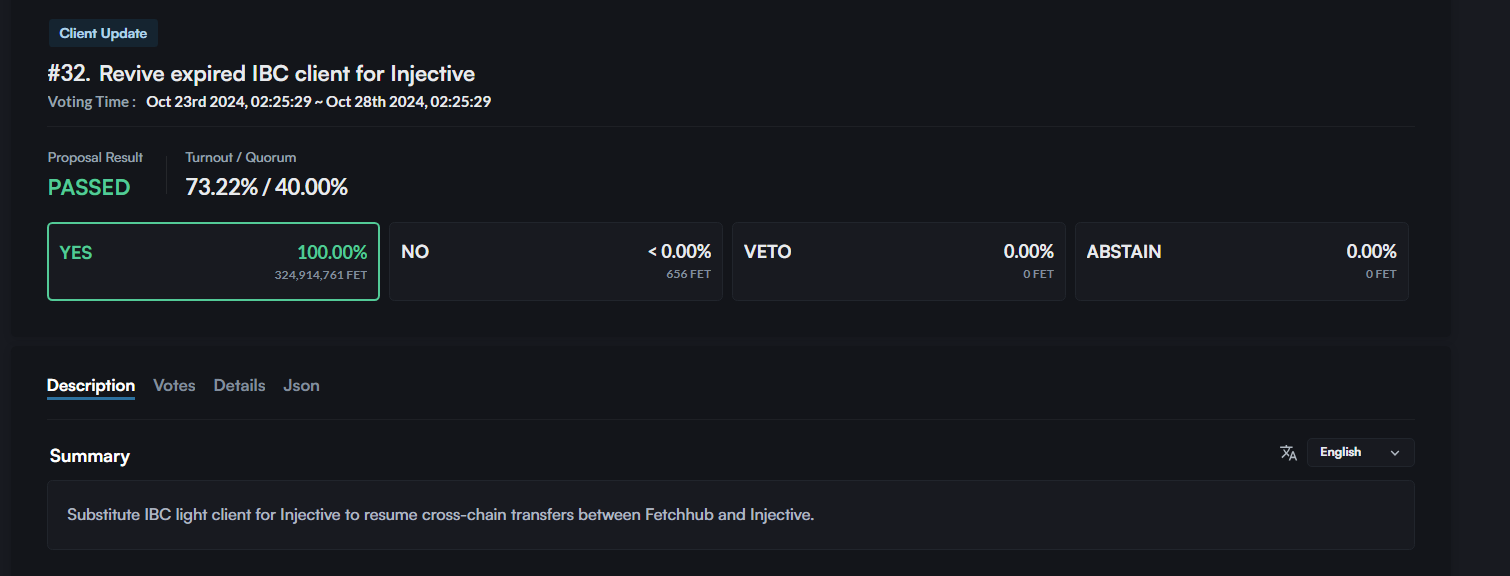

This week’s proposition by Fetch.ai and the ASI community for integrating Injective was unanimously approved. Every vote cast agreed with this action.

Based on the analysis of voting records, approximately 324 million FET cast their votes in favor of the proposal, while just 656 FET chose to oppose it. There were no recorded abstentions or vetoes. The voting period began on October 23 and concluded five days later, on October 28.

As per the plan, our aim is to reactivate an expired Injective Blockchain Client under the title “Reactivating Expired Injective Blockchain Client.” By doing so, Fetch.ai – now a member of the ASI Alliance – can leverage artificial intelligence within the extensive Injective Decentralized Finance network.

As an analyst, I can express this in a more personalized and straightforward manner: By establishing this connection, I, as part of the team, enable Fech.ai, our cutting-edge AI-focused platform, to seamlessly integrate its machine learning and artificial intelligence functionalities into Injective’s platform, thereby enhancing its capabilities.

Users stand to gain from AI-enhanced trading tools that are optimized for efficiency. Moreover, the team emphasizes that they can advantageously manage liquidity and make strategic decisions regarding asset distribution.

Despite the agreement, Injective and ASI will remain separate entities, each functioning independently. However, this collaboration is not a merger; rather, it involves Injective leveraging ASI’s artificial intelligence competencies.

Why Is INJ Down?

Although it appears optimistic, Injective’s prices have dropped recently when examining the daily chart. The bulls of Injective haven’t fully reversed the losses they experienced on October 25 yet. Consequently, despite a string of higher highs over the weekend and in the early part of the week, it seems the sellers are currently holding the reins.

To date, INJ has dropped approximately 20% from its October peak and has been confined within a range of $10. The significant resistance lies around $25, while a supportive floor can be found at $15. If the bullish investors return by Q1 2024, it’s expected that the momentum will strengthen once buyers successfully surpass the $25 mark, ideally with growing participation.

In addition to boosting the positive outlook for cryptocurrencies and increasing the overall value secured in Decentralized Finance (DeFi), Injection (INJ) might also gain advantages by leveraging Injective’s key features.

Among all the protocols, this one boasts the largest return on fully diluted valuation (FDV), surpassing even that of Ethereum.

A high score indicates a strong, brag-worthy revenue generation system that may potentially lead to increased costs.

Read More

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-10-31 22:34