As a seasoned analyst with over two decades of market experience under my belt, I’ve seen trends come and go, but INJ‘s recent performance has caught my eye. The altcoin’s strong surge past the $18 resistance is reminiscent of a well-timed breakaway in a high-stakes game of chess – unexpected yet strategically sound.

Over the past few hours, INJ has shown impressive growth compared to the wider crypto market, increasing by more than 19% from its value on Monday, whereas the majority of cryptocurrencies have seen losses ranging from 2% to 4% since yesterday.

Following the breakthrough of the $18 barrier, this altcoin’s robust showing is indicating a surge in bullish energy. As a result, investors and analysts are keeping a close watch on INJ, anticipating potential price increases, with some predicting that it could soon experience even greater growth.

Yet, it’s essential for INJ to assess crucial resistance levels and find backing at vital demand areas for the bullish trend to persist. While the present enthusiasm about Injective is driven by positive price dynamics, a prolonged rise will be necessary to solidify the trend’s longevity.

With keen interest, it’s worth noting that whether INJ can sustain these current levels could significantly influence its prospects for potential advancement in the approaching days.

Injective Setting New Local Highs

After several days of fluctuating and unpredictable price movements, Injective (INJ) has witnessed a significant spike. Currently trading above the 4-hour $18 resistance level, this altcoin has sparked enthusiasm among investors and analysts who foresee INJ as a potential standout performer during this market cycle.

A respected expert, known as Crypto General, has recently expressed his technical viewpoint on INJ, predicting a potential price surge towards $53 within the upcoming months. His analysis indicates that INJ is currently bouncing back from its crucial support level, which has historically provided a strong base for this upward trend.

As per Crypto General’s analysis, Injective Coin (INJ) might witness a significant surge if it manages to uphold its current support. Yet, he cautions that should the price falter in maintaining this level, we may observe a downward trend approaching the $14 region, indicating a potential reversal of recent growth.

Observers are closely following this progress, since the latest price fluctuations of INJ might signal larger shifts in the immediate future.

The crucial factor will be if INJ continues its pace and manages to surpass its resistance points. Should buyers successfully drive the price beyond the upcoming resistance area, a surge towards the middle $20 region might ensue, strengthening its status within the market even more.

In the upcoming period, the actions of prices are expected to be crucial in shaping INJ‘s future performance over the next few weeks. Whether there will be further increases or a reversal will primarily hinge on the overall market trends and the bulls’ capacity to maintain their upward push.

INJ Price Action Details

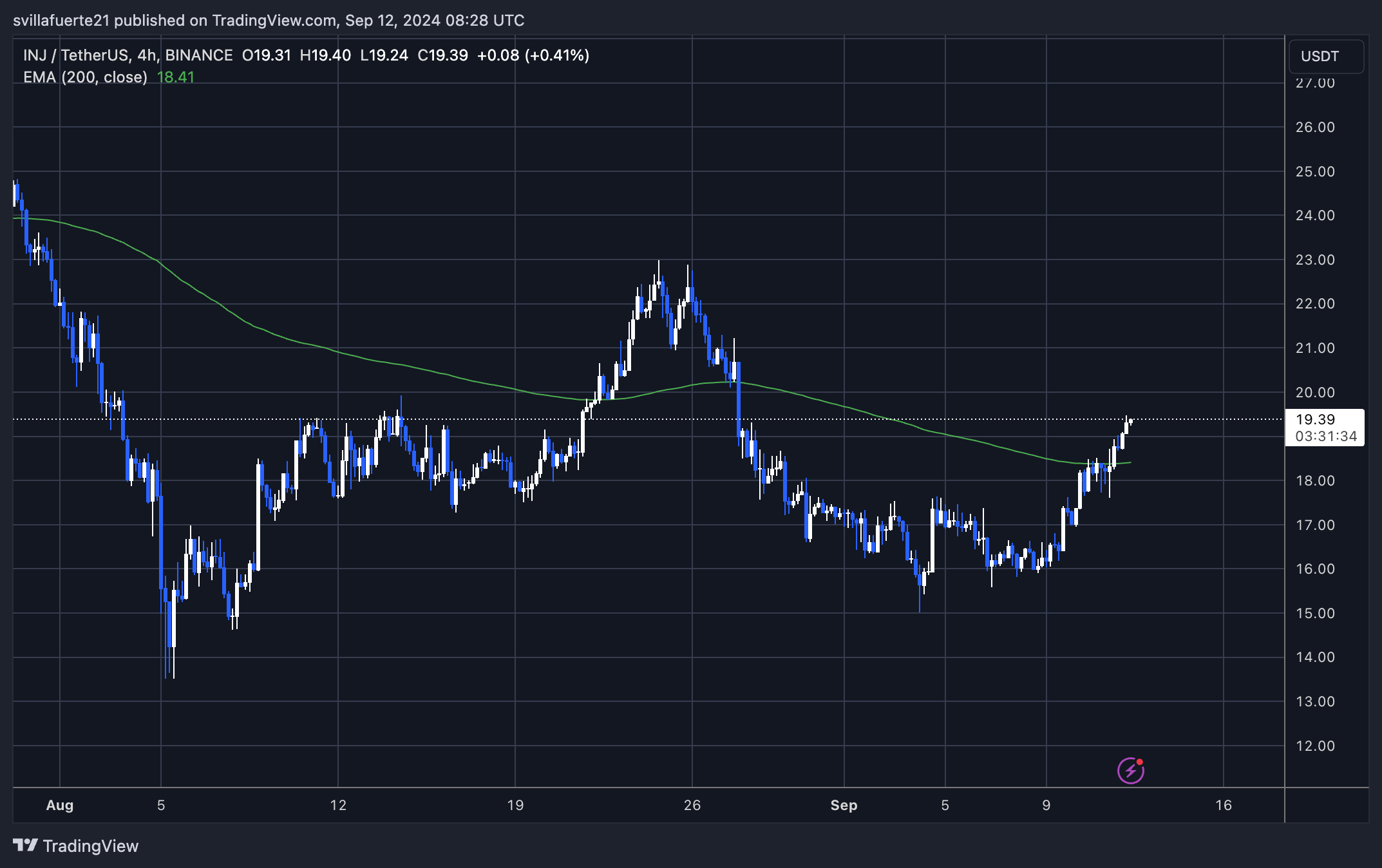

Currently, INJ is being traded at $19.38 following a substantial increase from its yearly lows around $15. This price rise has pushed it above the 4-hour 200 exponential moving average (EMA) of $18.41 for the first time since late August.

In simpler terms, the 4H 200 Exponential Moving Average (EMA) is an essential tool for determining short-term market resilience. If INJ manages to bounce back and stay above this threshold, it could imply a bullish trend continuation, hinting at more price increases ahead.

Keeping the current stance over the 4-hour 200 Exponential Moving Average could pave the way for INJ to reach potential higher prices. The areas around $23 are significant due to resistance and supply, making them the next major obstacles to surpass.

If the price doesn’t sustain this level and falls below $18, which acts as a support level, it might lead to a drop back towards areas of lower demand at approximately $16. In the immediate future, INJ‘s behavior near the 4-hour 200 EMA will play a crucial role in determining its next phase of price movement.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-09-12 23:10