As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have witnessed the rollercoaster ride that is Bitcoin and its impact on altcoins. The recent correction of BTC to around $93,000 levels has not deterred traders from seeking opportunities in “hot altcoins,” as per the latest data from Santiment.

The Bitcoin price has experienced a significant drop of over 5.2%, falling to approximately $93,629 in the last 24 hours. Despite this correction, traders continue to place their bets on some popular “hot altcoins,” as suggested by various on-chain data metrics.

On Tuesday, November 26th, I, as a researcher, noted that while Bitcoin’s price dipped below $93,000, traders were still enthusiastically investing in hot altcoins and sharing insights about lesser-known prospects offering intriguing opportunities. This was according to the blockchain analytics platform Santiment’s recent post.

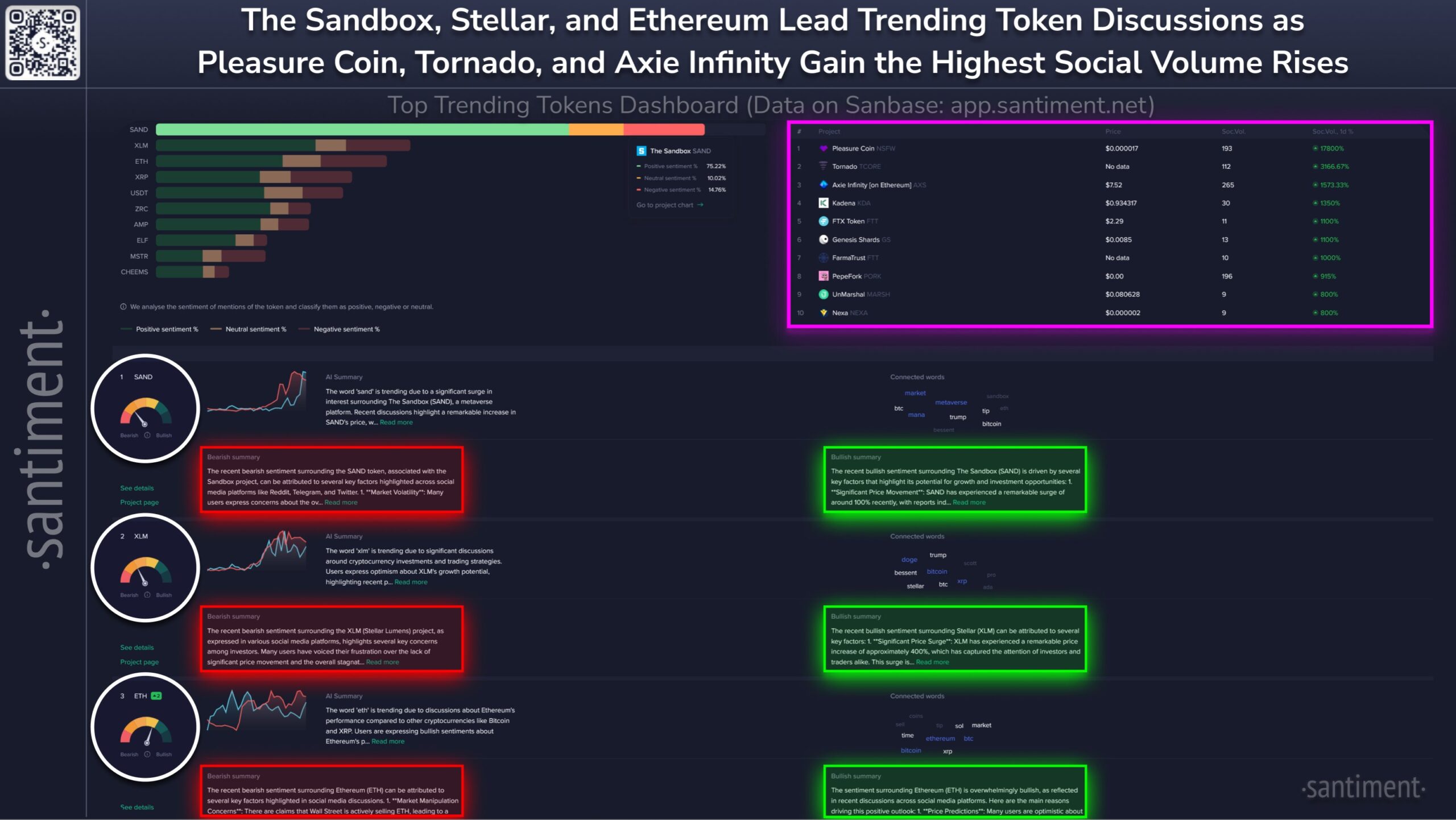

As a researcher delving into cryptocurrency trends, I’ve observed that tokens like The Sandbox (SAND), Stellar (XLM), and Ether (ETH) are currently leading the charge in trader discussions. A significant proportion of these conversations exhibit a bullish sentiment, indicating a robust enthusiasm for these altcoins. Here are some key metrics:

Courtesy: Santiment

In more recent periods, there’s been a surge of interest in Metaverse-related tokens, according to Santiment. At present, The Sandbox (SAND) stands out as the leading choice among investors who are increasingly optimistic about SAND and similar tokens, fueling its current growth. Additionally, discussions regarding the causes for this trend and the future prospects of these digital currencies are quite common.

Conversely, Stellar’s native cryptocurrency, XLM, has drawn interest from Korean investors due to a recent political occurrence. Some investors attribute the recent increase in XLM’s value to this event.

Meanwhile, Ethereum (ETH) is frequently making headlines as one of the popularly debated altcoins. According to Santiment, there seems to be a surge in optimistic opinions about Ethereum’s potential to surpass other leading cryptocurrencies, particularly under advantageous market circumstances.

Altcoins Face the Heat of Bitcoin Price Crash

According to a cryptocurrency liquidation chart on Coinglass, it appears that many altcoins are feeling the impact of the recent drop in Bitcoin’s price below $93,000. In just the past 24 hours, over half a billion dollars worth of positions have been liquidated in the crypto market, with $455.92 million being long liquidations and $115.59 million being short liquidations. The data suggests that altcoins have suffered the brunt of these wiped-out positions.

Cryptocurrency trader Moustache, on platform X, predicted that although there’s been a recent drop, “Altcoins are merely getting started,” implying that the main event is still to unfold. He provided a chart demonstrating that the ALT/BTC ratio is testing support levels again after a recent breakout.

#Altcoins

Looks like a deviation would apply to Altcoins/BTC.D.

This month’s close + December will be decisive.

I think Altcoins are just warming up here.

The real party starts soon imo.

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) November 26, 2024

Trader Eugene Ng Ah Sio expressed on X on November 26 that they will be remaining cautious, observing and staying patient due to the rising uncertainty in the market. He mentioned this as the most perplexing bull market altseason he has encountered, finding the movement of capital hard to decipher and the magnitude of shifts tough to foresee.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- All Elemental Progenitors in Warframe

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

2024-11-26 13:12