As a seasoned researcher with years of experience in the crypto market and a knack for drawing intriguing parallels between seemingly unrelated fields, I find Arthur Hayes’ analogy between avalanche science and geopolitical tensions in the Middle East both captivating and thought-provoking. His essay offers valuable insights into potential market reactions to escalating conflicts, particularly focusing on Bitcoin and other crypto assets.

Arthur Hayes, co-founder and ex-CEO of BitMEX, wrote an essay called “Persistent Weak Layer” on October 16. In this article, he discusses the possible effects of increasing conflicts between Israel and Iran on the cryptocurrency markets. Using avalanche science as a comparison, Hayes explains how the political climate in the Middle East could serve as a “persistent weak layer” (PWL), which might cause substantial disruptions across financial markets, potentially influencing Bitcoin and other crypto prices.

How Will The Crypto Market React?

In the opening of his essay, Hayes shares an account of his recent skiing adventure and points out that one particularly dangerous condition is called a Persistent Weak Layer (PWL), which could cause a massive avalanche when subjected to pressure. He likens this situation to the Middle East’s geopolitical landscape post-World War II, implying that it acts like a PWL upon which the current global order is built.

Hayes notes that often, events related to Israel seem to be the catalyst. He underscores that financial markets are mainly focused on predicting how energy prices might fluctuate, assessing the effect on worldwide supply chains, and considering the possibility of a nuclear conflict if tensions between Israel and Middle Eastern countries, especially Iran or its allies, intensify significantly.

As an analyst, I’ve outlined two possible situations regarding the Israel-Iran conflict. In the first instance, the confrontation remains relatively minor, characterized by occasional, retaliatory military actions. Israel carries out targeted assassinations and dismantling of certain critical components, to which Iran responds with predictable, non-escalating missile strikes. Essentially, no significant infrastructure is damaged, and there’s no use of nuclear weapons; hence, the Probability of Widening War (PWL) remains intact.

In simpler terms, Hayes is expressing his worries. He’s at a crossroads with his investments, deciding whether to keep turning traditional money into cryptocurrency or to decrease his crypto holdings by moving into cash, US Treasury bonds, or other safer assets. He explains that he doesn’t want to miss out on potential growth in the crypto market if it continues to rise, but at the same time, he doesn’t want to risk losing a significant amount of money if Bitcoin experiences a sudden 50% drop due to geopolitical tensions between Israel and Iran causing financial markets to crash. He mentions that while Bitcoin usually recovers, his main concern is some questionable investments in his portfolio, specifically meme coins.

Buy Or Sell Now?

To tackle this predicament, Hayes examines various potential outcomes by performing a detailed analysis of situations, specifically focusing on how a more intense scenario might affect cryptocurrency markets, particularly Bitcoin, his term for the “reserve asset” within crypto. He identifies three main risks:

Discussing the damage to mining facilities associated with cryptocurrency, Hayes points out that among Middle Eastern nations, only Iran is significantly involved in Bitcoin mining, contributing as much as 7% of the global mining power. Looking back at the situation in 2021 when China prohibited Bitcoin mining, he suggests that eradicating all Iranian mining capabilities would have minimal influence on the Bitcoin network and its market value.

As a researcher examining the potential impact of geopolitical events on various economic factors, I’m particularly interested in the possible repercussions should Iran decide to disrupt oil and gas supply by damaging key fields or closing the Straits of Hormuz. Such actions could lead to an unprecedented surge in oil prices worldwide, which would inevitably escalate energy costs. However, this turmoil might unexpectedly boost the value of Bitcoin relative to traditional currencies. This is because Bitcoin represents a form of stored energy in digital form, and as energy prices rise, the worth of Bitcoin in terms of fiat currency tends to increase.

As a researcher, I’ve been delving into the past to find parallels with the oil shocks of the 1970s. During the Arab Oil Embargo of 1973 and the Iranian Revolution of 1979, oil prices skyrocketed. To be precise, oil prices soared by an astounding 412%, and gold almost mirrored this increase with a rise of 380%. This underscores the fact that while gold managed to retain its purchasing power in relation to oil, stocks suffered significant devaluation when evaluated against energy costs. Drawing from this insight, I propose that Bitcoin, functioning as a digital form of ‘hard money,’ could maintain or even increase its value in response to escalating energy prices.

To conclude, Hayes delves into the fiscal aspects, focusing on potential financial responses from the U.S. regarding the conflict. He underscores that America’s backing of Israel primarily involves procuring weapons, which are financed through greater government borrowing instead of savings. He emphasizes that the U.S. government spends beyond its means, purchasing goods not with savings but on credit. Citing data showing negative US national net savings, he queries who will absorb this debt. Suggesting a possible solution, he implies that the Federal Reserve and the commercial banking system in the U.S. would likely step up, increasing their balance sheets and consequently printing more money.

Hayes notes historical instances where negative national savings corresponded with sharp increases in the Federal Reserve’s balance sheet, such as after the 2008 Global Financial Crisis and during the COVID-19 pandemic. “The Fed and the US commercial banking system will buy this debt by printing money and growing their balance sheets,” he asserts. He suggests that this monetary inflation would significantly bolster Bitcoin’s price. “Bitcoin has outperformed the rise in the Fed’s balance sheet by 25,000%,” Hayes emphasizes, indicating Bitcoin’s strong performance relative to monetary base expansion.

However, he cautions investors about the potential for intense price volatility and uneven performance across different crypto assets. “Just because Bitcoin will rise over time doesn’t mean there won’t be intense price volatility, nor does it mean every shitcoin will share in the glory,” he warns.

In response to Iran’s missile attack on Israel, Hayes drastically reduced his investments in various meme coins. He explains, “Given the uncertainty surrounding how crypto assets might respond to escalating conflicts in the short term, I felt my position was too large and needed to be significantly scaled back.” Now, he only holds one meme coin, which he refers to as the Church of Smoking Chicken Fish (symbol: SCF). Cheers!

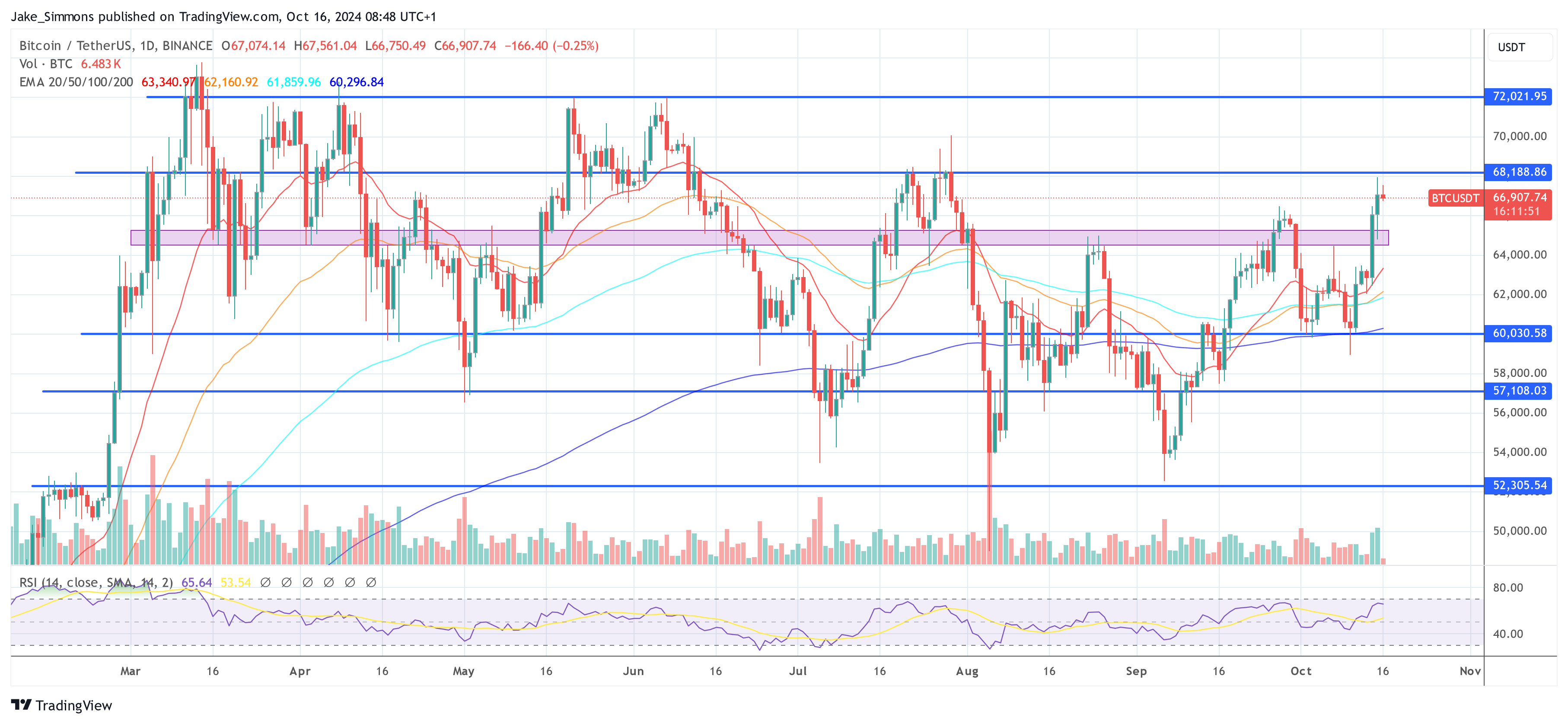

At press time, BTC traded at $66,907.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-16 19:35