As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. The current situation with Dogecoin (DOGE) is intriguing, to say the least. While I am not one to make bold predictions without substantial evidence, Kevin’s (@Kev_Capital_TA) analysis resonates with me given his impressive track record.

Following an impressive surge of over 200% within the first fortnight of November, Dogecoin (DOGE), has moved into a period of stabilization. Crypto analyst Kevin (@Kev_Capital_TA) posits that this could be a tranquil interval preceding another significant rise, much like a previous market trend, suggesting a possible impending spike.

Is Dogecoin Heading Towards $4?

Kevin notes that in Dogecoin’s last cycle, the memecoin consolidated for 24 days after its first massive rally before ascending again to what he describes as the “macro golden pocket”—a price range between $3.80 and $4.00 which aligns with the 1.618 Fibonacci extension level.He believes that if DOGE follows a similar trajectory, price could skyrocket by the end of the week, potentially leading to a new all-time high (ATH) by the end of the month.

According to Kevin’s analysis, when Dogecoin experienced its initial significant surge in the past, it paused for 24 days following that move before rising again towards a significant price level. If Dogecoin were to follow a similar pattern, he suggests that the next uptrend may begin by the end of this week and potentially lead Dogecoin to the macro golden pocket which is around $3.80-$4.00.

However, he tempers expectations by acknowledging that such astronomical performance is hard to predict: “That would be astronomical performance though and it’s hard to make that type of call. Let’s start with making a new ATH by end of month like I predicted back in September.”

At the moment, the situation with Dogecoin is significant. Upon examining the daily Dogecoin-to-US Dollar (DOGE/USD) chart, Kevin notices that Dogecoin is “currently challenging a crucial trend line of support on the daily Relative Strength Index (RSI). If this support level breaks, it could lead to a rapid decline. Ideally, bulls would like for this support to hold, if feasible.

He also mentions that although the RSI trend line managed to maintain its position at the daily close, “it needs to rebound now if we are going to sustain it.” The potential impact of Bitcoin‘s (BTC) price fluctuations could be decisive: “If BTC experiences an uptick, it could provide us with the support we need,” he suggests.

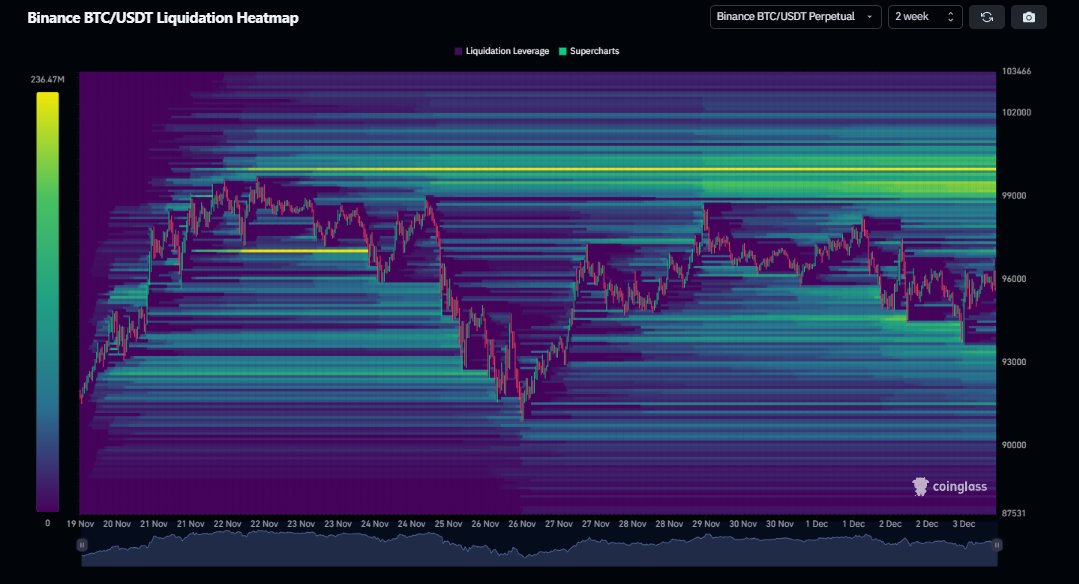

Bitcoin has been holding steady since hitting a reported all-time high of $99,588 on November 22, with its trading range between $90,800 and $98,500. As Kevin points out, the struggle is evident between price movements and the negative trend suggested by technical indicators such as MACD. He highlights that “one of these factors will eventually prevail.

On the 4-hour Bitcoin/USD chart, Kevin points out a nearly completed symmetrical triangle formation that could soon lead to a breakout. Despite the recent market fluctuations, “Bitcoin has yet to drop beneath or even close a 4-hour candle below this trend line,” which signals robust support levels are in place.

Additionally, he highlights notable sell-off points near the $100,000 mark, suggesting that “eventually, Bitcoin may choose to rise and tap into the available liquidity at $100,000.

Making such a move by Bitcoin might signal the impending significant rise in Dogecoin prices, following similar trends from the previous market cycle. According to Kevin’s findings, the relationship between Bitcoin and Dogecoin price fluctuations is key when trying to anticipate future market shifts.

At press time, DOGE traded at $0.4194.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-04 15:40