As a seasoned researcher with years of experience in the cryptocurrency market, I must say that the recent surge in Dogecoin (DOGE) price has certainly caught my attention. The increase in whale activity, as evidenced by the large transactions tracked by IntoTheBlock, is a clear sign of investor interest. However, the net flow data suggests a bearish outlook for DOGE price, with whales seemingly selling more than buying at this time.

The uptick in Dogecoin‘s price was a positive development for investors following its prolonged period around $0.09. This price movement has sparked activity among Dogecoin investors, including the large ones known as whales. As the price recovers, these whales have become more active, shifting vast amounts of DOGE in and out of their digital wallets. However, the overall trend of these whale transactions suggests a bearish outlook for Dogecoin’s price.

Dogecoin Whales Move Over $500 Million

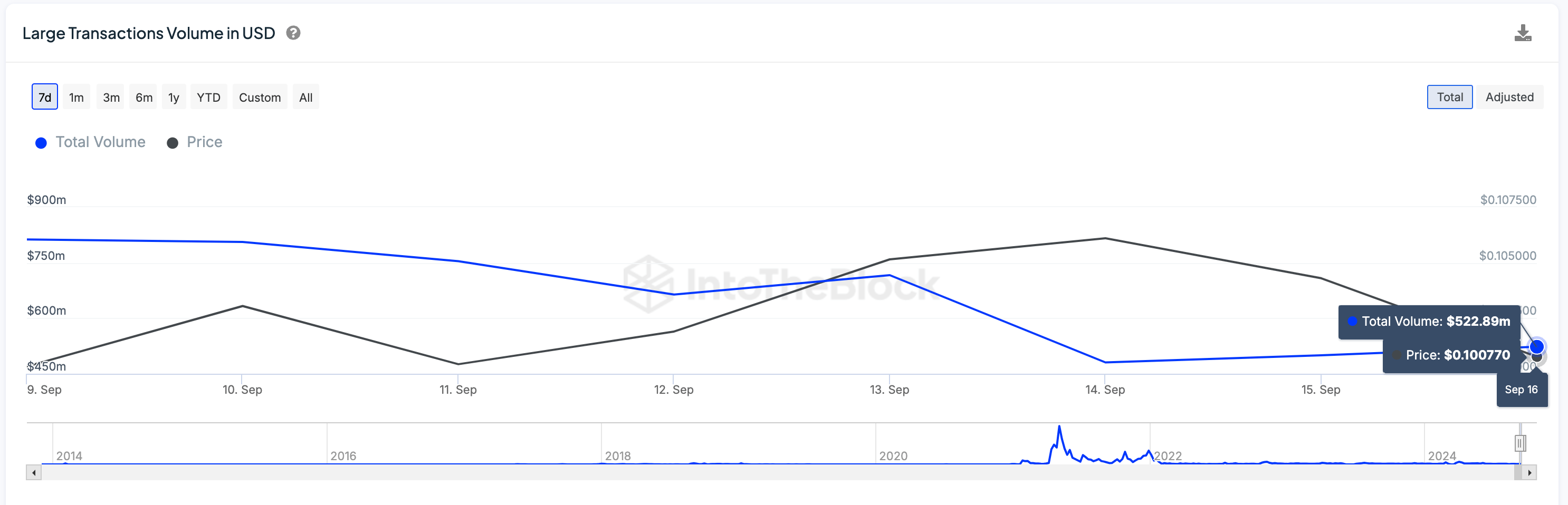

Large transactions worth $100,000 or more, monitored by the IntoTheBlock platform, have been steady this week, although they’ve dropped slightly compared to last week’s numbers. However, they’ve stayed relatively high, indicating that big investors (whales) are still actively involved. Over the past two days, an average of 800 such transactions has been recorded, suggesting that whale activity remains strong.

As a researcher, I noticed an interesting contrast when comparing the whale transaction numbers between Sunday and Monday. While the number of whale transactions decreased from 899 to 818, a different narrative emerged when looking at the amount of Dogecoin (DOGE) moved. According to data from IntoTheBlock, a staggering 5.19 billion DOGE were moved on Monday, contrasting with the 4.59 billion DOGE moved on Sunday.

These massive transactions amount to approximately 522.89 million dollars, compared to the previous 499.99 million. On average, these ‘whales’ transfer around half a billion dollars every day. As the value of Dogecoin recovers, we might see even more of these transactions as investors look to solidify their investments.

Where Are The Coins Headed?

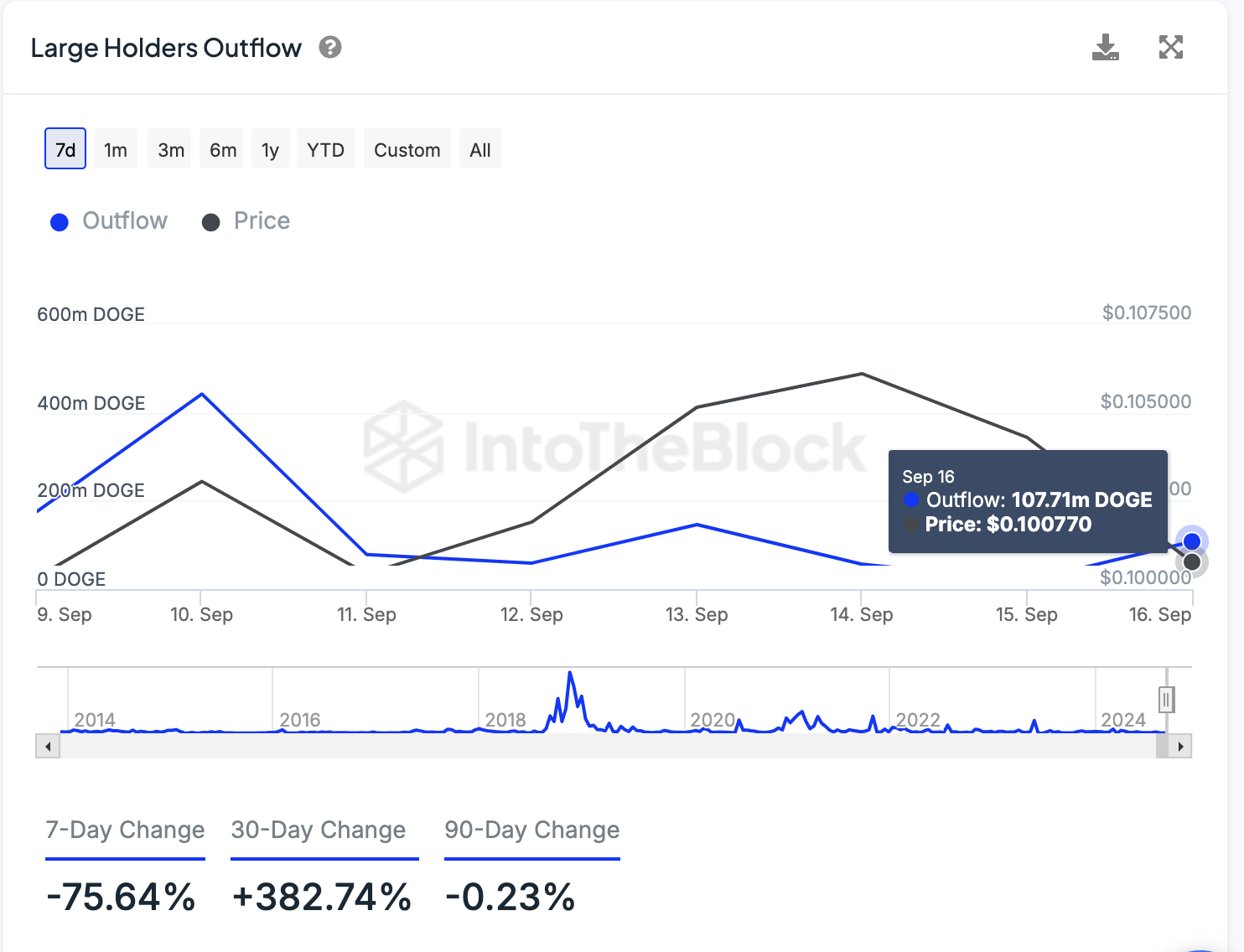

Analyzing the movement of DOGE coins among the large Dogecoin wallets (often referred to as “whale wallets”) can provide insights into where these whales are transferring their tokens. By monitoring both incoming and outgoing transactions, we can determine the amount being deposited and withdrawn from these whale wallets. Consequently, this data allows us to deduce whether these whales are currently buying or selling DOGE coins.

Based on data from IntoTheBlock, there’s been a decrease in deposits (inflows) into wallets over the past few days, while withdrawals (outflows) from large wallets have increased. Specifically, inflows dropped from approximately 37.4 million DOGE on Sunday to just 115.11 million DOGE on Monday. This suggests that the big Dogecoin holders, often referred to as whales, may not be purchasing as much DOGE in this timeframe.

Just like the increase in one situation, the amount of Dogecoin sent out (outflows) grew significantly from 18.37 million DOGE on Sunday to 107.71 million DOGE on Monday. This pattern indicates that large Dogecoin holders (whales) are more likely selling their coins rather than buying them. This heavy selling activity might be the reason for the resistance Dogecoin has been facing in trying to reach $0.1. Interestingly, net flow data, which is an average of incoming and outgoing transactions, has stayed relatively steady.

It appears that the overwhelming majority of Dogecoin holders seem to be investing with a long-term perspective. Approximately 3.93 million wallets have held their DOGE for over a year, while another 2.2 million have held between one and twelve months. This means that just about 113,660 wallets have been holding Dogecoin for less than a month.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-18 13:34