As a seasoned crypto investor with a keen eye for spotting promising projects, I’ve been closely watching Hedera and its native token, HBAR. My journey in this space has taught me that the crypto market is as unpredictable as a rollercoaster ride, but I can’t help but feel optimistic about HBAR.

Hedera, a blockchain that uses a proof-of-stake system, faced a strong sell-off by bears in early October. Following a rise in the price of its native token, HBAR, in September, the bulls’ rejection at the beginning of October led to a double top formation.

Generally speaking, there’s a positive outlook suggesting that bulls may regain control, potentially driving prices to record-breaking levels by the end of Q4 2024. The speed at which this growth occurs will be influenced by market conditions and whether the project’s underlying factors can attract buyers.

Will HBAR Rise By At Least 30X?

Despite some fluctuations or dips seen in the HBAR price movement, one analyst at X believes that this token could experience significant growth, given its decline from the April peak of roughly $0.18.

According to his evaluation, it seems likely that Hedera could potentially multiply its value by up to 30 times during upcoming sessions, much like how Cardano did in the previous cycle. This increase in value for Cardano was over 170 times its original value. If Hedera Hashgraph (HBAR) follows a similar trajectory, the token could potentially surge to around $6, representing an increase of more than 60 times from its projected highs in 2024.

Currently, the technical candlestick patterns indicate that sellers have an advantage. Following a surge to $0.18 in April 2024, HBAR has been on a downtrend. To help visualize this, let’s remember that the token dropped by 70%, but it has found some stability after encountering support in August and September.

As a researcher examining the cryptocurrency market, I’ve noticed that the recent peak around September has formed a double top – a potential resistance level for HBAR. If prices manage to surpass this significant liquidation zone, it could signal the beginning of a bullish trend for HBAR. This upward momentum might propel the coin towards $0.18, thus reinitiating the uptrend that was initiated in Q1 2024 and continued into early Q2 2024.

Hedera Fundamentals Key To Driving Growth

There are fundamental factors to consider that may propel HBAR, helping the token shake off weaknesses. Early this month, Canary Capital released the first United States HBAR Trust.

Similar to Grayscale offerings such as ETHE and GBTC, the HBAR Trust provides institutional investors a means to invest in HBAR. Consequently, increased interest might boost demand, potentially elevating prices.

In September, Hedera introduced its Asset Tokenization Workshop. This platform positions Hedera as a leader in the tokenization of tangible assets, all while respecting current legal frameworks.

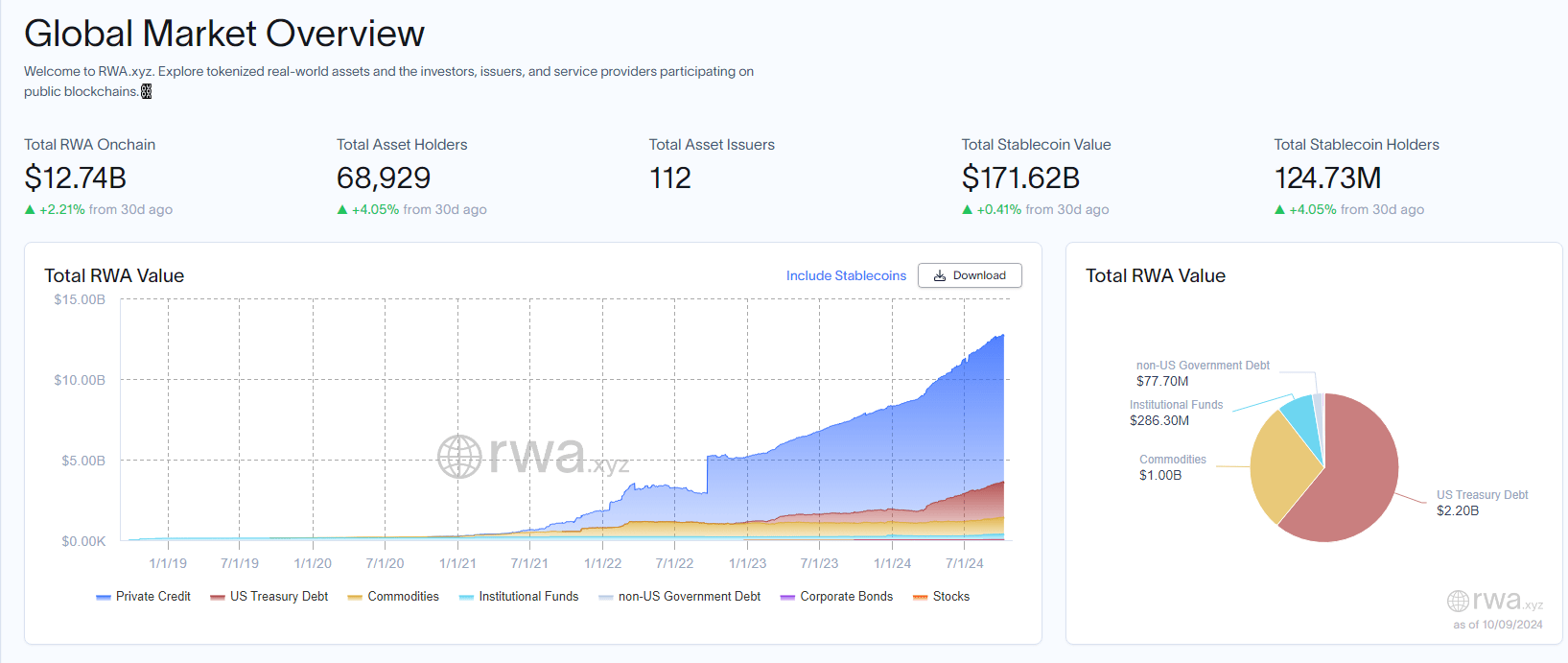

In the near future, it’s anticipated that tokenization, a practice currently managed by one of the world’s largest asset managers, BlackRock, will see significant growth, potentially handling trillions of dollars. As reported by rwa.xyz, approximately $12.7 billion in Resources for Wood and Agriculture (RWAs) have already been tokenized. Furthermore, there’s a growing level of interest in this field.

Over the past month, there’s been an increase of around 4% in the total number of RWA holders, bringing it up to approximately 68,929. A large portion of these assets are represented as tokens on both Ethereum and Stellar networks.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

2024-10-09 20:10