As an experienced crypto investor with a keen eye for market trends and a knack for spotting opportunities, this latest development by Hut 8 has caught my attention. With their BTC reserves now surpassing the $1 billion mark, they’ve not only solidified their position among the top corporate Bitcoin holders but also demonstrated a strategic approach to crypto investment.

In simpler terms, the Bitcoin mining corporation Hut 8, based in North America, has increased its Bitcoin (BTC) holdings even more by purchasing a sum of $100 million. This recent buyout boosts their total BTC reserves to over 10,096 Bitcoins, which translates to a value exceeding $1 billion at the present market rates.

Hut 8 Bitcoin Reserves Top $1 Billion

Despite Bitcoin’s recent spikes in value, the Miami-based cryptocurrency mining company persists in expanding its Bitcoin holdings. In a recent statement, Hut 8 disclosed the acquisition of approximately 990 Bitcoins for around $100 million, with each Bitcoin costing an average of $101,710.

This purchase has pushed Hut 8’s total Bitcoin holdings above $1 billion. The Bitcoins obtained were bought at an average price of around $24,485 per Bitcoin. This action aligns with the company’s strategy: producing Bitcoin economically while also making strategic market purchases to boost returns and fortify its reserve assets.

Significantly, Hut 8’s latest acquisition places it among the top ten global corporations with the most Bitcoin in their possession. MicroStrategy currently holds over 250,000 BTC, making it the front-runner on this list. In response, Asher Genoot, CEO of Hut 8, commented:

We strongly trust our core business and see the establishment of a strategic Bitcoin reserve as a means to bolster our financial stability while we pursue ambitious growth projects in both power and digital infrastructure. Furthermore, as we expand our operations and enhance our cost efficiency in Bitcoin mining, we expect a self-reinforcing cycle (often referred to as a ‘flywheel effect’) to help us accumulate more Bitcoins at prices below the market average, thereby increasing the profitability of our reserve strategy.

In harmony with this idea, Hut 8 CFO Sean Glennan outlined that incorporating Bitcoin as a reserve asset is a crucial part of our strategic plan to provide “exceptional profits” to shareholders via smart treasury management. He further mentioned that the company might utilize its Bitcoin reserves to achieve business goals, like enhancing our mining equipment.

This month, Hut 8 announced a large-scale $750 million project focused on corporate goals, debt repayment, and increasing its Bitcoin holdings. In the past year, Hut 8’s shares have climbed more than 102%, currently trading at $27.11 per share as I write this.

4 Mining Firms Among Top 10 Corporate BTC Holders

Among the most prominent corporations holding Bitcoin, MicroStrategy, Tesla, Block, Coinbase, and four more – Marathon Digital Holdings, Hut 8, Riot Blockchain, and CleanSpark – are known as significant Bitcoin miners.

Previously, Riot Blockchain disclosed a substantial growth in their Bitcoins. Currently, this Bitcoin mining company is in possession of approximately 8,490 Bitcoins.

In a similar vein, not too long ago, Marathon Digital Holdings added another 703 Bitcoins to its reserves, bringing the total to 34,794 BTC. This action seems consistent with the statements made by Marathon’s CEO, suggesting that major institutions are eager to accumulate Bitcoin.

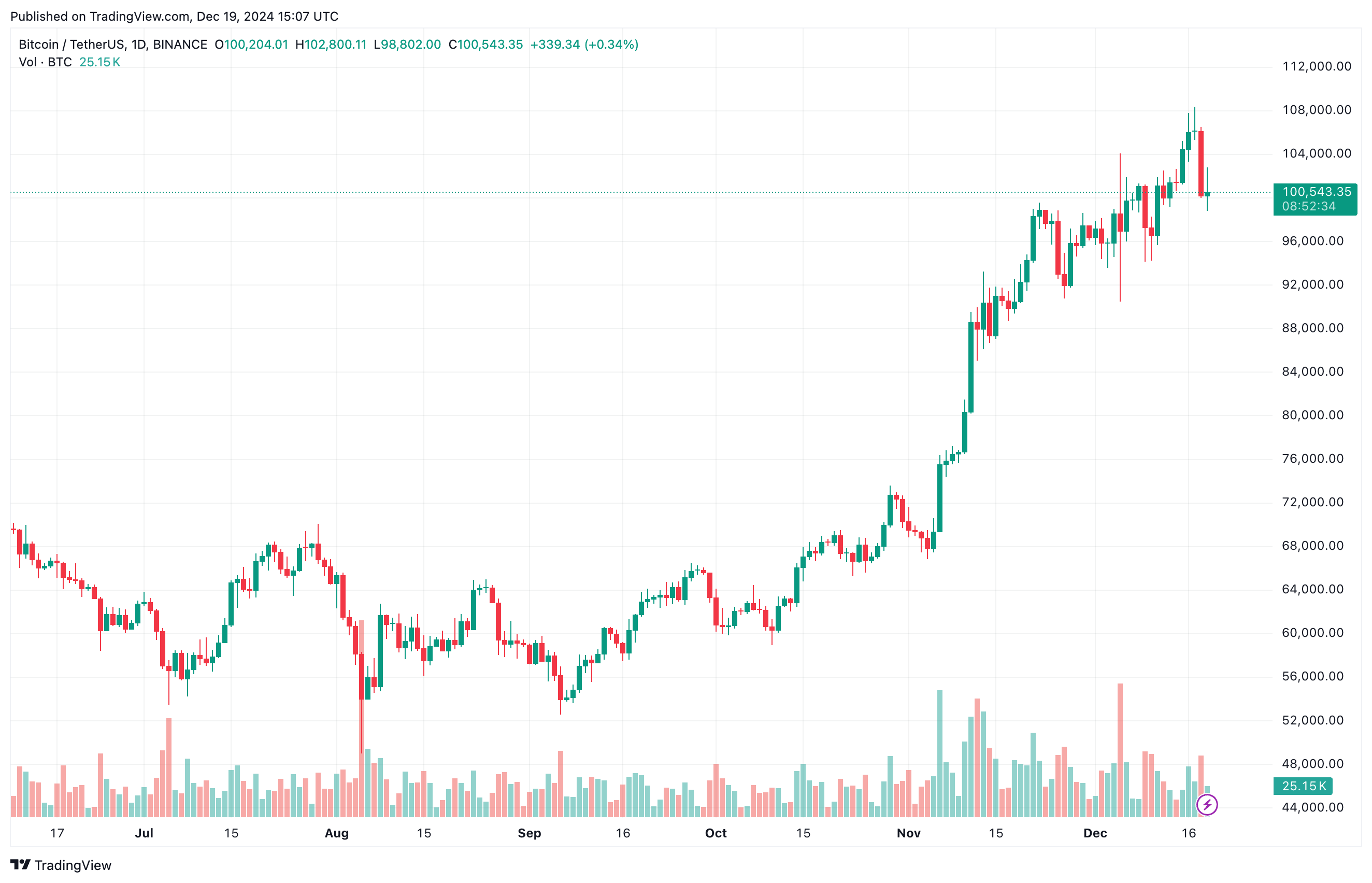

In October, Zach Bradford, CleanSpark’s CEO, forecasted that Bitcoin might reach approximately $200,000 within the subsequent 18 months. Presently, Bitcoin is exchanging hands at $100,543, experiencing a decrease of 3.1% over the last 24 hours.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-12-20 07:17