As a seasoned crypto investor with over a decade of market experience under my belt, I find Dan Gambardello’s analysis both insightful and thought-provoking. His comparison of historical S&P 500 behavior to the current market conditions provides a valuable perspective that I believe many of us are seeking during these uncertain times.

In a recent video discussion, well-known crypto expert Dan Gambardello explored the possible future cost trends of Cardano (ADA), considering the worrying predictions about an impending US economic downturn. Boasting a substantial fan base of 369,000 on YouTube, Gambardello addressed the growing concerns among ADA investors and the broader crypto community due to the ongoing discussions about a potential recession.

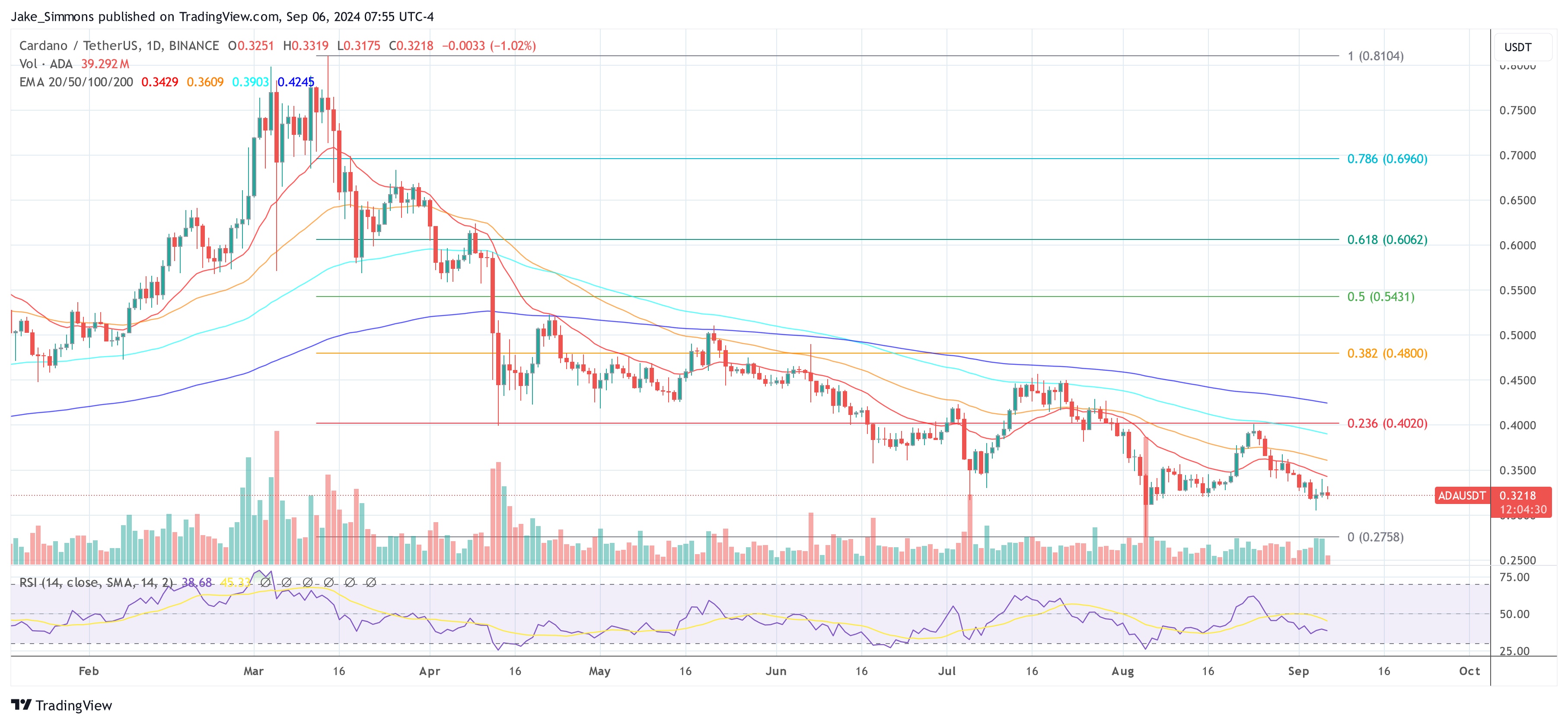

Will Cardano Bottom In December?

He drew parallels between historical S&P 500 behavior and current market conditions, noting, “On average the S&P 500 bottoms three months after a recession begins, but 10 months before the recession ends.” This observation is crucial as it sets a potential timeframe for when investors might expect the crypto market, including ADA, to bottom out.

“Gambardello indicated that there’s about a 50% chance we’re currently in a recession, based on historical patterns. Specifically, he noted that the Federal Reserve has signaled an interest rate cut in September on nearly every occasion preceding a period when they began cutting rates, and in almost all such cases, a recession followed.

In simpler terms, Gambardello suggested that the ongoing debate about a possible U.S. recession might influence investment plans. If past trends are any guide, the market could reach its lowest point around December 2024. This prediction is based on his analysis of market downturns since 1957, which usually show significant drops three months after the start of a recession.

The analyst suggested that the market’s recovery will likely be sudden and powerful once the market bottom has been reached. However, they pointed out that predicting the exact timing can be challenging, as it’s usually not identified until around 10 months later when they look back and say, “Ah, the recession started 10 months ago.” The analyst added that there isn’t a specific science to pinpointing the start date, but approximately three months after it, the market bottom is typically reached.

Later on, Gambardello discussed the indications given by the Federal Reserve regarding potential interest rate reductions. Historically, such cuts have been preceded by recessions. This trend makes market analysis even more intricate, hinting that a recession could already be happening or about to start. “In almost every case in history,” he said, “when the Fed has reduced rates, a recession followed, except for two instances.” He emphasized the seriousness of the current economic warnings.

In discussing Cardano, Gambardello compared the recent market performance of ADA with its historical trends. He noted that, much like previous cycles, ADA is presently 89% below its peak, showing a striking resemblance to past market slumps where it had dropped by 94% at comparable stages.

Gambardello remarked that currently, Cardano is only performing at 11% of its previous peak. He noted that the time between Cardano’s all-time high in 2018 and its current position took about 992 days. This time, it’s been approximately 1,100 days since the all-time high, making this period especially challenging for Cardano holders.

In addition, he examined Bitcoin‘s impact on cryptocurrencies like Cardano. He delved into the possibility of a ‘Altcoin Season,’ which is a time frame during which altcoins tend to increase significantly if Bitcoin’s market dominance decreases. Based on his findings, such a season isn’t happening right now but might be approaching, coinciding with his forecasted market bottom in December. As Gambardello stated, “When the market hits its bottom and crypto rebounds, most altcoins, particularly the established ones like top altcoins, will soar.

In summary, Gambardello adopted a moderate optimism in his assessment. He acknowledged the challenges of forecasting crypto markets due to their inherent uncertainties, yet emphasized the significance of past trends and current economic signals when devising investment plans. His recommendation was for viewers to remain alert, closely monitor market statistics, and brace themselves for possible further declines. However, he also urged them to be prepared for a period of rapid expansion that often follows economic downturns.

At press time, ADA traded at $0.3218.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-09-06 20:46