As a seasoned researcher who has witnessed the ebb and flow of the crypto market for years, I find it fascinating to observe the resilience of Bitcoin miners amidst adversity. The April halving event undoubtedly dealt a significant blow to miner revenues, causing what seemed like an inevitable crisis. However, the recent recovery signaled by the Hash Ribbon metric is a testament to the adaptability and tenacity of this sector.

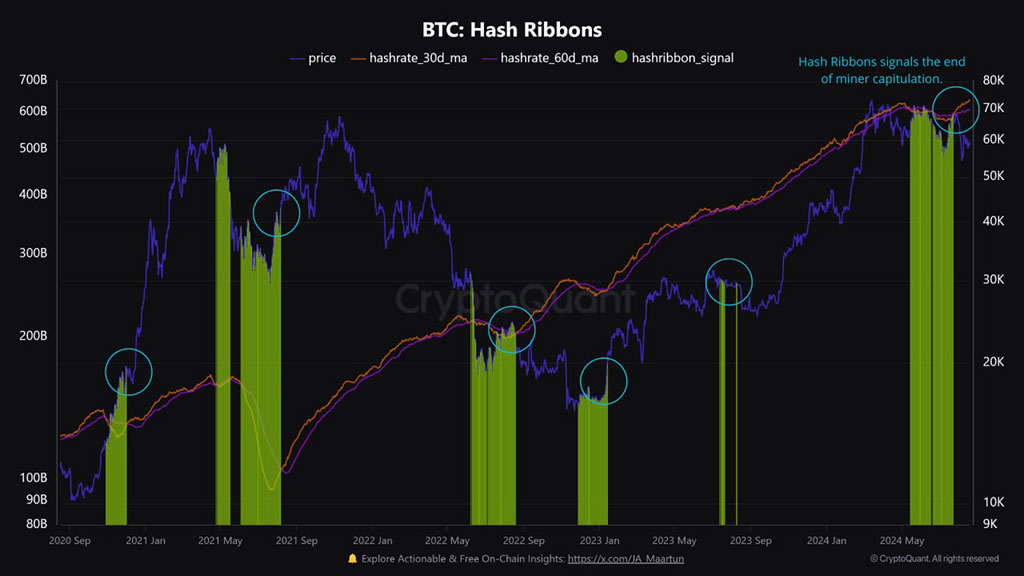

Following the reduction in Bitcoin (BTC) miner’s income by half due to the April post-halving event, which is often referred to as a “profitability crisis” among miners, there was a significant downturn in the mining sector. However, after more than three months, the Hash Ribbon metric suggests that the mining segment has started to show signs of improvement in its overall health.

According to CryptoQuant, a cryptocurrency analytics platform, their metric suggests that the ‘miner capitulation’ may have ended.

Photo: CryptoQuant

In this context, the metric serves to monitor mining strain or turmoil (represented by green), consistently aligning with a significant decrease in the hash rate, which refers to the computational capacity required for Bitcoin mining.

In simpler terms, smaller Bitcoin miners who aren’t as efficient or don’t have the resources to scale may struggle and exit the market due to a miner crisis. On the other hand, larger players such as MARA are able to invest in cutting-edge hardware and optimization strategies to keep their operations running smoothly.

Will Less Miner Supply Allow BTC to Rally?

According to CryptoQuant, it appears that miners have upgraded their mining gear since the Bitcoin hashrate rebounded and reached a record high of 638 quadrillion hashes per second.

It makes sense that miners are turning their equipment back on, upgrading to more efficient models, and less inclined to sell, given the recent all-time high of Hash Rate at 638 EH/s.

Indeed, mining companies such as Marathon Digital are keeping the Bitcoins they mine and actively increasing their purchases instead.

Does that mean the supply pressure from BTC miners could be over?

Photo: IntoTheBlock

It’s highly likely that based on data from Into The Block, the proportion of mining activity compared to the total network volume (Miners’ Flow Volume Share) has decreased significantly. Specifically, it dropped from approximately 20% in May down to less than 10% in August.

In short, the impact of miners on BTC prices has declined considerably over the past three months.

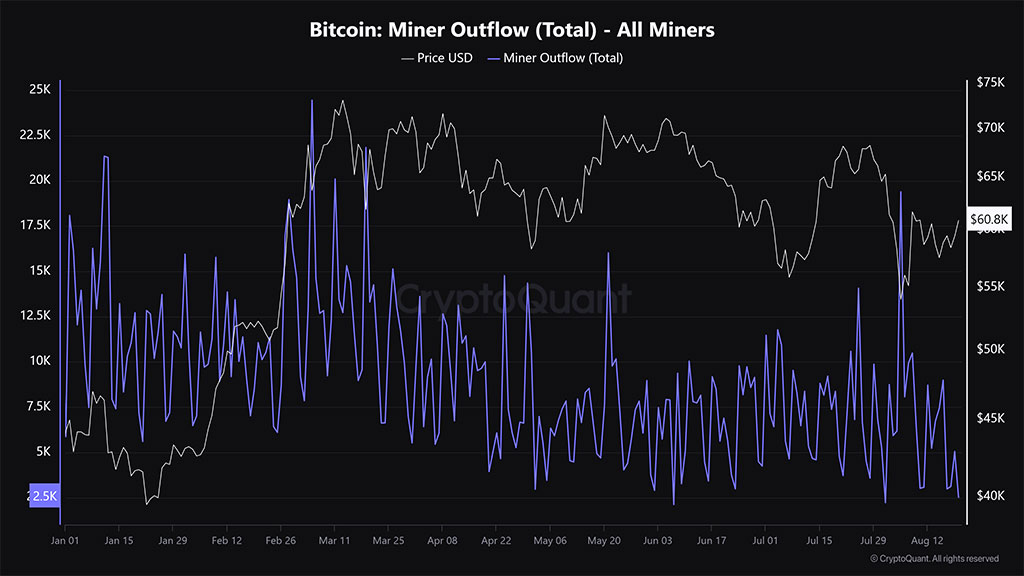

The decrease in Bitcoin transfers from miner wallets to centralized exchanges, as monitored by Miner Outflows, reinforces this pattern.

Photo: CryptoQuant

Following the Bitcoin halving in April, miner outflows steadily increased from May through August. Notably, there were two significant surges of approximately 16,000 BTC and 19,000 BTC transferred to exchanges on May 21st and August 5th respectively. These instances represent miner-induced supply pressure as they liquidated some of their holdings to meet operational expenses.

As a crypto investor, I’ve noticed that the outflow of mined Bitcoins has decreased dramatically to around 2.5K BTC at this moment. This decrease in miner-induced selling pressure might provide the necessary conditions for Bitcoin prices to surge and potentially turn around recent losses.

BTC Price Analysis

Photo: TradingView

On the daily chart, BTC has struggled to stay above $60K since the massive dump to $49K in early August. At the time of writing, it attempted to reclaim the range-lows ($60.7K).

Despite this, Bitcoin remained within a downtrend, since its value was beneath the 200-day Simple Moving Average (SMA). Interestingly, the 200-day SMA coincided with a short-term stockpile around the $63K level.

If the resistance zone at $63K can be overcome and subsequently transformed into a support level, it is likely that Bitcoin’s chances for continued recovery will strengthen.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-08-20 14:38