As a seasoned researcher who has witnessed the ebb and flow of the crypto market for years, I find Hedera’s Q2 performance quite intriguing. The network’s resilience amidst market turbulence is commendable, and its progress across key financial indicators is a testament to its potential.

In the second quarter of the year, Hedera (HBAR) distinguished itself as a notable success, bucking the negative trajectory experienced by numerous other projects. A recent analysis by research firm Messari underscores Hedera’s advancements in crucial financial metrics.

Hedera Q2 Momentum

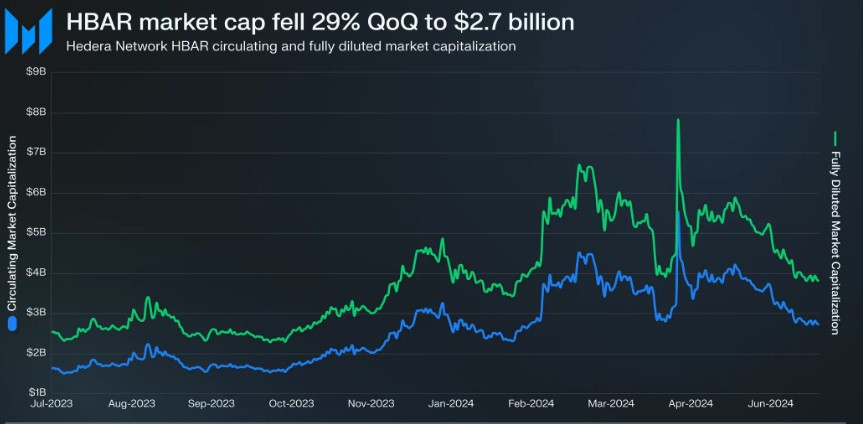

One significant milestone for Hedera in Q2 was the progress made in key financial indicators. Although the circulating market cap dropped by 29% compared to the previous quarter, reaching $2.7 billion, its token, HBAR, rose six places from 36th to 30th position among all tokens. This move allowed it to outrank other cryptocurrencies with comparable prices.

According to the report, Hedera’s revenue served as a significant milestone during Q2, increasing by 26% to reach $1.4 million in USD. Additionally, HBAR revenue showed a notable growth of 19%, rising to $14.6 million compared to the previous quarter.

72% of the total possible 50 billion HBAR coins were circulating by the end of Q2, and it was emphasized that this rate of issuance would continue. In the upcoming quarter, an extra 1.5 billion HBAR coins will be released, with a majority (94%) being dedicated to supporting ecosystem development and open-source projects.

The number of new accounts per day rose by 31% to reach 11,100, but the number of active addresses daily decreased by 37% to 10,600. This suggests a combination of expanding growth and diminishing user engagement within the network. In the second quarter, transaction activity picked up significantly, with an average of 132.9 million transactions per day increasing by 46%, mainly due to the surge in usage of the Hedera Consensus service.

Staking Surge And DeFi Fluctuations

The report further highlighted Staking in the network, which emerged as a significant trend within the ecosystem, with 62.2% of the circulating supply staked, signaling a high level of engagement from entities like Swirlds and Swirlds Labs.

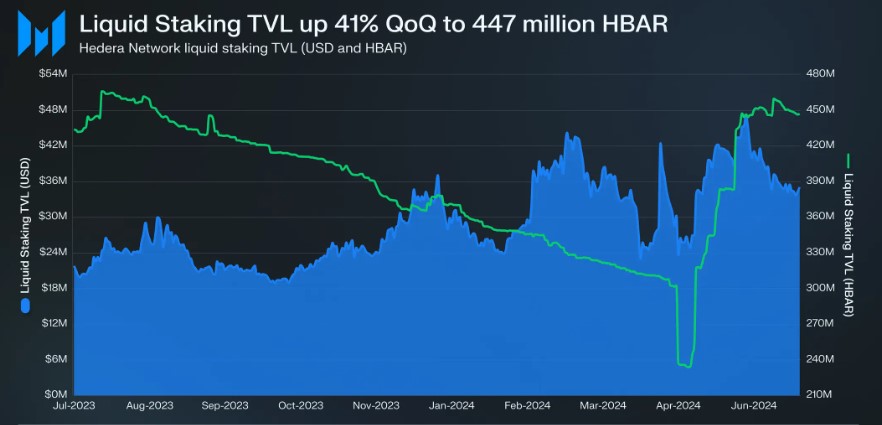

As a crypto investor dabbling in DeFi on the Hedera network, I observed some volatility during Q2. The Total Value Locked (TVL), whether measured in USD or HBAR, saw a downward trend, indicating a decrease in the amount of funds locked within DeFi protocols on this platform.

Still, Messari asserts that initiatives like the HBAR Foundation’s DeFi TVL growth program have injected vitality into the ecosystem, driving liquidity and awareness. Liquid staking on the other hand, saw a resurgence in Q2, with Stader’s TVL increasing by 41% in HBAR terms.

To wrap up, it’s worth noting that the trading volume on Hedera’s decentralized exchange (DEX) decreased during the second quarter following a robust start in the first quarter, as reported by Messari. However, the DEX has continued to perform well compared to the same period last year.

As I pen this down, I’m witnessing a substantial 22% drop in the value of HBAR over the past month, with the coin currently trading at $0.050. This slide comes during a period marked by widespread market turbulence, driven mainly by heightened volatility in the heavyweights, Bitcoin (BTC) and Ethereum (ETH).

Moreover, data from CoinGecko indicates a significant reduction in trading activity for the token over the last two days, amounting to a 35% decline. It’s crucial to note that HBAR is currently 91% lower than its peak price of $0.056, which it reached in September 2021.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-30 09:04