As a seasoned analyst with over two decades of market experience under my belt, I’ve seen my fair share of market cycles and volatility. The recent Bitcoin price action reminds me of a roller coaster ride – exhilarating, unpredictable, and often leaving you on the edge of your seat.

Yesterday, Bitcoin saw dramatic fluctuations following its record high of $104,088 on Wednesday. Subsequently, a “Darth Maul” candle appeared on the daily chart, indicating Bitcoin’s rapid decline from around $103,550 to as low as $90,500, before regaining some stability. While some might have viewed this drop at the psychologically significant price point of $100,000 as a strong rejection, leading analysts propose that it could be just a regular market cleaning rather than a peak in the cycle.

Could This Be The Bitcoin Cycle Top?

Experts at X consensus indicate a coordinated storyline: the sudden rise followed by a fall was probably manipulated by influential traders exploiting high-leverage positions. Seasoned trader IncomeSharks (@IncomeSharks) commented, “Bitcoin resembles Darth Maul from Star Wars. I might be mistaken, but I don’t recall such a candle on any other asset. Typically, such candlestick patterns are used to punish late long investors, trap short sellers, and push prices even higher.

As a researcher delving into cryptocurrencies, I find myself echoing the sentiments of another analyst, Astronomer (@astronomer_zero). His observation is that the recent market fluctuations might not be due to the intended purpose, but rather large investors (whales) aggressively using high leverage sell orders. However, it’s crucial for us to observe if the downside of these rapid sell-offs gets cleared before drawing definitive conclusions. This could potentially explain the current situation in the market.

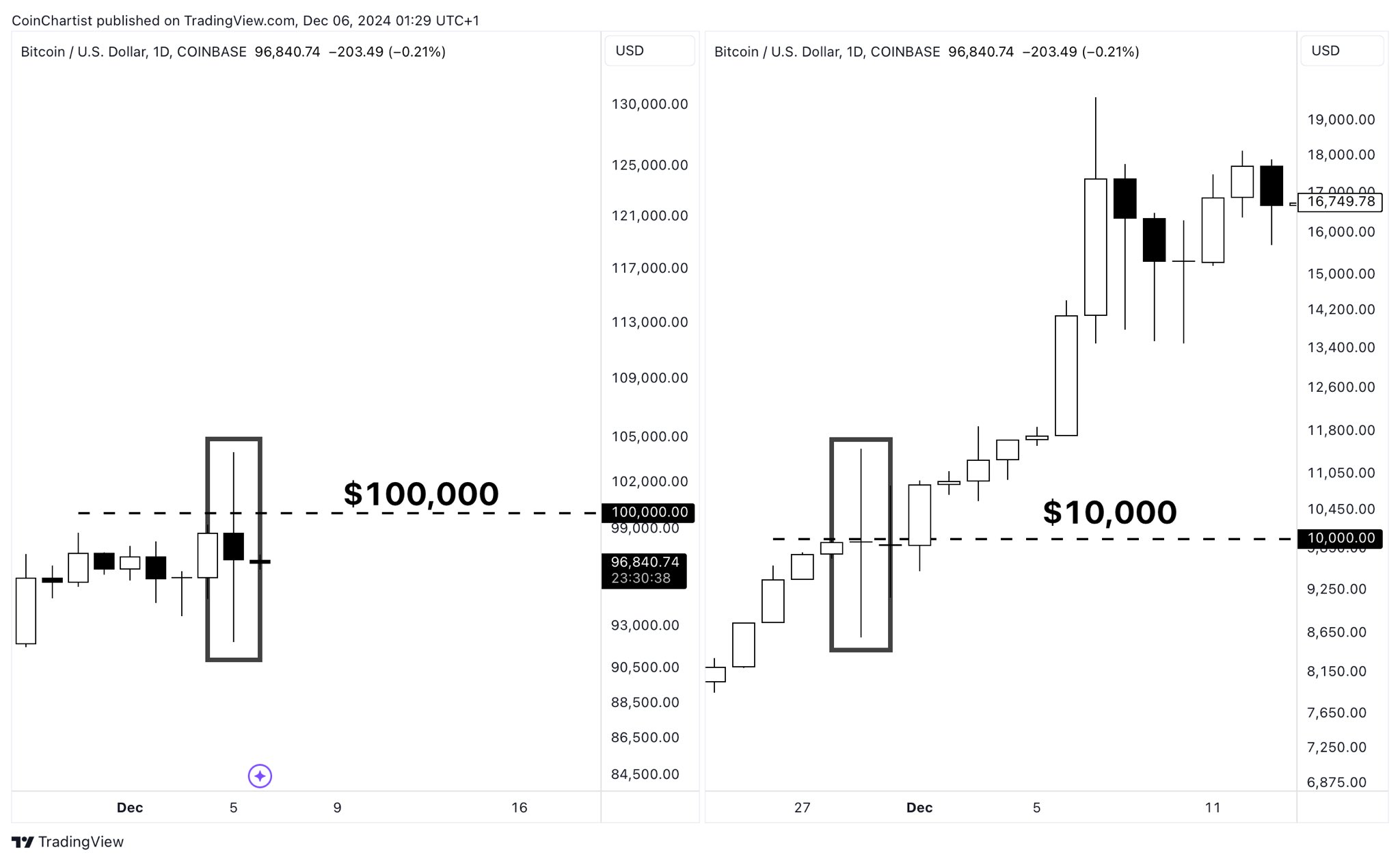

Tony Severino, a Certified Market Technician (CMT), emphasized the magnitude of these price movements, remarking: “A significant ‘Darth Maul’ swing of around $11,000 on the Bitcoin daily chart. Both buy and sell stops were triggered. Extremely high volatility in Bitcoin is becoming commonplace. Prepare yourself for the rollercoaster ride when Bitcoin reaches $100,000. Daily price swings of $10,000 are no longer unusual.

He followed up, “$100K Bitcoin is the new $10K,” sharing comparative charts from the 2020–2021 bull run and drawing parallels to the current price environment.

Charles Edwards, the founder of Capriole Investments, emphasized a familiar perspective: “Bitcoin, indeed, this is common.” Just like before, he shared a comparable graph, bringing up the dramatic fluctuations Bitcoin experienced when it was priced at $10,000 and $1,000 in early 2017.

In simpler terms, key signs continue to point towards more growth ahead. Matthew Sigel, research head at VanEck, states that there aren’t many warning signs at these current levels. “Except for funding rates which might stay high for a while, most of our important indicators suggest the cycle isn’t reaching its peak. In my view, the trend is still moving upwards.

Sigel highlighted four significant indicators: the MVRV Z-Score remains under 5, suggesting more growth potential; the Bitcoin Price Simple Moving Average Multiplier shows room for expansion; Google Trends are relatively low; and Crypto Market Dominance is at a moderate level. Taken together, these factors suggest that we might not be close to reaching the peak of this current cycle.

Macro analyst Alex Krüger (@krugermacro) expressed his opinion differently: “Someone asked if that was the peak, so I’d like to offer my perspective. In my view, the initial heavy sell-off during a robust bull market, especially one fueled by solid fundamentals, doesn’t necessarily signify the market’s highest point.

Krüger pointed out that while the action was broadly expected in terms of overall timing (though not the exact moment), it doesn’t affect Bitcoin’s fundamental upward momentum. He further mentioned that a sudden shift by retail investors towards older, “dinosaur” altcoins could potentially mark a peak for those assets, but not necessarily for Bitcoin. In his opinion, there hasn’t been much change in the situation. He would have preferred to see the funding reset on altcoins as well, but unfortunately, that didn’t happen.

At press time, BTC traded at $98,146.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-12-06 18:40