As an analyst with over two decades of experience in the financial markets, I find Sminston With’s approach to be both intriguing and thought-provoking. His use of the “decaying peaks” concept and the exponential decay fit to analyze Bitcoin’s price trajectory is a refreshing take on market analysis.

Bitcoin‘s price action has been mixed, displaying both bullish and bearish tendencies, without hitting a significant new high since surpassing $73,000 in March. Over the last week, the cryptocurrency has stayed below the $60,000 level, showing signs of resistance whenever it approaches that price point.

Despite some recent challenges, numerous analysts and industry experts remain hopeful about the future of leading cryptocurrencies. For instance, renowned Bitcoin expert Sminston recently presented an intriguing prediction for BTC, focusing on its historical price trends during previous market cycles.

Decoding Bitcoin’s ‘Decaying Peaks’

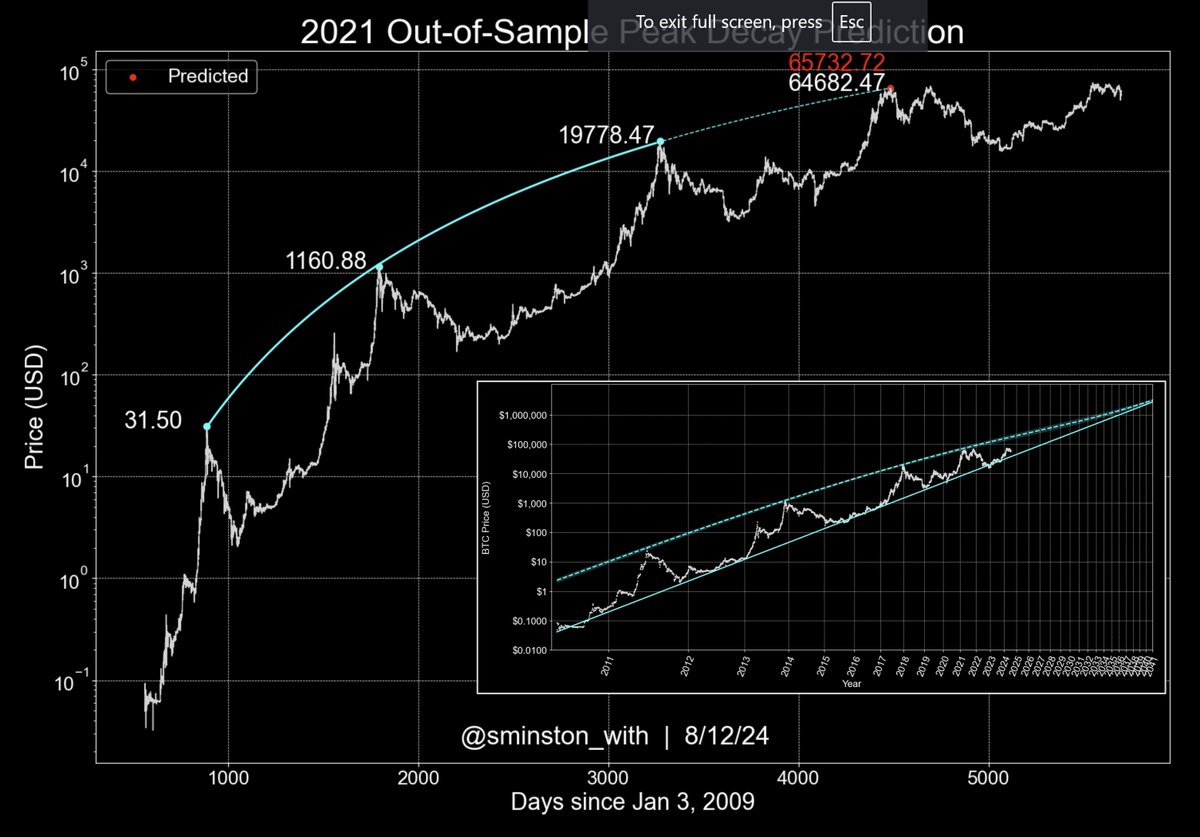

On Elon Musk’s social network, X, a post shares an analysis that predicts potential future trends for Bitcoin by referencing its peak periods such as 2011, 2013, and 2017.

As a seasoned crypto investor, I’ve noticed an intriguing pattern in Bitcoin’s bull markets that I refer to as “waning peaks.” This pattern indicates that with each passing bull run, the returns tend to decrease, suggesting that the market is becoming more mature and finding broader acceptance among investors.

As someone who has closely followed Bitcoin since its early days, I have observed that the “exponential decay fit” analysis provides a valuable tool for understanding the peaks of Bitcoin’s past bull cycles. By aligning the historical data points from 2011, 2013, and 2017, this method helps to reveal a potential pattern that could offer insight into future price movements. In my experience, this approach can be useful for those seeking to make informed investment decisions in the rapidly evolving world of cryptocurrencies.

I wanted to highlight a study looking at the decaying peaks of the #BTC price residuals from each cycle (this is what is used to build the Decay Channel and also the Oscillator).

Here I simply did an exponential decay fit of the max residuals (price / .05 quantile power law…

— Sminston With (@sminston_with) August 12, 2024

In the research he conducted, the analyst used this particular model to forecast the 2021 market peak, coming very close to the real-world market behavior. The model projected a peak price of approximately $65,732.72, which was quite similar to the actual peak price of $64,682.47. This suggests that the analytical method may have strong potential for accuracy.

Towards A $164,000 Bitcoin By 2025?

Moving forward with my analytical lens, I am daringly projecting a forecast for the 2024-2025 timeframe.

The projected path for the decaying peaks model suggests a bold journey where Bitcoin might peak at around $164,000, given the consistent trends seen in its historical market activity.

While these predictions should be viewed with a degree of caution, as they’re based on analysis of just four market cycles so far. As pointed out by the analyst, the dataset is relatively small.

While the exact exponential decrease of the peaks seems quite significant compared to the power law baseline, given that we currently have just four data points, it’s advisable to approach this finding with caution. However, it’s crucial to keep a close eye on this trend as we progress through the current cycle, as it could potentially hold valuable insights.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-08-15 12:05