As a seasoned crypto investor with over a decade of experience under my belt, I must admit that the recent developments surrounding Injective Protocol have caught my attention. Having witnessed the rise and fall of countless projects, I am always on the lookout for promising DeFi platforms that can deliver tangible results. The fact that Injective is generating more revenue than established players like BNB Chain and Avalanche is a testament to its growing popularity and potential.

The Injective Protocol, a decentralized finance (DeFi) focused platform built on Cosmos technology, is experiencing growth as it generates interest due to the gas fee revenues shared with its validators by the end of Q3 2024.

With INJ, the native currency of the protocol, experiencing a dip following its peak at around $52 earlier this year, the latest developments offer a significant morale boost. Examining these trends might suggest an increase in users joining Injective, which could potentially benefit INJ in upcoming trading periods.

Injective Generates More Revenue Than The BNB Chain, Avalanche

Based on CryptoRank’s findings, Injective Protocol earned approximately $4 million in revenue primarily from transaction fees (gas fees). Similar to networks such as Bitcoin and Solana, each transaction or smart contract deployment triggers a gas fee. This fee is paid out to the selected validator or miner who maintains the network, serving as an incentive for them to continue operating a node.

Compared to BNB Chain and Avalanche, two major players in the blockchain industry, Injective raked in over $4 million in revenue, while the former earned approximately $3.4 million and the latter around $2.1 million, as reported by CoinMarketCap.

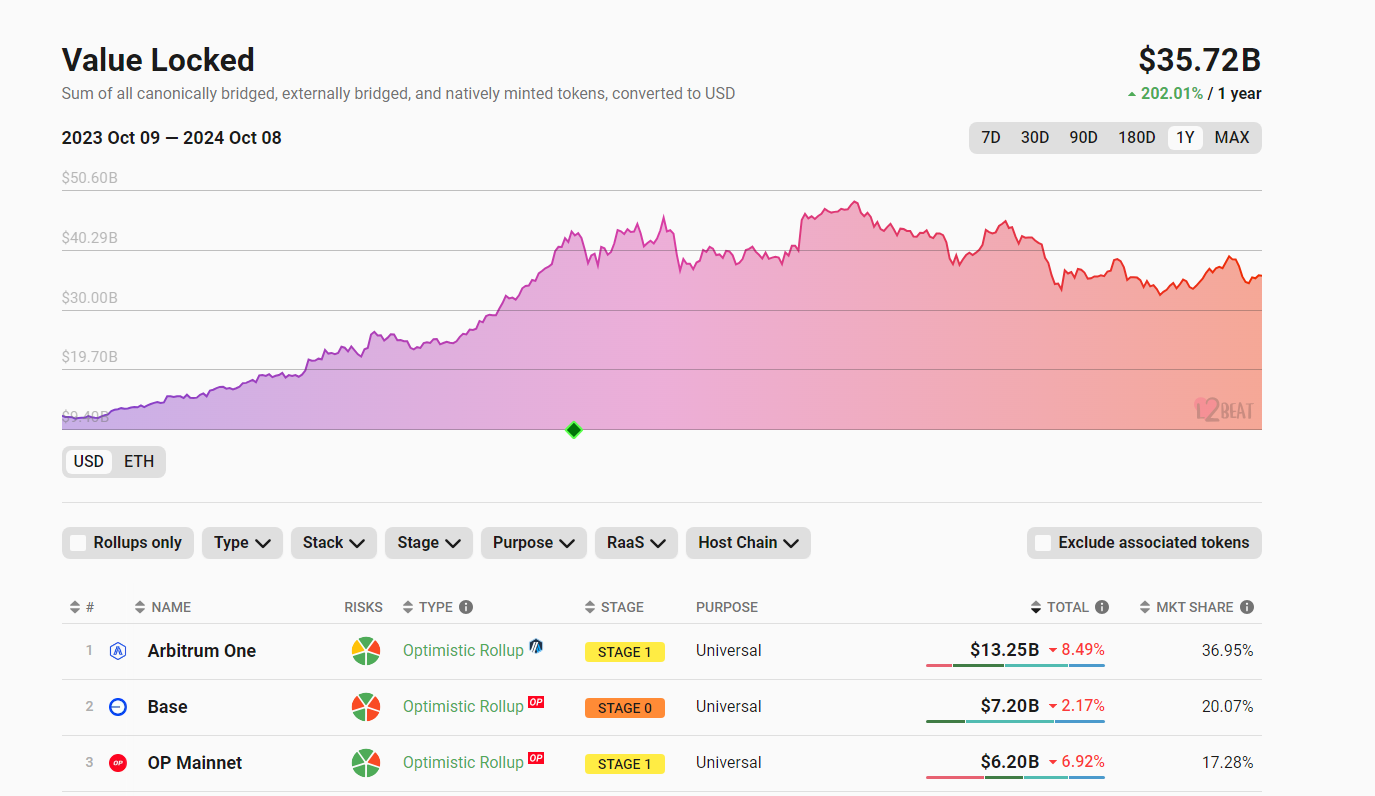

At this stage, Injective has outperformed the achievements of some leading Ethereum layer-2 solutions, such as Arbitrum, Optimism, and Blast, during this timeframe. For a point of reference, Arbitrum, despite being the largest with over $13.2 billion in management, according to L2Beat.

During the period of July to September, Ethereum, Tron, and Solana generated more earnings compared to Injective. Specifically, Ethereum distributed approximately $159 million to its validators, whereas Tron and Solana together transferred over $200 million collectively.

The growth in Tron’s income, primarily driven by meme coin transactions on its system, is attributed to the introduction of SunPump in August. Meanwhile, Solana has also seen gains from meme coins and increased activity on decentralized exchanges during this timeframe.

Will INJ Rise To $50?

It’s yet to be determined if the revival of DeFi activities will positively impact Injective and its Total Value Locked (TVL). As per DeFiLlama data updated on October 8, the protocol currently manages more than $40 million. Additionally, the platform has facilitated over a billion on-chain transactions.

At the beginning of October, Injective unveiled the release of Injective 3.0. This update enables the protocol to modify its token economics and make the INJ token deflationary. As a result, some INJ tokens will be taken out of circulation, making them less common.

Currently, INJ is located within a falling trendline (descending channel), bouncing off the support level at $15. Despite Q1 2024 investors still being present, the token has dropped approximately 60% from its March peaks. If INJ manages to break above this descending channel, it could potentially reach its 2024 highs near $52.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- All Elemental Progenitors in Warframe

2024-10-09 03:40