As a seasoned researcher with over two decades of experience in financial markets, I’ve witnessed more than my fair share of market fluctuations and cycles. The recent plunge in Dogecoin (DOGE) has certainly caught my attention, given its similarities to past patterns we’ve seen in the crypto world.

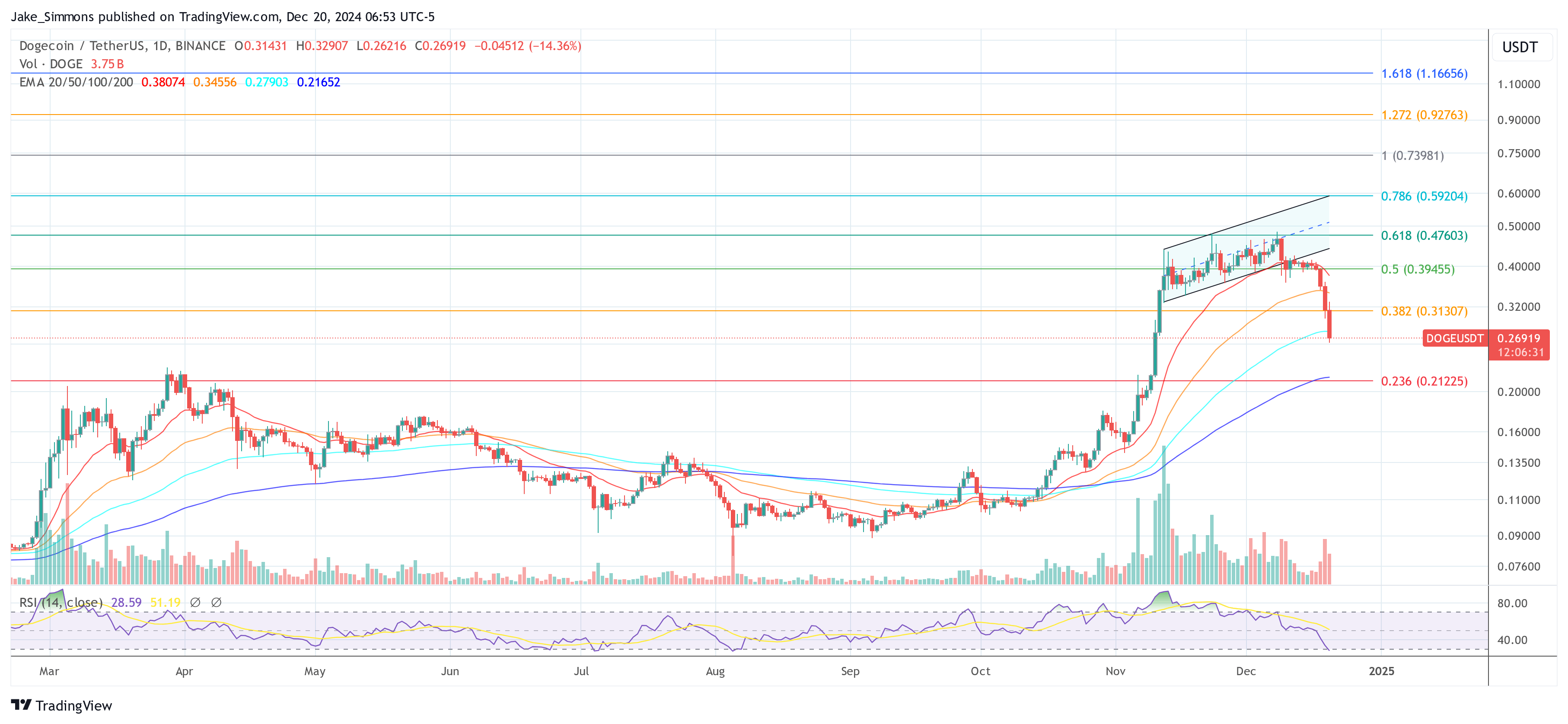

For approximately two weeks now, Dogecoin (DOGE) has experienced a significant drop, losing over 40% of its worth. Following its peak at $0.48 on December 8th, this internet-inspired cryptocurrency temporarily dipped to $0.2638 by December 20th. This sudden decrease has sparked much discussion about Dogecoin’s short-term trajectory. The recent slide in value can be linked to the broader crypto market’s reaction to signals from the US Federal Reserve, particularly more aggressive predictions made by the Federal Open Market Committee (FOMC).

While the Fed’s December meeting delivered a widely expected 25 basis point rate cut, the real shock came from the revised dot plot, which pointed to fewer future cuts than previously anticipated. The market had hoped for three rate cuts in 2025, but the FOMC’s guidance now leans toward just two, suggesting a more cautious approach amid persistent inflationary pressures. This shift in outlook triggered broad-based selling in risk-on assets, including cryptocurrencies. Bitcoin (BTC) dropped below $93,000, and altcoins -20% drawdowns. Within 24 hours, a staggering $1.17 billion in long positions were liquidated across the crypto markets.

How Low Can Dogecoin Go?

Several well-known experts have offered their insights on Dogecoin’s recent decline, placing it within broader trends and influential factors. For instance, technical analyst Kevin (@Kev_Capital_TA) emphasizes the importance of past patterns. He observes that in the past, Dogecoin has gone through several significant corrections as it approached its peak cycles. In this context, he suggests that the current decline – much like previous 50% drops – may be a normal aspect of a bull market rather than an indication of underlying systemic issues.

Based on Kevin’s explanation, it seems that in the past cycle of Dogecoin, there were three significant corrections amounting to 50% each before reaching its peak. If we encounter macro-level support and a “golden pocket” just beneath it, this could represent a 45% correction from the high. Given historical patterns, such a drop might be sufficient for the market to continue its uptrend. However, if Dogecoin falls below $0.26 cents on a weekly close, he would become concerned about the market structure. Until then, these price movements should be considered as typical pullbacks in a bull market.

In addition to emphasizing Bitcoin’s impact on the altcoin market, Kevin suggests that instead of just analyzing Dogecoin’s individual chart, traders should maintain a broader perspective and not overly concentrate on the charts of various altcoins. This is because Bitcoin, being the key asset, significantly influences the overall direction of the crypto market as its price movements often shape sentiment across the cryptocurrency sector.

Kevin reinforced his point by displaying a Bitcoin/Tether liquidation heatmap, hinting that the market might aim to eliminate areas of lower liquidity before considering any significant recovery. Essentially, he’s suggesting we should swoop in and grab the liquidity around $95,000 – $90,000 first, and only then could we discuss a potential surge. Until that happens, there’s no need for excessive analysis. From a fundamental perspective, the market seems to be overinterpreting Powell’s words rather than truly listening to him. His rate cut projections are not the actual focus of his statements.

As a dedicated crypto investor, I’m keeping a close eye on the $0.26 level for Dogecoin. According to Balo (@btcbalo), a respected analyst in our community, if we can manage to close the weekly trading above this mark, it will help maintain a robust market structure. In other words, we’ve got a few days left to make it happen and secure the week!

Defending the $0.26 area could lead to a fresh upward momentum, possibly pushing Doge back up to $0.42 – a key turning point Balo refers to as a potential launchpad. Overcoming $0.42, according to him, would catapult DOGE towards the $4 level, a situation he links with a full-blown bull market rebound.

As an analyst, I’ve noticed a striking resemblance between the current trend of Dogecoin (DOGE) and its usual 3-4 year cycle. From my vantage point, it seems prudent to step back and consider this multi-year cyclical pattern that DOGE has consistently demonstrated in the past.

The analyst compares Dogecoin’s current price fluctuations to its previous market cycle pattern. In 2021, Dogecoin saw a significant surge towards its record high. After a 50% decline, Dogecoin regained momentum, surpassed its all-time high, and entered a period of unpredictable pricing, known as price discovery. Previously discussed, this pattern might lead to the $0.26 price prediction.

At press time, DOGE traded at $0.26919.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-12-21 00:40